NFP with a big revision

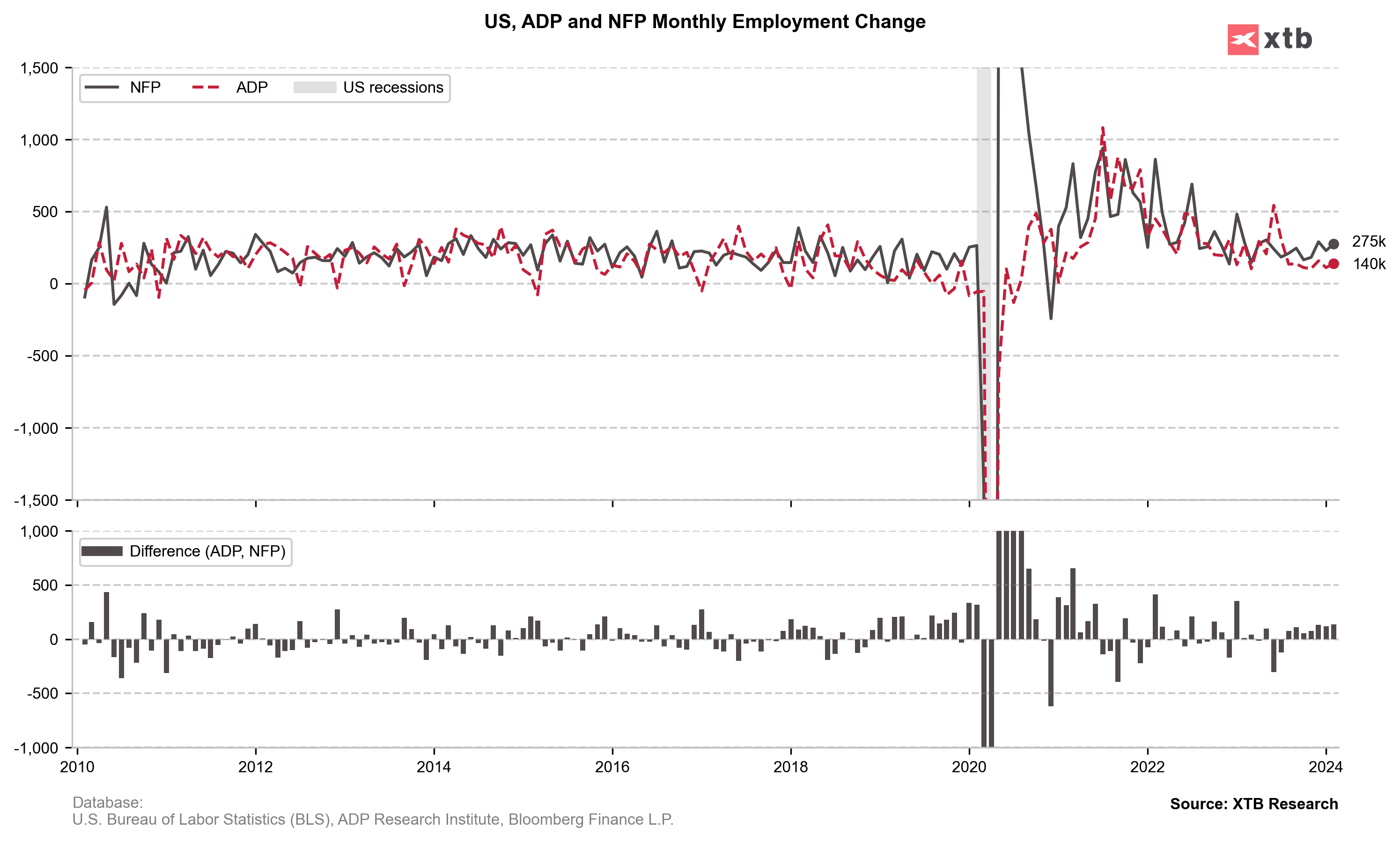

Today's NFP report showed another strong gain in US employment. Full-time job growth reached 275,000, following a very strong January. The snag is that January was very much revised downwards. As we wrote about in the preview, the percentage of surveyed companies that sent out their January surveys before the NFP was just above 50%. A revision was to be expected. Thus, the reading for January was revised down to 223,000 from 353,000.

