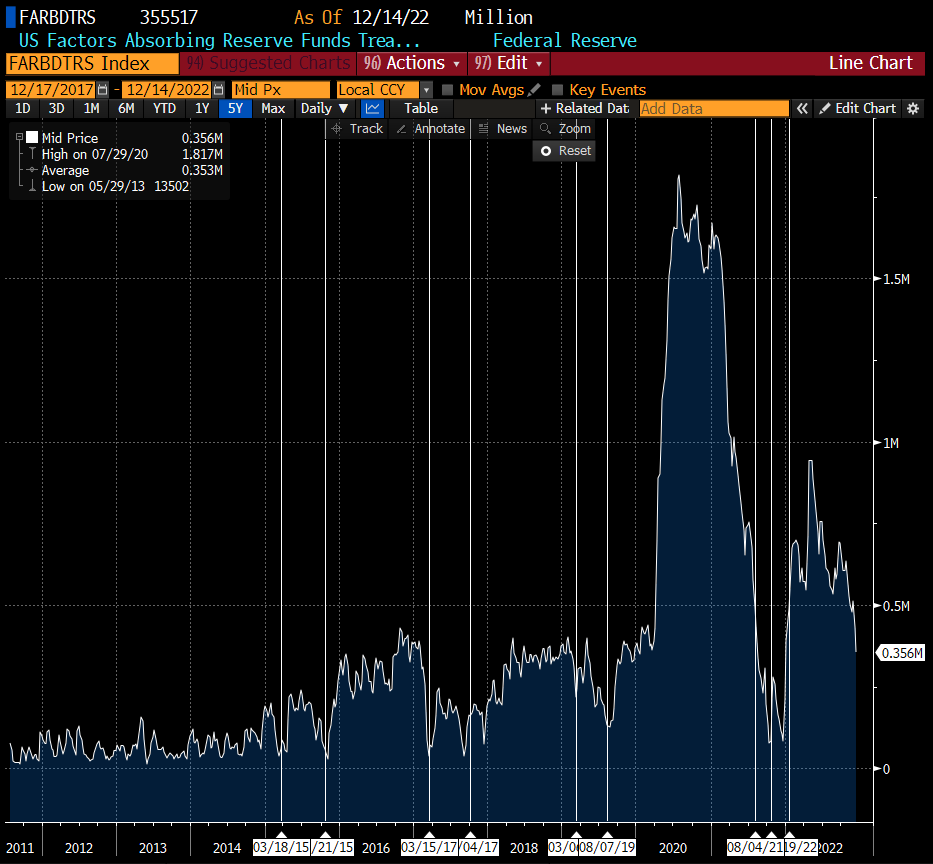

TGA is key to watch at the beginning of the next year

- Next year, the United States will again face the problem of reaching the debt limit, which is likely to be raised again.

- In order to "speed up" negotiations, the Treasury Department is getting rid of cash from the Treasury Department's main account just before the debt limit is reached. Moreover, usual operations cannot be financed by debt so TGA drains quickly. The TGA is the Treasury Department's main account for tax revenues and other government spendings.

- Looking at previous situations when the debt was approaching the limit, the TGA has been falling below $100 billion. A similar situation can be expected in the coming weeks.

- "Withdrawals" from the TGA mean a real increase in liquidity in private markets, as the Treasury Department releases "frozen" liquidity from its account.

- The limit is likely to be reached Q1 23, which means we should see additional liquidity in the markets in the coming weeks. On the other hand, right after the limit is raised, dollar liquidity may collapse, through the rebuilding of funds on TGA and QT by the Fed.

The dates marked show situations when the debt was approaching the limit. A drop in TGA means increased liquidity in private markets. Source: Bloomberg

Bank reserves are crucial for the S&P and may increase temporarily

- The level of reserves of commercial banks in the Fed account has been a very important factor for the behavior of the SPX in the last 3 years.

- If the money from TGA goes to the private market, the S&P 500 may rebound and stay close to 4000 points or even higher if the Fed will limit reverse repo operations.

- On the other hand, it is expected that liquidity could be drastically reduced once a new debt limit is set. So after that the S&P 500 may continue its downward move.

