After the market close on Wall Street today, e-commerce giant Amazon (AMZN.US) will report its fourth-quarter 2023 earnings. Investors eagerly anticipate another strong showing, with expectations of record revenue and continued growth in key segments. Analysts closely watch Amazon's cloud computing arm, AWS, as a major driver of innovation and future potential.

Market Expectations:

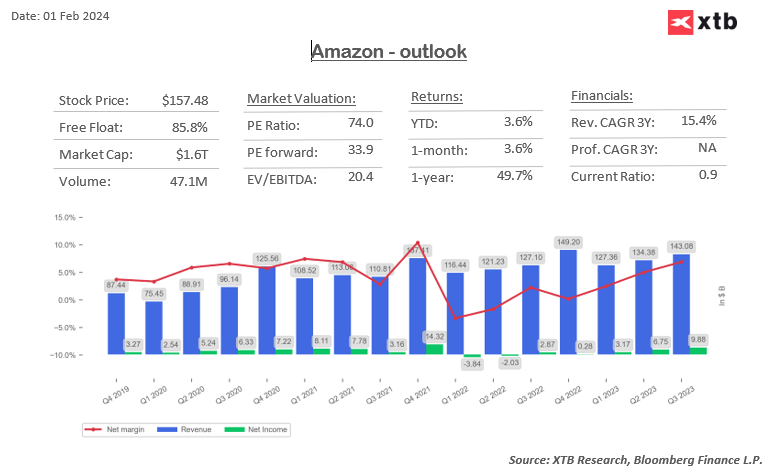

- Record Revenue: Analysts predict $166.25 billion in revenue, an 11.42% year-over-year increase.

- Strong EPS Growth: Earnings per share (EPS) are expected to be 79 cents, representing a significant 172% year-over-year growth.

- Core Retail Strength: Online sales are expected to reach $68.91 billion, with seller services generating an additional $42 billion.

- Cloud and Advertising Growth: Continued momentum is expected in the AWS (Amazon Web Services) and advertising segments. AWS revenue forecast is $24.5 billion, up 12% year-over-year, while advertising revenues might exceed $12.5 billion, representing a 9% year-over-year increase.

- Focus Areas: Investors will pay close attention to the company's plans for further cloud development, particularly regarding investments in artificial intelligence.

- Outlook and Advertising Returns: The upcoming quarters' outlook and returns on advertising after enabling Prime Video ads in the US will be closely scrutinized.

Market Concerns:

- EPS Lower Than Expected: Some analysts warn of potentially lower EPS growth, impacting share prices negatively.

- Economic Slowdown Impact: Concerns about a potential economic slowdown might raise uncertainty about Amazon's future performance.

- Competition and Growth Slowdown: Amazon may face challenges from growing online competition, potentially slowing down growth in key segments like online sales.

What to Watch:

- Investment Strategy: Declining investments in cloud development could weaken Amazon's position against competitors, but could also lead to higher margins and profits.

Market analysis:

- Analyst Sentiment: The company has 68 buy ratings, 2 hold ratings, and 0 sell ratings, indicating strong analyst confidence.

- Price Target and Volatility: The average price target of $148.8 per share suggests an 18% upside potential, with an implied daily share price change of +/- 7% after earnings release.

- Historical Performance: Amazon has beaten EPS estimates in 9 of the last 12 quarters. Its shares have gained 51.5% over the past year, compared to the S&P 500's 20% gain.

Technical view:

Unlike other tech giants, Amazon is far from its 2021 peak and hasn't kept pace with the US100 recently. Key support for the share price lies around $145, with potential upside to $166-170 on positive earnings.

Source: xStation5

Key data:

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Navigating Middle East uncertainty and tariff risks

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.