The NFP report does not look bad only superficially. Of course, a month-on-month gain above 200k is a lot, but certainly the labour market is not as heated as some thought just a month ago. Source: Bloomberg Finance LP, XTB

FTEs are not people employed

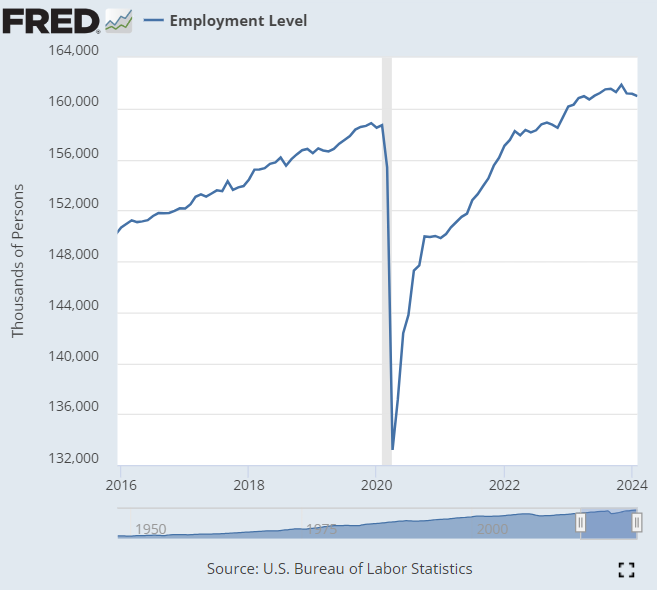

Another problem is that an increase in posts does not necessarily mean an increase in the number of people employed. In this respect, we have seen a significant decline in the number of people employed for a long time (since November). This data comes from the household survey. This report showed that the decline in employment for February was 184,000 to 160.968 million employed. This means that more and more people are working 2 or perhaps even more full-time jobs. This is not necessarily indicative of the strength of the labour market.