Bank reserves and S&P500. Source: Bloomberg

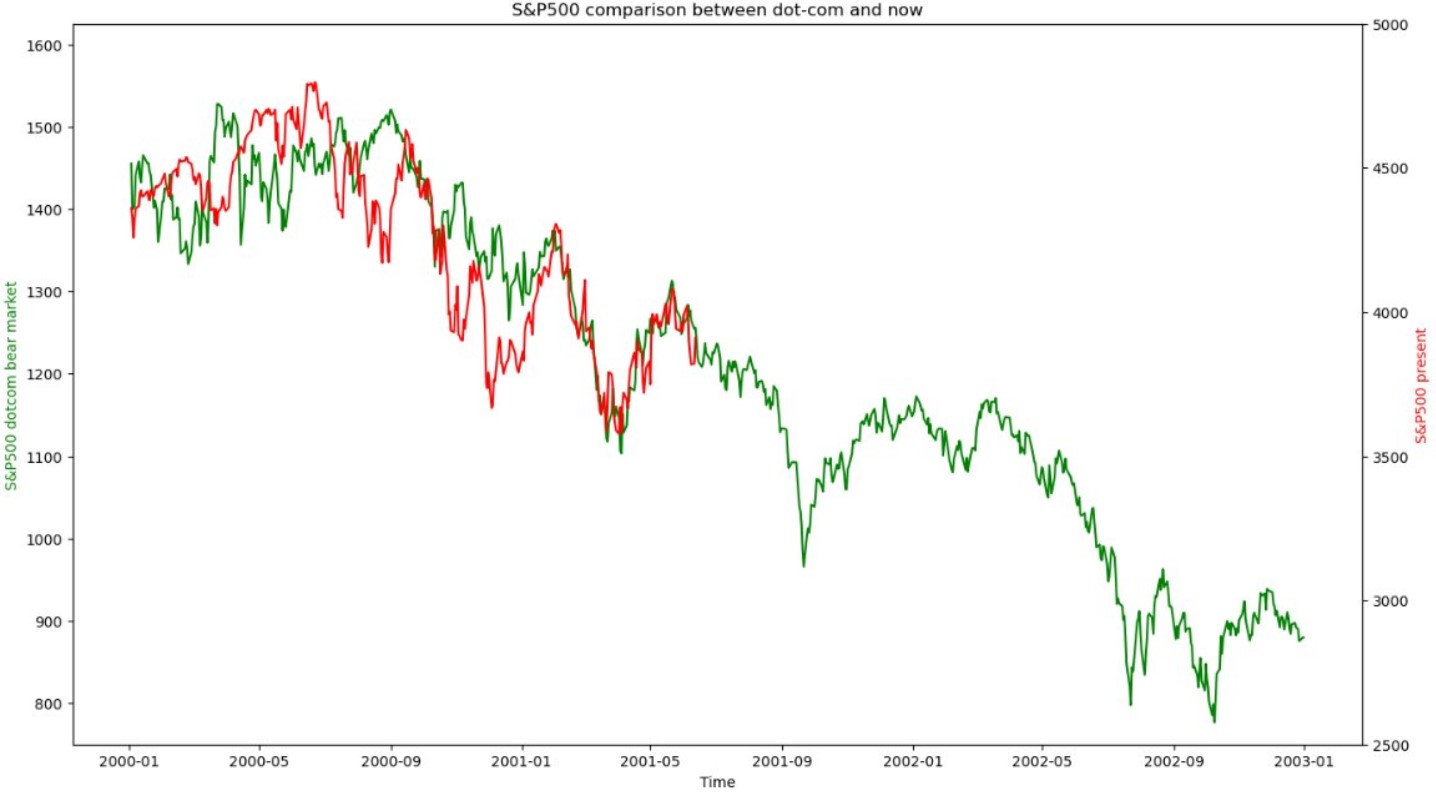

As we can see on the chart above, the current price behaves similarly to the period of the dot-com bubble. It means that we are still in the downward trend and some correction moves may occur in the coming months. Source: Bloomberg, XTB

As we can see on the chart above, the current price behaves similarly to the period of the dot-com bubble. It means that we are still in the downward trend and some correction moves may occur in the coming months. Source: Bloomberg, XTB

Of course, we should remember that the market is closed today as Christmas Day fell on Sunday this year!

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector

Cockroach fears cause stock market sell off, as we wait for clearer details

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.