-

GBP gains following hawkish comments from BoE officials

-

Market prices in 2 full rate hikes by June 2022

-

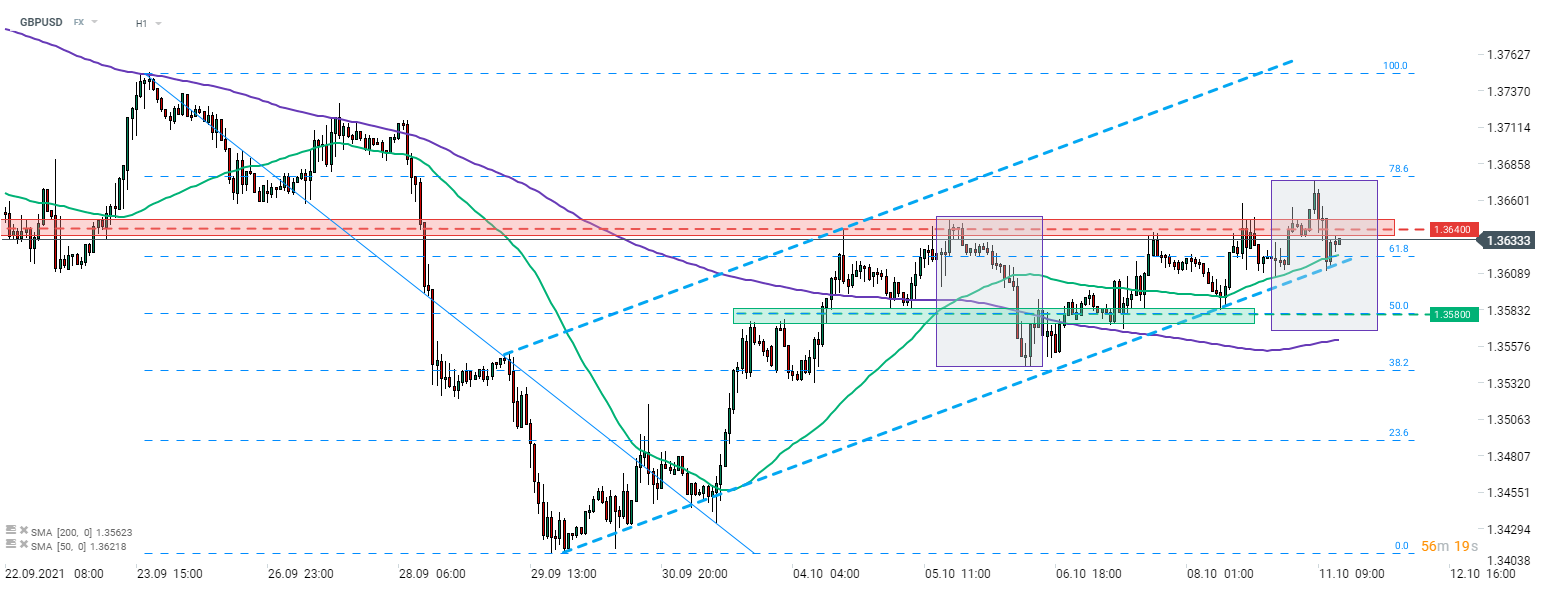

GBPUSD eyes a retest of 1.3640 resistance zone

The British pound is one of the best performing major currencies today. On one hand, solid performance of the UK currency can be ascribed to a general improvement in moods on the FX market. However, there are also more country-specific factors. Namely, comments made by BoE officials over the weekend were viewed as hawkish and provided a lift for the currency. Bank of England Governor Bailey said he is becoming increasingly concerned about acceleration in price growth while BoE member Saunders said that the market is right to expect quicker rate hikes. Interest rate derivatives market prices in a 20 basis points tightening by December 2021 and a 50 basis points tightening by June 2022.

Taking a look at the GBPUSD chart at H1 interval, we can see that the pair has erased a large chunk of today's gains after peaking in the morning. Subsequent pullback was halted at the upward trendline near the 61.8% retracement of the downward impulse launched in late-September. GBPUSD attempts to climb back above the 1.3640 resistance at press time. Should it succeed, a move back towards a recent local high near 78.6% retracement may be on the cards. On the other hand, failure to break above 1.3640 may trigger a pullback that would push the pair below the aforementioned trendline. In such a scenario, two support levels to watch are 50% retracement at 1.3580 and a lower limit of the market geometry at around 1.3570.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.