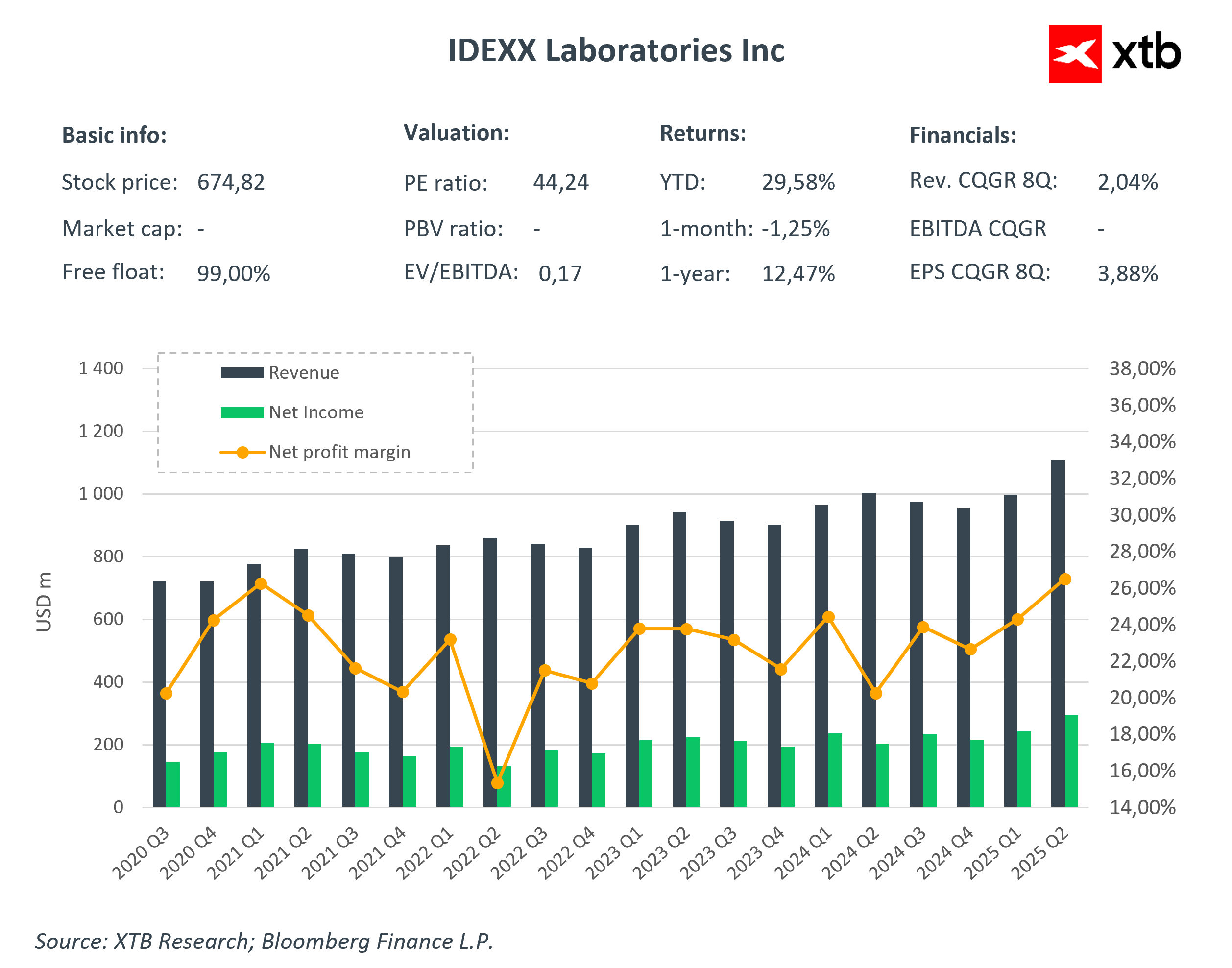

Shares of Idexx Laboratories jumped 26% to USD 676 per share after posting strong second-quarter results that beat Wall Street expectations and raising full-year guidance. Revenue rose 11% y/y to USD 1.11 billion, driven primarily by the Companion Animal Group (CAG) segment, which generated USD 1.02 billion (+11% y/y), including the installation of nearly 2,400 InVue Dx diagnostic devices—a new product that exceeded expectations. Earnings per share (EPS) rose to USD 3.63 from USD 2.44 a year earlier, significantly topping analysts’ consensus of USD 3.30. Gross margin improved to 62.6%, and operating income surged 41% to USD 373 million.

Key financial highlights:

- Revenue (Q2): USD 1.11 bn (+11% y/y); consensus: USD 1.07 bn

- CAG revenue: USD 1.02 bn (+11% y/y); consensus: USD 980.2 mn

- Water segment revenue: USD 51.0 mn (+9.1% y/y); consensus: USD 50.7 mn

- LPD revenue: USD 31.8 mn (+4.8% y/y); consensus: USD 31.2 mn

- Gross margin: 62.6% vs. 61.7% y/y; consensus: 62.2%

- Operating income: USD 373 mn (+41% y/y); consensus: USD 352.5 mn

- EPS (Q2): USD 3.63 vs. USD 2.44 y/y; consensus: USD 3.30

- FY25 EPS guidance: USD 12.40–12.76 (previous: USD 11.93–12.43)

- FY25 revenue guidance: USD 4.21–4.28 bn (previous: USD 4.10–4.21 bn)

- Number of InVue Dx devices installed in Q2: approx. 2,400

-

![]()

Management attributed the success to strong global adoption of Idexx's diagnostic technologies, particularly the InVue Dx analyzer, which enhances veterinarians' workflow and delivers faster results. CEO Jay Mazelsky emphasized that growth is driven by innovation and the resilience of the pet health market, stating, “We saw exceptional momentum in InVue Dx installations, exceeding our expectations.” Growth was also supported by rising consumables sales (+15%), strong demand for reference lab services and imaging systems. International markets, particularly in water testing, also posted double-digit growth.

Looking ahead, Idexx raised its full-year outlook. The company now expects EPS between USD 12.40–12.76 (previously: USD 11.93–12.43) and revenue between USD 4.21–4.28 billion (previously: USD 4.10–4.21 billion). Analysts view these revisions as a sign of confidence, despite recent concerns about declining vet visit volumes. The company also reaffirmed its capital expenditure plan of USD 160 million and forecast an operating margin between 31.3% and 31.6%. Continued growth is expected to be fueled by the aging pet population, stable demand for diagnostics, and expanding presence in international markets.

Source: xStation 5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chubb to insure ships crossing the Strait of Hormuz 🗽 What does it mean for the company?

An elevated oil price is here to stay as supply concerns grow, equities fall

Rheinmetall earnings: Formidable growth, but the market expected more

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.