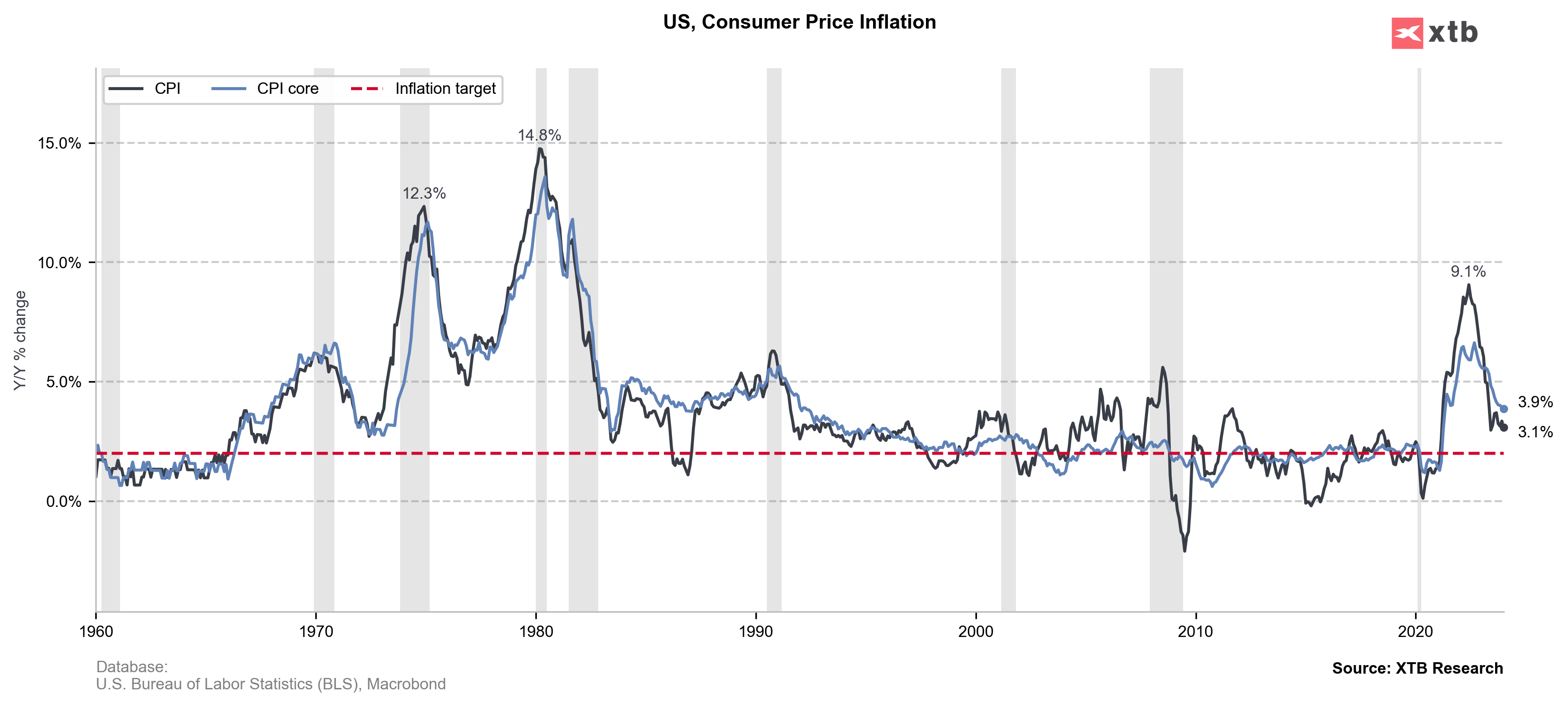

USD is trading higher against EUR, GBP and JPY today as investors await release of a key piece of US data. US CPI inflation report for February is scheduled to be released at 12:30 pm GMT today. Market expects core gauge to slow and headline gauge to stay unchanged. Let's take a quick look at what to focus on in the reading and what it may mean for the Fed.

What market expects?

Median consensus for February's US CPI data is for annual headline price growth to stay unchanged at 3.1% YoY and for core price growth to slow from 3.9 to 3.7% YoY. On a monthly basis, headline price growth is seen at 0.4% MoM, slightly quicker than in January, and core price growth is seen at 0.3% MoM, slightly slower than in January. ISM data also pointed to easing of inflationary pressures in February, with manufacturing Prices Paid subindex dropped from 52.9 to 52.5 in February, while ISM non-manufacturing Prices Paid subindex plunged from 64.0 to 58.6. A lot of attention in today's release will be on rents, precisely on owner's equivalent rate, which increased 0.6% in January and outpaced a 0.4% increase in a broader rent category. Another hike OER reading may suggest that rent inflation is proving to be more sticky than previously thought.

