As we wait for the Federal Reserve, a few things are moving markets. Overall, European stock markets are lower, and US stock market futures are pointing to a higher open, after the S&P 500 hit another record high on Tuesday. The focus is on the Federal Reserve decision later today and the Dot Plot, but that doesn’t mean that markets are quiet in the lead up to this meeting.

1, Sterling drops as a June rate cut comes into play

After this morning’s weaker than expected inflation report from the UK, the market is taking that as a green light to price in a June rate cut from the BOE. Previously the first rate cut had been August. The market now expects just under 3 rate cuts from the BOE this year. The market is poised for a dovish BOE on Thursday.

Our BOE watch list includes the BOE decision split – will there be anyone voting for a hike? With progress made on wage increases and inflation, there is a chance no one will vote for a hike at this meeting. This could be seen as a step closer to the BOE cutting interest rates.

GBP/USD is falling as we move through the European morning session. It has fallen through the $1.27 level, although it is finding support around the 1.2690.

2, Dollar is king

Ahead of tonight’s FOMC decision, the dollar is rising. It is the strongest currency in the G10 FX space so far on Wednesday, and is particularly strong vs. the JPY. USD/JPY is ripping higher, and is above 151.70 at the tome of writing, its highest level since 1990. There has been no sign of official BOJ intervention to prop up the yen, which is why the market is pushing it higher. However, this pair is at risk of intervention, and could be volatile over the next day or so, especially if the Fed is considered to be hawkish.

US Treasury yields have been mostly flat so far this week, as we wait for more direction from the Fed. We expect any change to the Dot Plot, for example, a reduction in rate expectations for this year from 3 to 2 rate cuts, could have a big impact on the global bond market. While UK and European yields move due to domestic factors, they are also influenced by the US Treasury market. If there is a big move in US yields later tonight, that could also impact yields elsewhere.

3, Lagarde won’t pre commit to an interest rate path:

There have been a raft of speakers at an ECB conference on Wednesday, including the ECB President Christine Lagarde. The key takeaways from her speech include: 1, the latest wage data is encouraging, 2, service price inflation is likely to remain elevated this year, 3, even after the first rate cut, the ECB cannot pre-commit to a rate path.

The last point is worth noting. Markets are desperate to price the number of rate cuts from central banks in the coming months and years. This highlights the difference between the ECB and the Federal Reserve: the Fed have a Dot Plot, which visually depicts where FOMC members expect interest rates to be in the short and medium term. While the Dot Plot is not a commitment, it is still a good yard stick for financial markets to price in what the Fed is expecting to do in the future. The ECB does not have this, and Lagarde is ruling out the idea of pre-committing to a rate path. Right now, the market expects just over 3 rate cuts from the ECB this year, and the first rate cut is expected in June. But, if Lagarde is worried about service price pressures, there could be some volatility in European interest rate expectations for the rest of the year.

4, Luxury weighs on European stocks

The Cac 40 is the worst performer in Europe so far today. Gucci owner Kerring issued a profit warning for this year, which sent its stock price down by more than 12%. This news has weighed on the overall luxury sector. Gucci sales slumped by 20% in Q1, and part of this was down to a sharp decline in sales in China. This is causing concern that other luxury houses could see a similar downturn in demand from this important market.

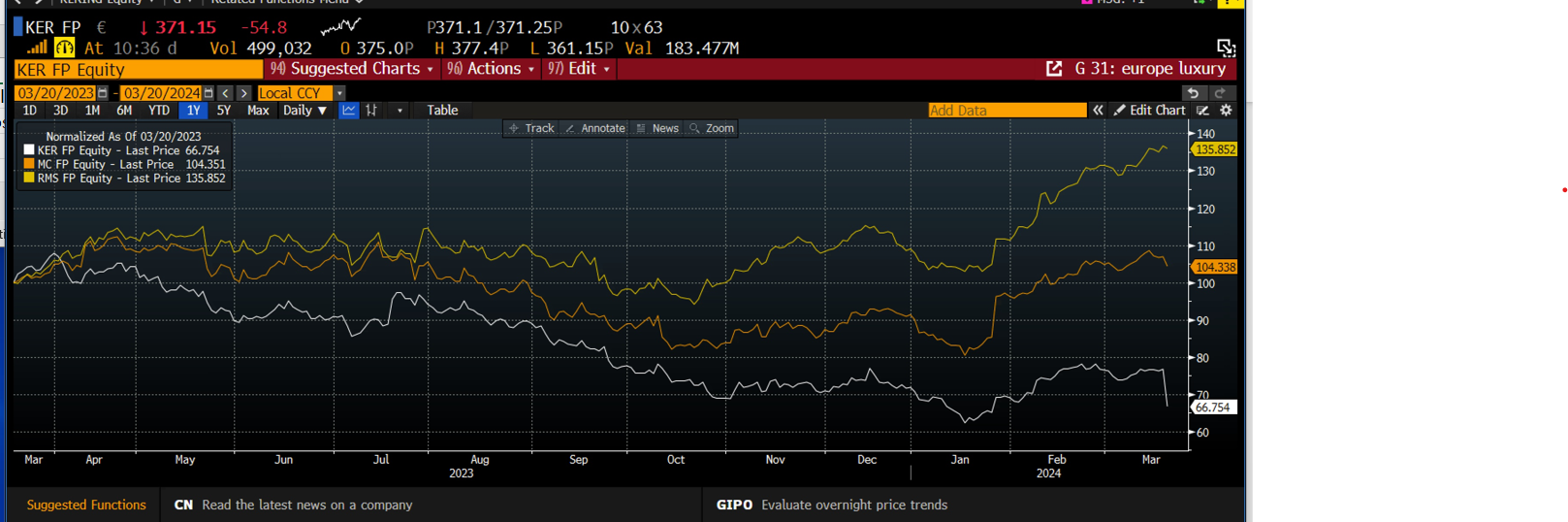

Analysts have been revising down their profit estimates for Europe’s textiles and Apparel sector, and this could weigh on luxury stocks in the medium term. However, as you can see in the chart below, Kerring is a major underperformer in Europe’s luxury market over the last year, and some of its troubles are company specific, rather than sector specific. This means that Kerring may see the brunt of the selling pressure in this sector.

Chart 1: LVMH and Hermes outperform Gucci owner Kerring

Source: XTB and Bloomberg

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Join NFP Live Now

NFP Market Live

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.