Summary:

-

Forthcoming US session could decide whether midterm reaction persists

-

US500 back above 200 day SMA

-

Greenback sliding lower with EURUSD near key level

-

Trump press conference at 4:30PM (GMT)

This afternoon’s price action will be no doubt keenly viewed as Traders look to see whether the initial moves following the US midterm election results persists or whether there are any significant reversals. While the moves seen in stock indices and the USD haven’t been as large as they were back in 2016 (as you’d expect) they have been pretty clean and clear with stocks moving higher while the US dollar has fallen back. The move in stocks is likely less due to the outcome of the Democrats taking the house, and more a reaction to the expected result occurring and also the political uncertainty going forward being lifted somewhat.

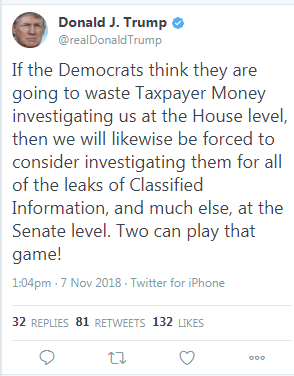

Donald Trump is scheduled to conduct a press conference later this afternoon (4:30PM GMT) and given that his post 2016 election speech coincided with a turning point in the market it could well be worth watching. Having said that he has already taken to Twitter to offer a typically combative response to suggestions that the Democrats may investigate his administration and it is unlikely he strikes a positive bipartisan tone later. Source: Twitter

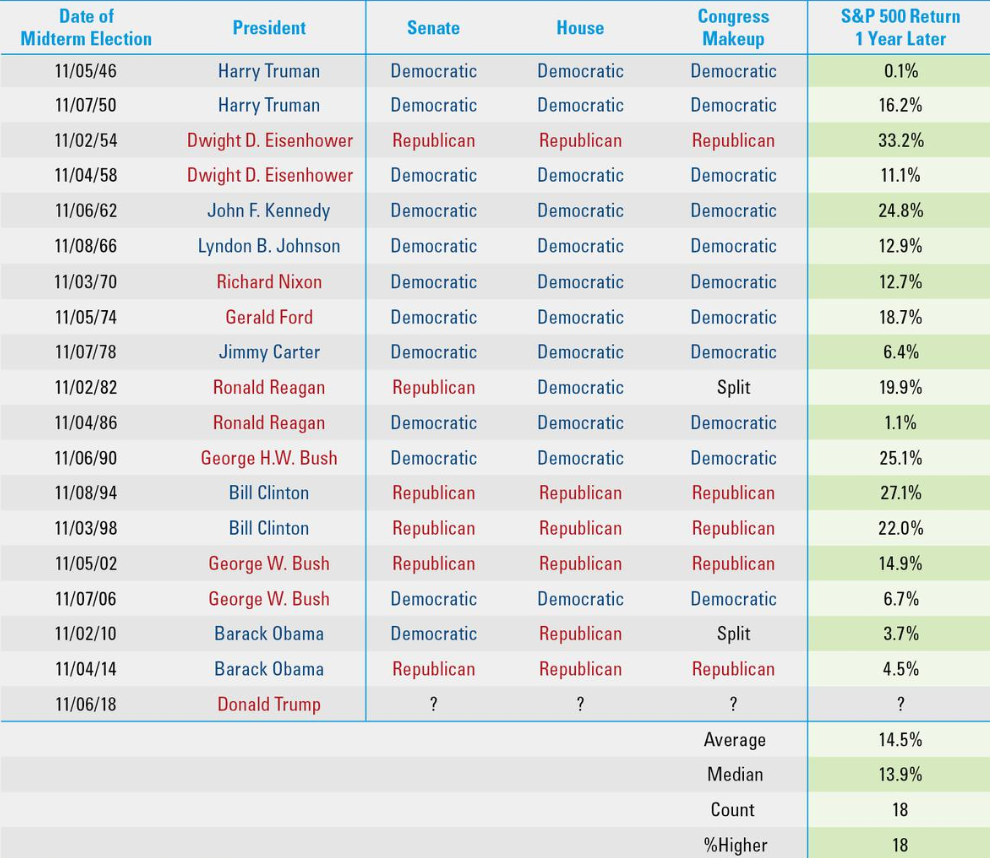

A Democrat clean sweep (House and Senate) had been seen as unlikely but would’ve represented a potentially large negative shock to the markets and therefore avoiding this outcome can be seen as positive. Looking back to the end of the Second World War there has been a clear positive trend following midterm results with the S&P500 (US500 on xStation) higher on each of the 18 occasions.

The S&P500 (US500 on xStation) has been higher 1 year after the Midterms every year since 1946 with an average gain of 14.5%. Note there have only been two split outcomes with large gains seen after 1982 but a fairly meagre rise of 3.7% after 2010. Source: LPL Research

The US500 has pushed up to its highest level in almost 3 weeks today and the market is on course for a 6th gain in the past 7 sessions. More importantly from a long term trend perspective price has got back above the 200 day SMA after a fairly prolonged period below it and if the market can end above there (currently 2763) tonight then that will be seen as a further positive development with 2824 the next swing level above. However, on the other hand should the market fall below there and end lower than shorts would have another opportunity to push down towards last month’s lows. Sharp V shaped reversals are rare in markets without at least a retest somewhere in the vicinity of the swing low and we can note that when the market bottomed back at the start of the year price fell back after a sharp initial recovery.

The US500 has moved back above the 200 day SMA today for the first time in almost 3 weeks and a daily close above there (currently 2763) would open up the chance for further gains towards 2824. However, the sharp nature of the recovery does suggest there’s a fair chance that price retests lows around the 2600 region even if they do ultimately hold. Source: xStation

Turning our attention to the US dollar and it is apparent that the buck has dipped since the results became clear with only EM currencies faring worse. The declines are fairly measured but their breadth could be seen as telling and several pairs involving the USD are shaping up nicely. Arguably the market that is at the most interesting level is the EURUSD, with the most popular FX cross hitting a key fib retracement zone. The region from 1.1498-1.1514 is the 38.2-41.4% fib retracements of the larger declines and how price reacts here may well prove pivotal. A clean break above 1.1514 would pave the way for a further recovery with the 50% at 1.1558 and the 61.8% at 1.1619 possible targets. A rejection here would keep the market in the lower reaches of the recent range with the 23.6% fib at 1.1423 possible support.

The EURUSD is at a key fib level from and a clean break above 1.1514 would open up the possibility of further gains towards 1.1619. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.