US employment levels have been falling since November. Source: FRED

Rising unemployment rate

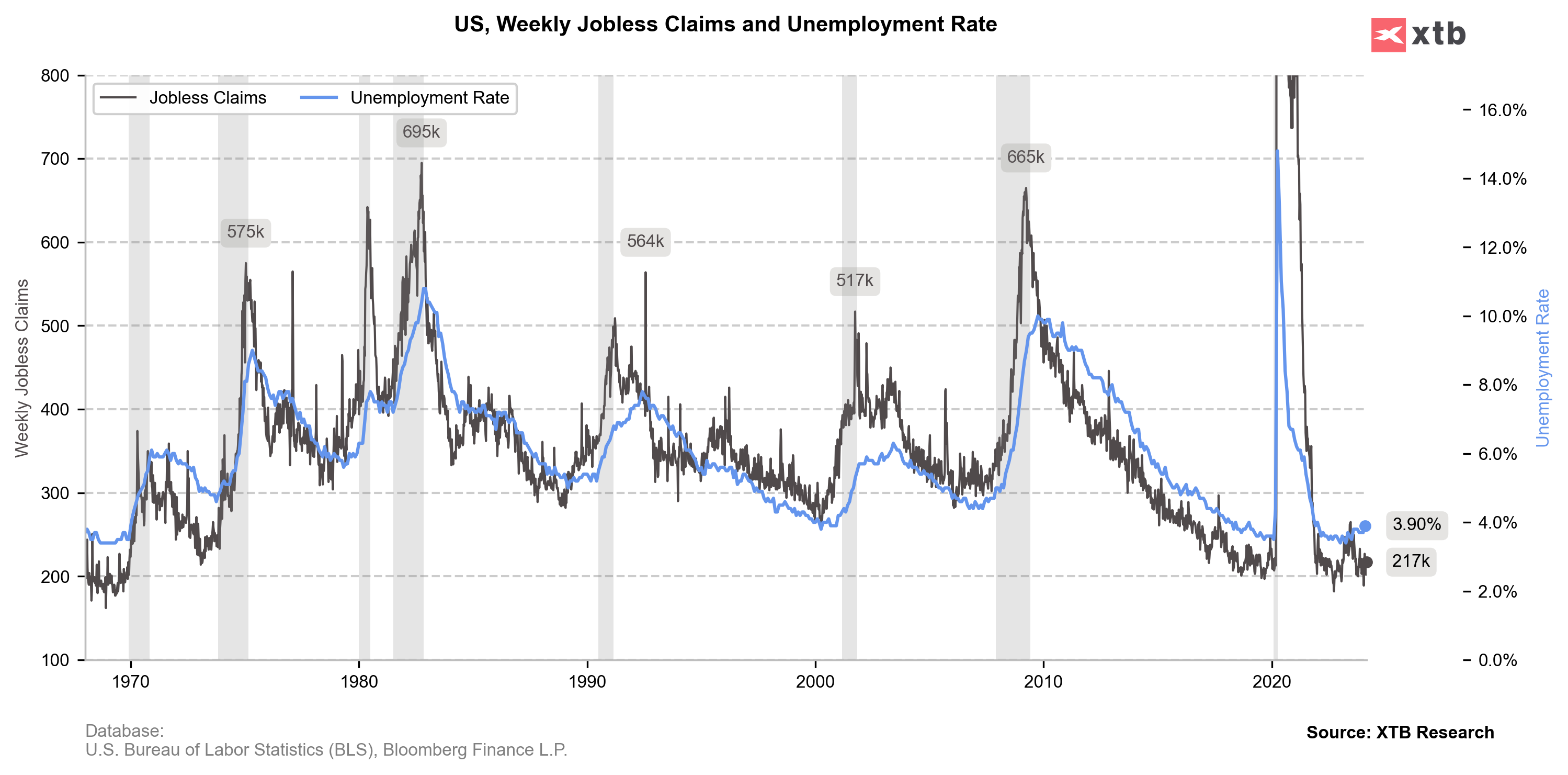

The unemployment rate also comes from the household survey, so it should come as no surprise that we have an increase in the number of full-time jobs and an increase in the unemployment rate. The rate rises to 3.9% from 3.7% and the rate was not expected to rise.

The unemployment rate is approaching 4.0%. In the past, exceeding this level has suggested the possibility of the economy entering a recession. Source: Bloomberg Finance LP, XTB

