- What’s particularly notable is new information from the Dutch pension fund Stichting Pensioenfonds ABP, indicating the fund has reduced its U.S. Treasury holdings by about 30% and sold roughly $10 billion of U.S. government bonds over a six-month period (through September 2025).

- ABP still holds around $19 billion in Treasuries, but the shift adds weight to the narrative that some large investors are gradually trimming exposure to U.S. debt. Even if the scale remains limited for now, it can still be enough to pressure the dollar and support gold.

- Strong demand from gold ETFs is also helping the upside. Volatility may pick up later today ahead of the U.S. NFP labor market report (14:30 CET). Recent U.S. employment data have been largely disappointing, which has provided additional support for precious metals.

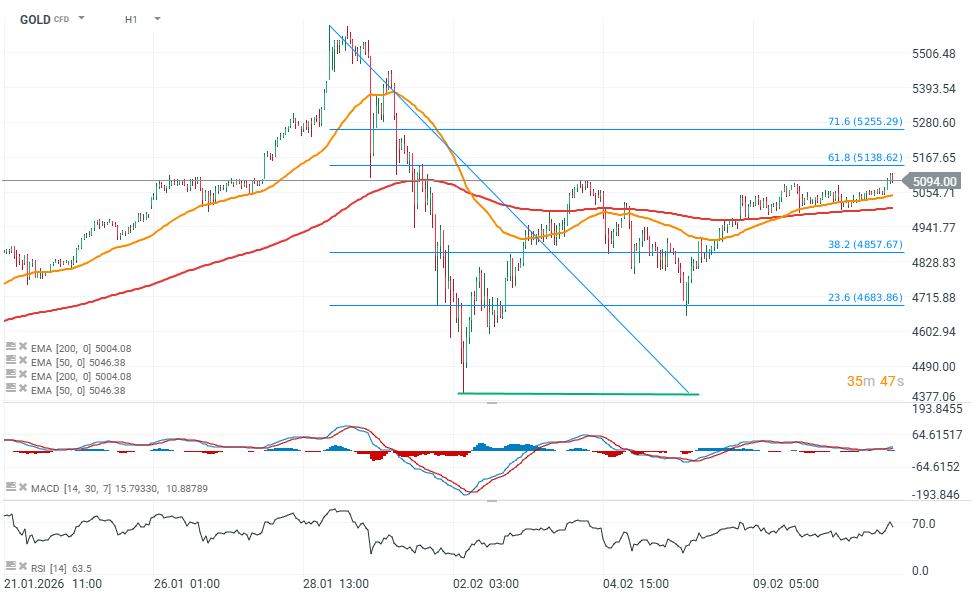

From a technical perspective, the hourly gold chart suggests an important resistance zone near the 61.8% and 71.6% Fibonacci retracements of the latest downswing. A break above $5,260 could open the way toward fresh all-time highs. Price remains above both the EMA50 and EMA200, pointing to strong bullish momentum.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.