Merck & Co., the global pharmaceutical giant known for oncology drugs and vaccines, today released its fourth-quarter 2025 results and 2026 guidance, which can be described in one word: mixed. The company posted solid quarterly revenue growth driven by key products such as Keytruda and new lung disease treatments, but at the same time faced significant challenges with its Gardasil vaccine, which weighed on full-year forecasts.

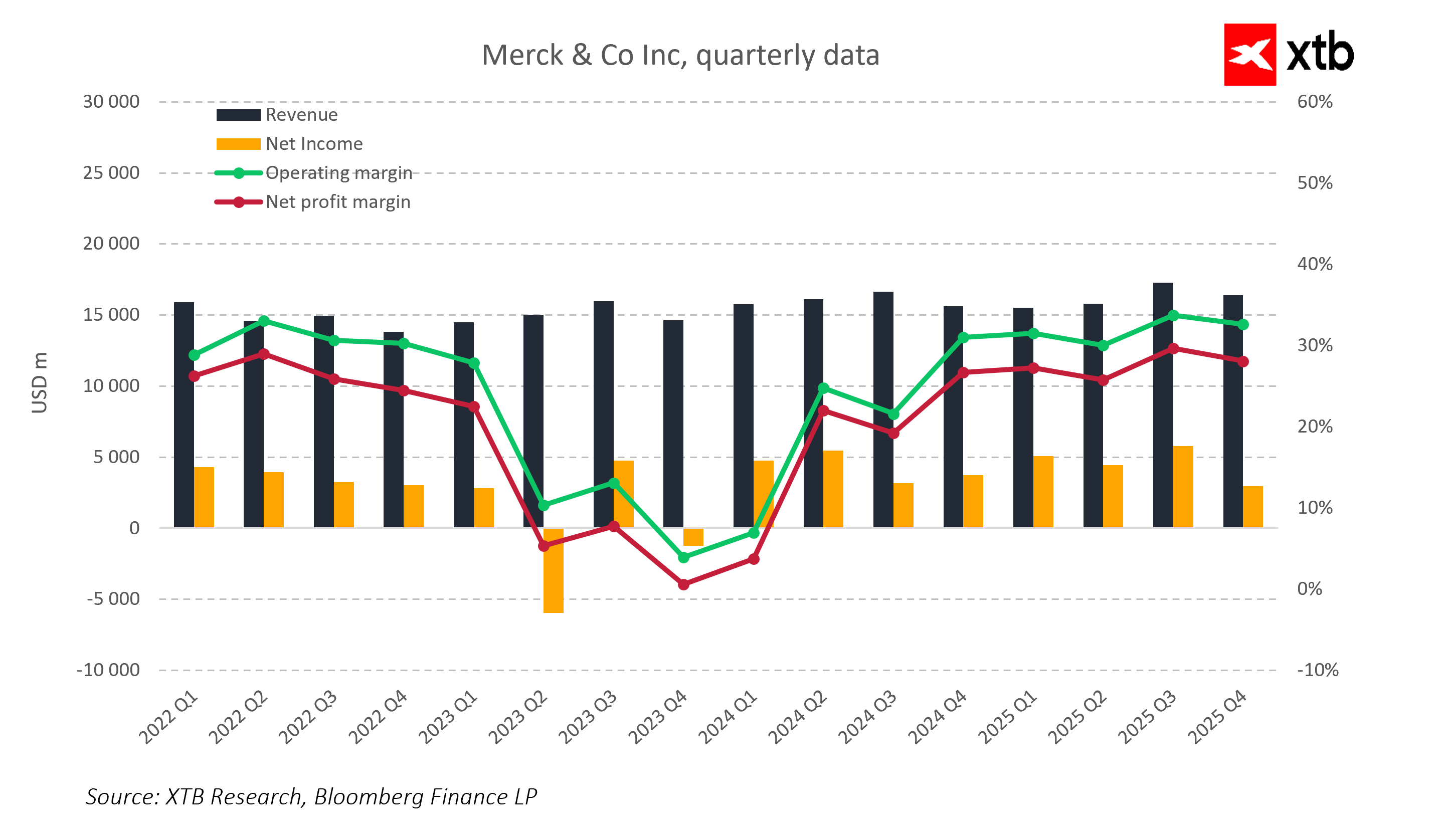

Revenue for Q4 reached USD 16.4 billion, up 5% year-over-year, exceeding analyst expectations of USD 16.17 billion. Adjusted earnings per share (EPS) came in at USD 2.04, slightly above the forecast of USD 2.01. GAAP EPS was USD 1.19, down from USD 1.48 a year earlier.

