Summary:

-

The UK CPI inflation decelerated more than expected

-

BoE Minutes reveal concerns over growth of non-investment-grade companies borrowing

-

GBPUSD deepens decline following data release

After labour market report released yesterday showed a pick-up in the wage growth investors were offered another piece of data from the UK economy today. However, the inflation report was nowhere as good as the data we saw yesterday. In turn, the British pound deepened today’s pullback.

The UK price growth slowed in September. Source: xStation5

The UK price growth slowed in September. Source: xStation5

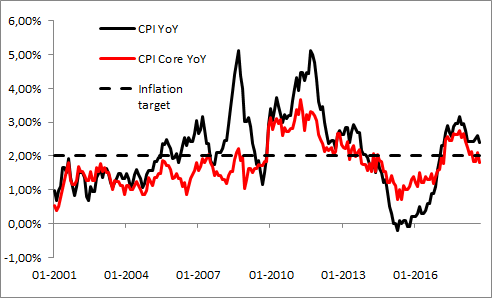

The UK headline CPI inflation was expected to decelerate from 2.7% YoY to 2.6% YoY in September and the core gauge was viewed to move from 2.1% YoY to 2% YoY. However, investors were offered a miss in both cases with the former coming in at 2.4% YoY and the latter at 1.9% YoY. On the other hand, a stronger-than-expected pick-up was spotted in the producers’ prices. Such a situation does not bode well for the UK companies as it suggests that companies are unable to pass higher input prices onto consumers what may eventually lead to shrinking profit margins. Moreover, inability to charge higher prices may also hint at lacklustre strength of demand in the UK economy. The key factor contributing to lower CPI print were food prices that decreased noticeably in September.

GBPUSD plunged following the release of inflation report but managed to regain some ground later on. Nevertheless, the pair is moving lower today. Source: xStation5

GBPUSD plunged following the release of inflation report but managed to regain some ground later on. Nevertheless, the pair is moving lower today. Source: xStation5

While the CPI inflation still sits above the Bank of England target it is unlikely that we will see any monetary move in the nearby future as the Bank warned that it will remain cautious ahead of the Brexit scheduled for March next year. However, money market prices in two rate hikes next year. Speaking of Bank of England it is worth to mention that simultaneously to the inflation data Minutes from the latest Financial Policy Committee meeting were released. The UK central bankers recognized hurdles towards replacing Libor rate with Sterling Overnight Index Average (SONIA) rate. FPC noted that despite efforts to shift away from the current reference rate some banks are still entering long-term contracts with Libor as the benchmark rate. BoE wants to phase out Libor after the manipulation scandal surfaced and replaced it with SONIA rate that will be calculated by the Bank. Apart from new rate adaption hurdles the document unveiled concerns over the growth of leverage lending in the United Kingdom. According to the Bank of England the outstanding debt (leverage loans and high-yield bonds) of non-investment-grade companies constitutes around 20% of total UK corporate borrowings. In case a broader economic downturn occurs a wave of default on these loans may be triggered what may threat the stability of the financial system.

While it is worth to keep track of data and latest BoE members’ comments one should not forget that it is Brexit that drives the GBP market right now. EU leaders will launch summit today in the evening with official dinner and the talks will be held over the next days.

GBPUSD is pushing lower today. The pair erased a half of this week’s gains already and may be set for more in the upcoming days in case no progress on Brexit is made once again. The 23.6% Fibo level of the latest downward move around 1.3070 handle may serve as the first support level to watch. Source: xStation5

GBPUSD is pushing lower today. The pair erased a half of this week’s gains already and may be set for more in the upcoming days in case no progress on Brexit is made once again. The 23.6% Fibo level of the latest downward move around 1.3070 handle may serve as the first support level to watch. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.