Summary:

-

Indices trade in the red after Tuesday’s large gains

-

US500 back near the 2800 level

-

Netflix called to open 10% higher after strong user growth

Yesterday saw a turnaround for stock markets with sizable gains seen across the board. In a role reversal to last Wednesday’s heavy declines it was US tech that was leading the way higher, with the US100 recovering almost all of the losses seen in the past week. This morning started brightly in Europe with Tuesday’s highs taken out to the upside, but sellers have since stepped in and most market are in the red ahead of the Wall Street open.

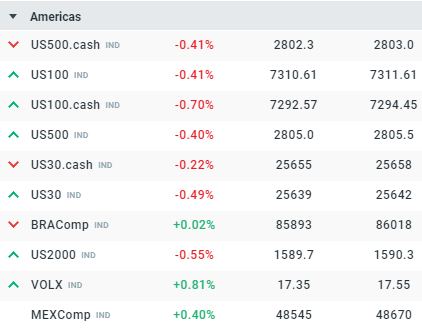

US markets are all trading lower apart from the volatility index (VOLX) which trades inversely to the US500. The declines at present seem to be just a pullback after Tuesday’s large gains but any further selling in the coming hours would put them back under pressure of steeper declines. Source: xStation

The US500 rallied more than 2% during yesterday’s session with the market moving, and ending, back above the recent highs of 2799. This is no doubt a positive development as this region has acted as something of a swing level before but it would be premature to declare the selling over. Price has rallied up to the 8 EMA and made a high of 2824, but it remains below the 21 EMA and these continue to be in a negative orientation. As long as 2799 isn’t broken below cleanly then a further recovery may lie ahead, with a move above 2824 opening up the 21 EMA and a bigger push to 2850. However, if price dips back below 2799 then the bears may look to push home their advantage and could drive price back near last week’s lows of 2712. It is worth pointing out that there is yet to be a retest of the lows around 2712 and a retest and hold of support is common when markets make a bottom - or put another way it is rare that markets bounce sharply without a lookback after a large sell-off.

The US500 bounced strongly yesterday but remains in a downtrend according to the EMAs. Previous lows have shown a retest and hold before a recovery could ensue and if price moves back below 2799 then another attempt at recent lows around 2712 may occur. Source: xStation

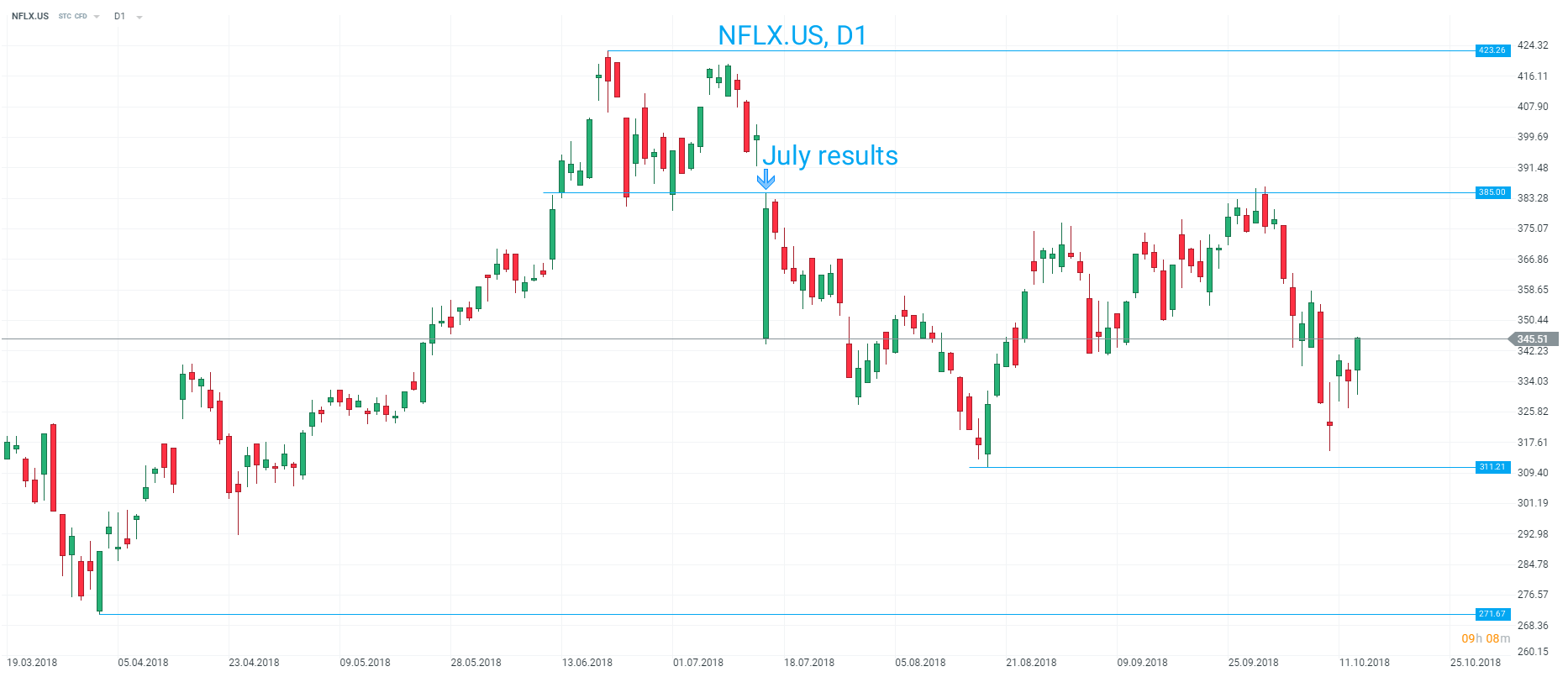

There was more good news for US tech stocks after last night’s closing bell with Netflix jumping in post-market trade after delivering a better than expected set of results. The online streaming giant has been the best performing FAANG stock this year and rallied more than 10% in after hours trade following the latest update. The firm added nearly 7m net new subscribers in the third quarter - well above the 5.3m expected by analysts and the 5m its executives had predicted just 3 months ago. The numbers eased fears that Netflix might repeat a miss seen following its previous update, which sent the stock sharply lower. While the results are no doubt pleasing, the company still relies on debt to finance its ballooning levels of content spending - with plans of a total spend of $8b for this year. The pleasing results have now seen the firm anticipate free cash outflows of about $3B in 2018, down from an earlier forecast of $4B.

Netflix shares are called to open strongly higher by around 10% and somewhere near 380 after a pleasing earnings release last night. The news has seen the market jump higher by almost the same amount as it fell back in July on its last trading update and could boost wider investor sentiment in FAANG and tech stocks in general. Source: xStation

Netflix shares are called to open strongly higher by around 10% and somewhere near 380 after a pleasing earnings release last night. The news has seen the market jump higher by almost the same amount as it fell back in July on its last trading update and could boost wider investor sentiment in FAANG and tech stocks in general. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.