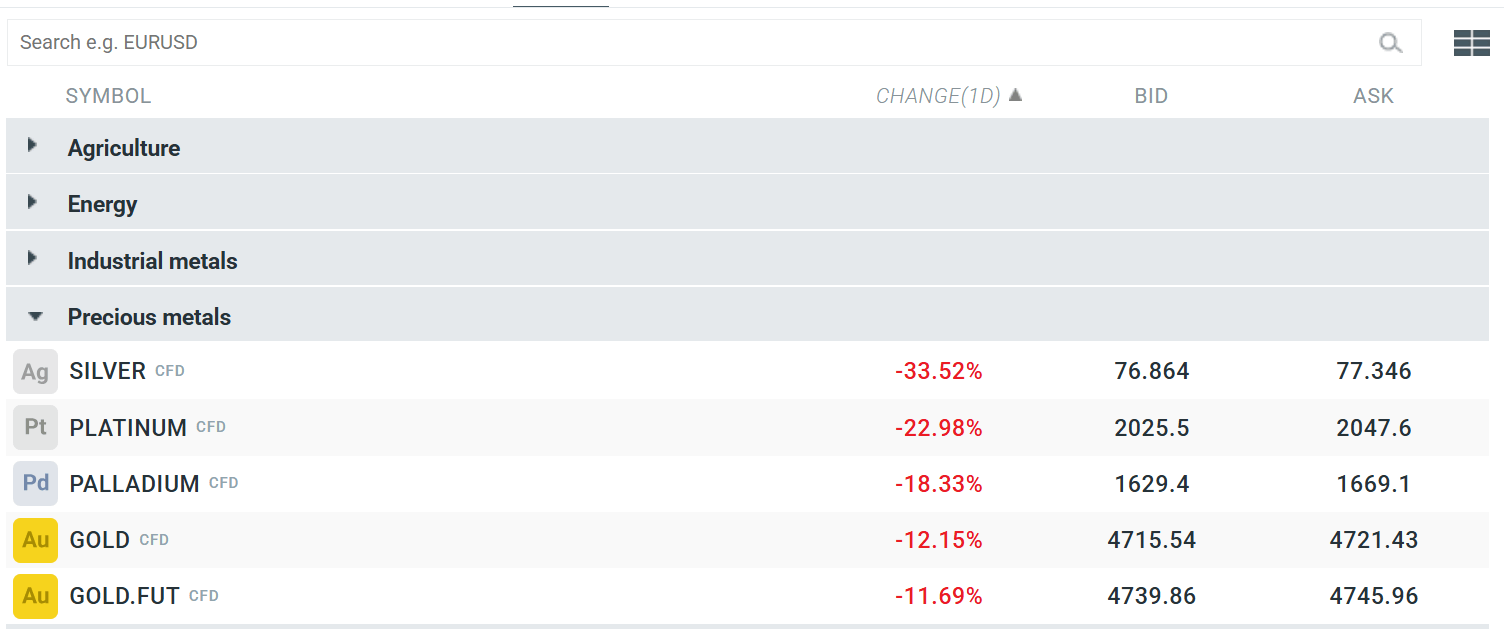

Gold and silver are experiencing unprecedented declines, closing the most difficult day in their modern trading history. Gold has already lost more than 12% of its value, falling to $4,716/oz. Silver is doing even worse, falling by as much as 34% to $76.5/oz, which is the worst daily percentage result in the history of trading this commodity, surpassing even the famous Hunt brothers' crash of the 1980s. The market lost nearly $10 trillion in capitalisation in just 24 hours, clearly indicating the bursting of the speculative bubble that had been forming over the last few months of a frenzied bull market fuelled by fears of inflation, political uncertainty and massive purchases by central banks.

Despite the dramatic correction, current levels remain historically high – gold at £4,716 is still an unimaginably high price compared to previous years. Analysts point to technical support below the £4,000 level, where long-term investors and "strong hands" ready to buy the dip may step in. The market is waiting for several critical catalysts: Trump's decisions on Iran, the Supreme Court's ruling on tariffs, and Kevin Warsh's first public comments as the newly elected head of the Fed, which may signal a new direction for monetary policy.

Source: xStation

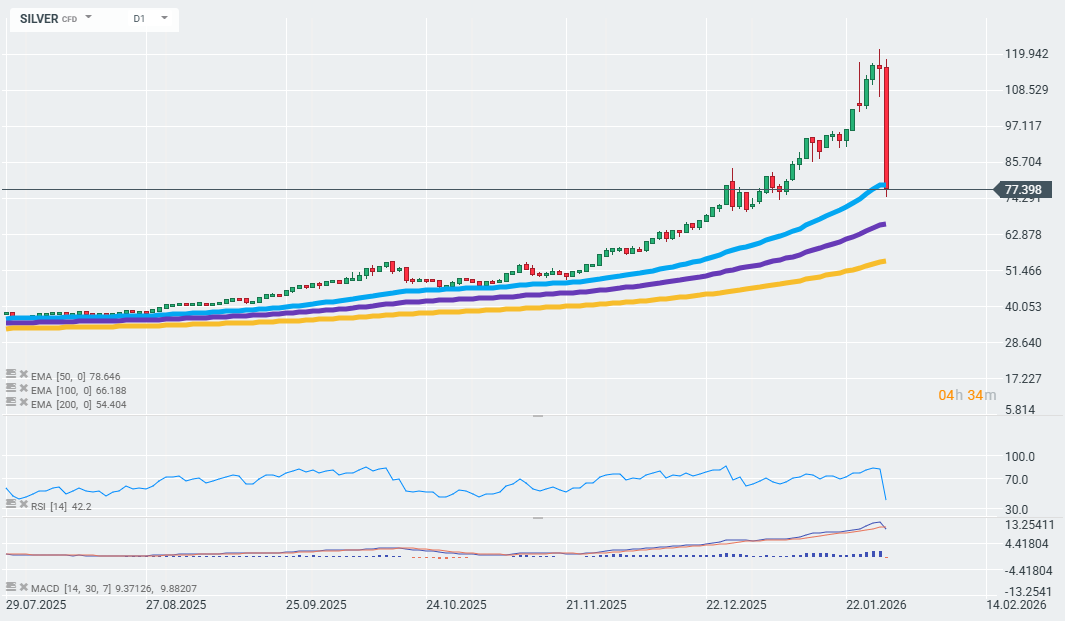

SILVER is currently testing the long-term support marked by the 50-day EMA.

Source: xStation

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.