US, CPI inflation report for February

- Headline (annual). Expected: 3.1% YoY. Previous: 3.1% YoY

- Headline (monthly). Expected: 0.4% MoM. Previous: 0.3% MoM

- Core (annual). Expected: 3.7% YoY. Previous: 3.9% YoY

- Core (monthly). Expected: 0.3% MoM. Previous: 0.4% MoM

Source: Macrobond, XTB Research

Source: Macrobond, XTB Research

What today's reading will mean for Fed?

So far, the official message is that FOMC does not have enough confidence in inflation yet to begin cutting rates. Such a view was delivered by Fed Chair Powell at the latest post-meeting press conference as well as during his semiannual testimonies in Congress last week. However, Powell acknowledged that the next Fed move is likely to be cut and is likely to be delivered sometime this year.

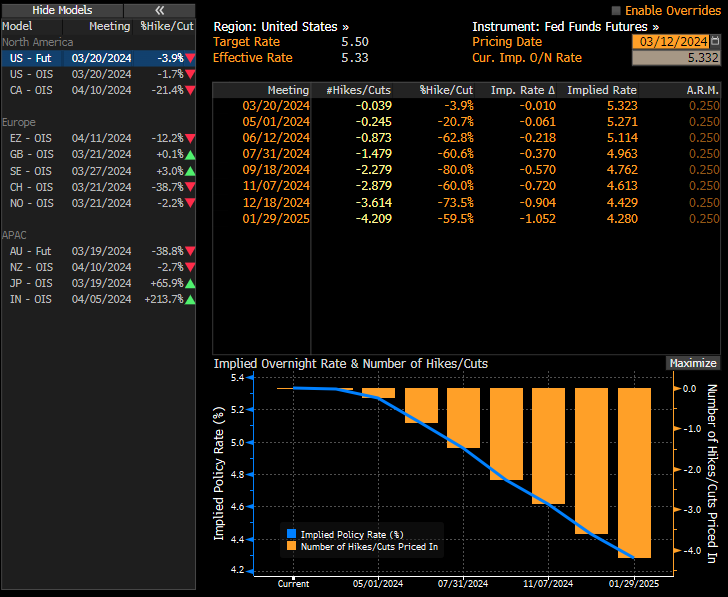

While inflation in the United States continues to drop towards Fed target, today's report, regardless of the outcome, is unlikely to encourage Fed to cut rates as soon as at next week's March meeting. Right now discussion in the markets is whether the first cut will be delivered in May or June. A view that rent inflation will continue to fall is among key factors contributing to expectations that inflation target will be reached soon. Another month of high rent growth may make investors reconsider this view and prove that Fed was right in staying patient.

Money markets are seeing the June meeting as the most probable timing for the first Fed rate cut. Source: Bloomberg Finance LP, XTB

