According to the latest information, MicroStrategy (MSTR.US), founded by Michael Saylor, has invested an additional approximately $821.7 million in purchasing 12,000 more bitcoins. The company acquired the additional bitcoins from February 26 to March 10, 2024. The investment was financed with $781.1 million from a recent bond offering and $40.6 million of excess cash. As of March 10, the company held a total of 205,000 bitcoins, purchased for a total of $6.91 billion, averaging $33,706 each, including fees and expenses. Assuming a bitcoin price of $72,000, the total value of MicroStrategy's assets amounts to $14.7 billion, thus the total profit from the investment has exceeded $7.79 billion.

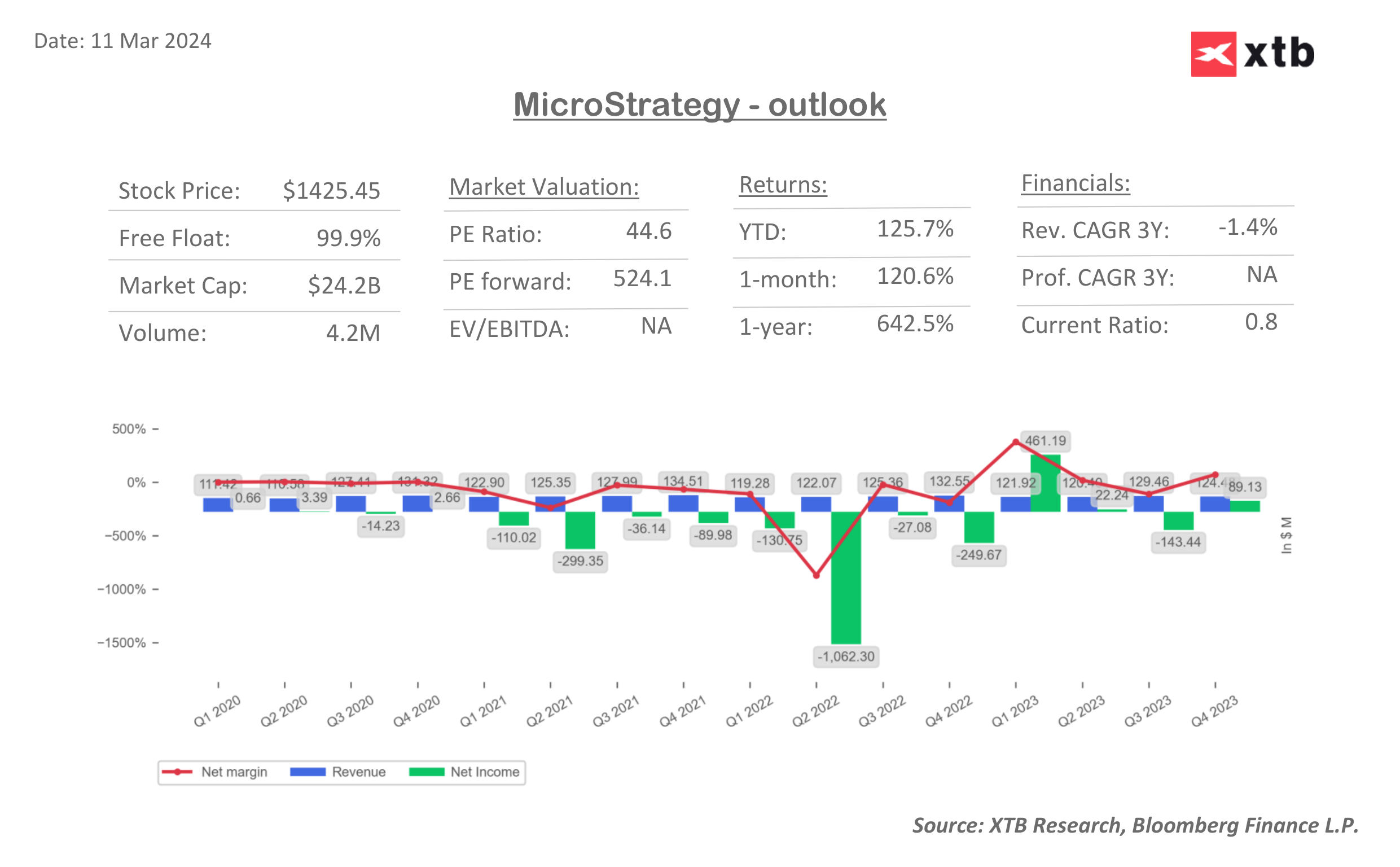

As we can see on the attached dashboard, the scale of MicroStrategy's business operations is incomparably smaller than its recent investment activities in the cryptocurrency market.

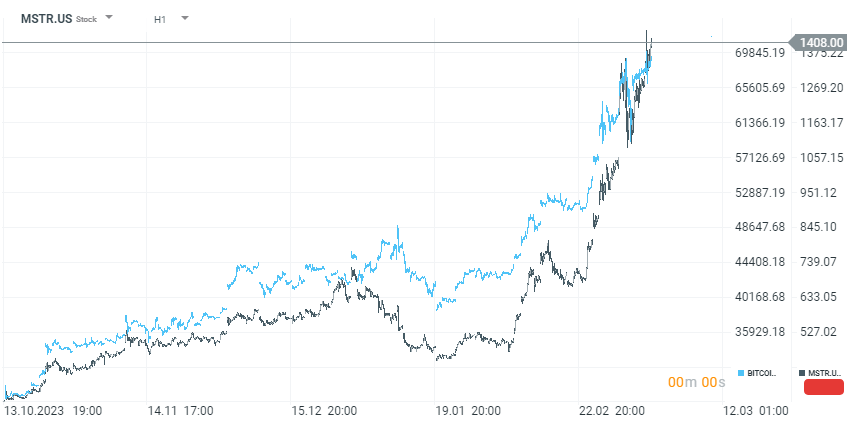

MicroStrategy's (MSTR.US) shares are gaining nearly 10% in pre-session trading. As the company increases its exposure to the cryptocurrency market, its stock prices are becoming more correlated with the price of BTC. Consequently, its market capitalization is becoming less dependent on its core business areas from a few years ago, which used to be IT, Cloud, and Business Intelligence solutions and services.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.