Lower wage growth

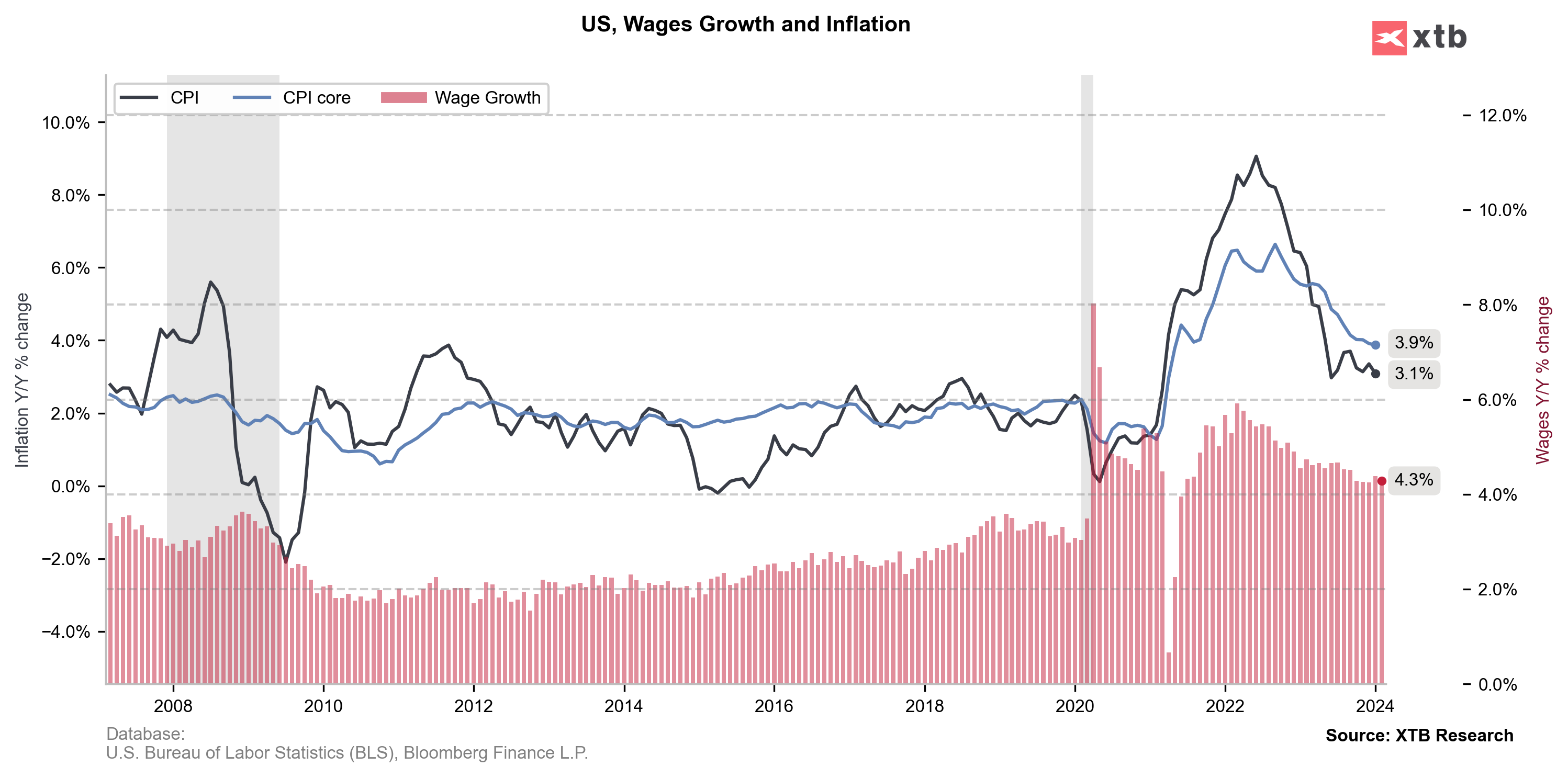

This data will certainly be welcomed by the Fed. Lower wage dynamics mean there is less prospect of a demand-led boost to inflation. However, the dynamics are still relatively high compared to the inflation target. According to the Fed, wages can grow at 3% for the inflation target to be met. Nevertheless, the monthly increase was only 0.1% m/m.

In contrast to the euro area, there are no rising wage pressures here, so the risk of a larger rebound in core inflation is limited for the time being. Source: Bloomberg Finance LP, XTB

Employment change will fall to zero?

Looking at an interesting comparison presented by ZeroHedge, which takes the NFIB employment survey and pushes it back a bit, this would suggest that a sizable drop in employment growth is lined up in the coming months, particularly in Q2 and Q3.

Source: ZeroHedge, Bloomberg

Is bad data good data?

Everyone can see that the details of the report are not good, although at the same time it is hard to say that the labour market looks weak. Of course, the report makes one think about the timing of the first reduction by the Fed. Will the bank decide to react before the problem actually occurs? Won't another negative revision await us in a month's time? Would this mean the publication of data to show the state of the economy too well ahead of the upcoming elections? The indices have rallied to historic highs and the dollar has started to lose ground. Nevertheless, the market is seeing more and more reluctance towards the dollar, with additional speculation that a possible hike by the BoJ could reverse the world's most important carry trade, which could threaten financial stability worldwide.

Is gold a warning of more global dedollarisation? Or merely benefiting from a wave of asset price inflation. Source: xStation5

Is gold a warning of more global dedollarisation? Or merely benefiting from a wave of asset price inflation. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.