A look at the markets

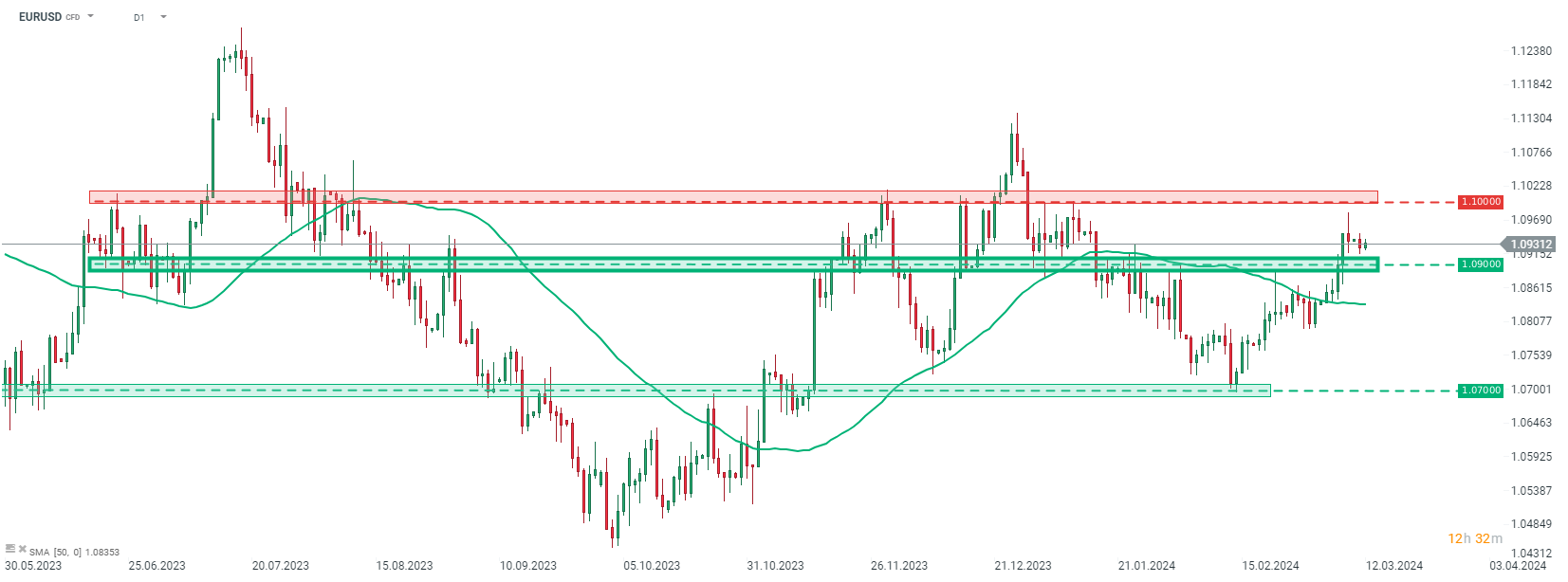

EURUSD has been giving back part of recent gains in the past few days. The main currency pair pulled back below 1.0950 mark and is looking towards a retest of the 1.09 price zone, but this time as a support. A hotter-than-expected CPI reading may provide more fuel for the pullback. Source: xStation5

EURUSD has been giving back part of recent gains in the past few days. The main currency pair pulled back below 1.0950 mark and is looking towards a retest of the 1.09 price zone, but this time as a support. A hotter-than-expected CPI reading may provide more fuel for the pullback. Source: xStation5

Nasdaq-100 futures (US100) halted recent downward move at the 17,925 pts support zone. However, bulls failed to push the index back above 50- and 200-hour moving averages during the subsequent recovery move. A lower-than-expected CPI reading could help bulls regain control over the market and potentially break above the aforementioned moving averages. Source: xStation5

Nasdaq-100 futures (US100) halted recent downward move at the 17,925 pts support zone. However, bulls failed to push the index back above 50- and 200-hour moving averages during the subsequent recovery move. A lower-than-expected CPI reading could help bulls regain control over the market and potentially break above the aforementioned moving averages. Source: xStation5

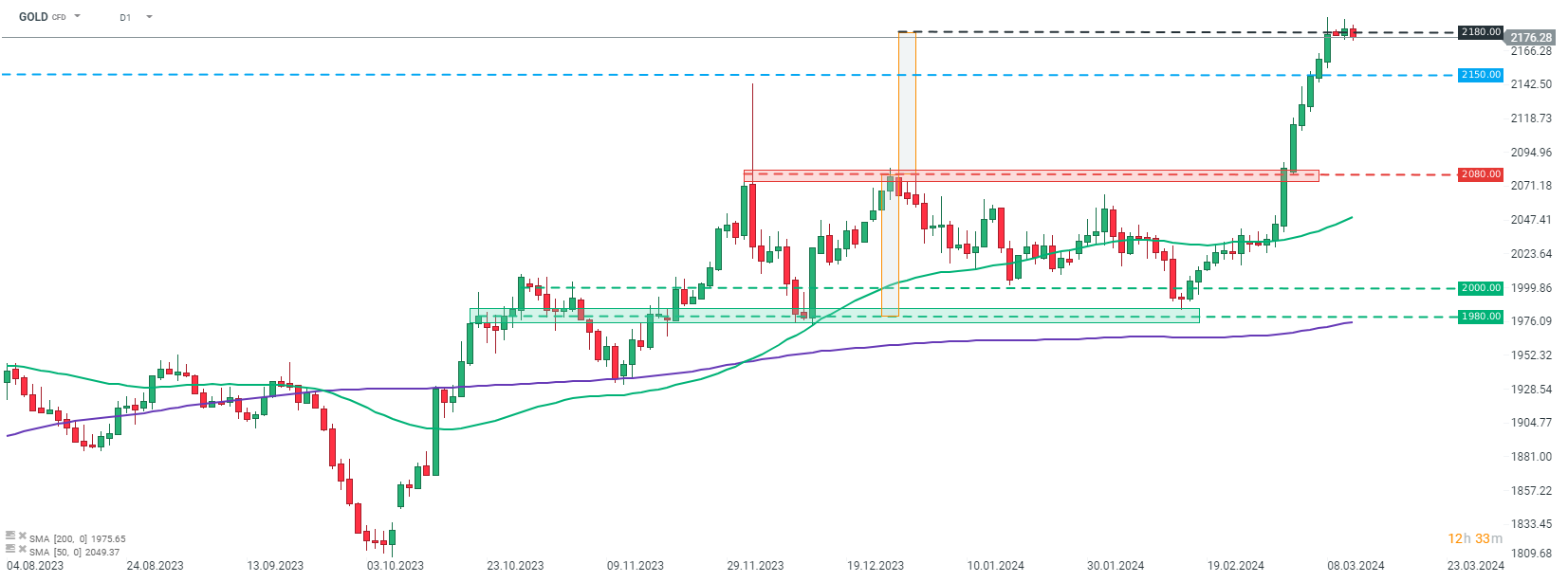

GOLD rallied above $2,150 per ounce recently, setting fresh record highs. Price of the precious metal reached $2,180 per ounce area, marked with the textbook target of the upside breakout from trading range, after which the advance was halted. Signs of investors' indecisiveness can be spotted on the chart in recent days and today's CPI print may help make the outlook more clear. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.