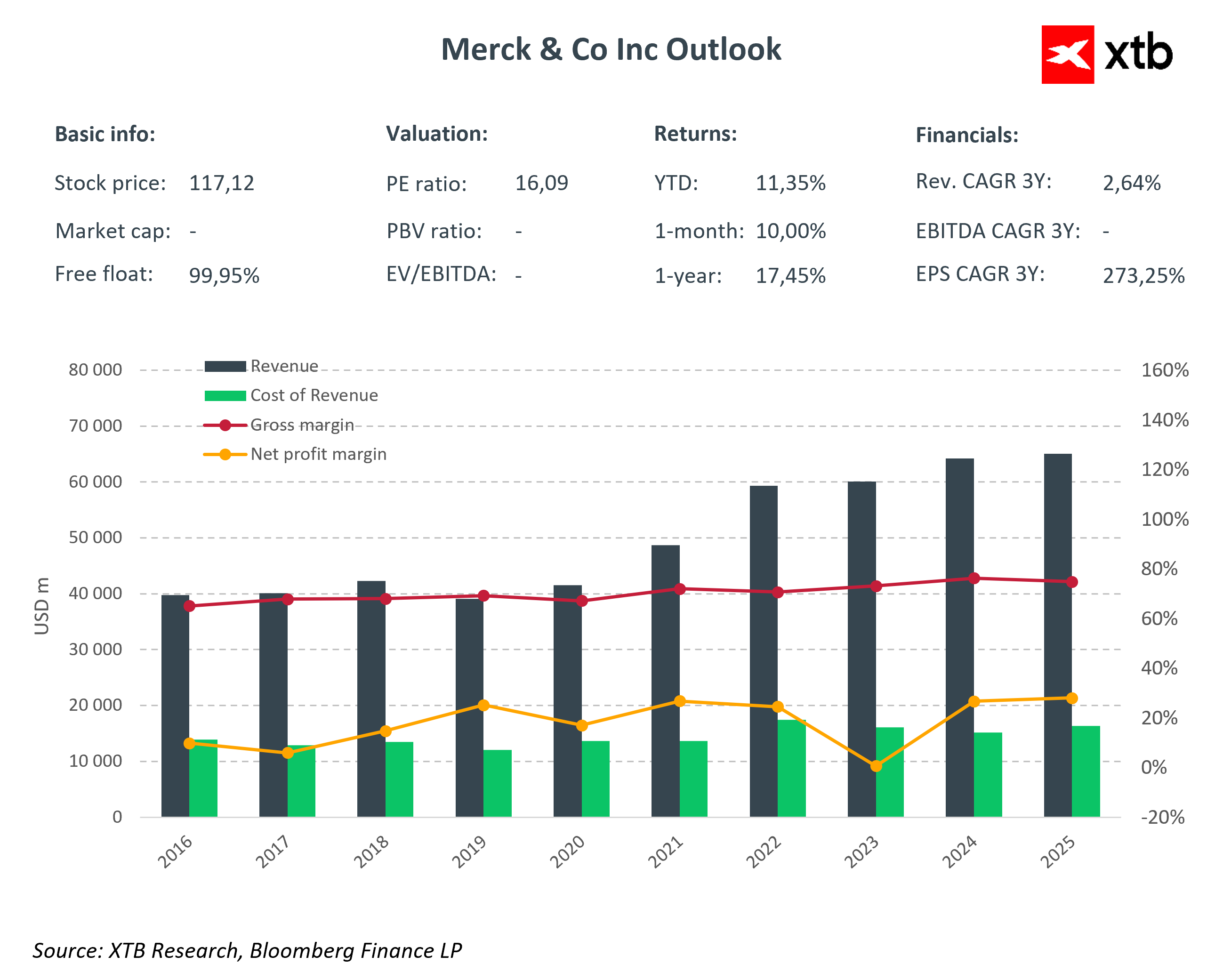

Despite strong quarterly results, Merck’s guidance for 2026 was somewhat disappointing: the company expects revenue between USD 65.5 billion and USD 67 billion, with adjusted EPS of USD 5.00–5.15, compared with analysts’ expectations of USD 67.5 billion and EPS of USD 5.27. Gross margin is projected at approximately 82%, slightly above market expectations of 81.8%.

Key Financial Results for Q4 2025

-

Total revenue: USD 16.40 billion (+5% y/y, forecast: USD 16.17 billion)

-

Adjusted EPS: USD 2.04 (forecast: USD 2.01)

-

GAAP EPS: USD 1.19 (down from USD 1.48 y/y)

-

Keytruda: USD 8.37 billion (+6.8% y/y, forecast: USD 8.24 billion)

2026 Guidance

-

Revenue: USD 65.5–67 billion (forecast: USD 67.5 billion)

-

Adjusted EPS: USD 5.00–5.15 (forecast: 5.27)

-

Gross margin: 82% (forecast: 81.8%)

Key Products and Segments

Q4 results show a mixed picture for Merck’s business:

Growth Drivers:

-

Keytruda: Sales rose 6.8% y/y to USD 8.37 billion, above the forecast of USD 8.24 billion.

-

New lung disease drugs (Ohtuvayre/Winrevair): Strong results following the Verona Pharma acquisition.

-

Other products (Reblozyl, Lenvima, Bridion, Isentress): Sales in line with or slightly above expectations.

-

Animal Health: USD 1.51 billion (+7.7% y/y), a stable non-pharmaceutical segment.

Products Under Pressure:

-

Gardasil: Sales declined 33% y/y to USD 1.03 billion, with no deliveries to China planned in 2026.

-

Lagevrio and Lynparza: Sales below expectations.

Strategy and Development Outlook

In terms of strategy and development, Merck continues efforts to diversify its portfolio and prepare for market changes, including the expiration of Keytruda’s U.S. patent in 2028. The company is focusing on expanding its portfolio with new oncology, pulmonary, and antiviral drugs, as well as innovating existing products. In this context, Merck is investing heavily in R&D and expanding U.S. production, planning capital and R&D expenditures exceeding USD 70 billion. Additionally, the company reached an agreement with the U.S. government regarding import tariffs, under which products will be supplied through a “direct-to-patient” program in exchange for a three-year tariff delay.

Merck’s 2026 guidance points to moderate revenue and profit growth while maintaining stability in key business segments. Strong results from Keytruda and new pulmonary drugs, combined with product development investments and portfolio optimization, position the company to face upcoming generic competition and maintain its strategic pharmaceutical footprint.

Conclusions

-

Merck maintains a stable position in the pharmaceutical sector, with strong foundations in oncology, pulmonology, and specialty drug segments.

-

Q4 results show growth in key areas, offset by a decline in Gardasil sales.

-

Full-year guidance indicates moderate growth, while the company prepares for future generic competition for Keytruda.

-

Strategic acquisitions and investments in new products demonstrate efforts to diversify revenue sources and strengthen the company’s long-term position.

US stocks sell off on Nvidia’s good news, as traders wait for results of key UK election

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

A tale of two earnings releases: Rolls Royce beats Nvidia, because its European

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.