-

In spite of a pick-up in yield, US indices finished yesterday's trading higher. S&P 500 gained 0.84%, Dow Jones moved 1.06% higher, Nasdaq added 1.28% and Russell 2000 jumped 1.63%

-

10-year US yield climbed to 1.95%

-

Upbeat moods extended into Asian trading with major indices from the region gaining as well. Nikkei and S&P/ASX 200 moved 1.1% higher, Kospi gained 0.8% and indices from China traded 0.8-1.9% higher

-

DAX futures point to a higher opening of the European cash session today

-

Fed's Daly said she favors rate hike in March but central bank cannot be too aggressive

-

BoJ's Nakamura said that conditions for rate higher were not met yet and that hiking before wages begin to grow steadily would be a mistake

-

According to Kommersant report, Russia may soon recognize digital assets as currencies

-

According to JPMorgan, Bitcoin fair value is around $38,000

-

API report pointed to a 2.0 million barrel drop in US oil inventories (exp. +0.7 mb)

-

Precious metals trade mixed - gold and silver gain while palladium and platinum drop

-

Oil continues pullback with Brent and WTI dropping 0.7% each

-

AUD and GBP are the best performing major currencies while CHF and JPY lag the most

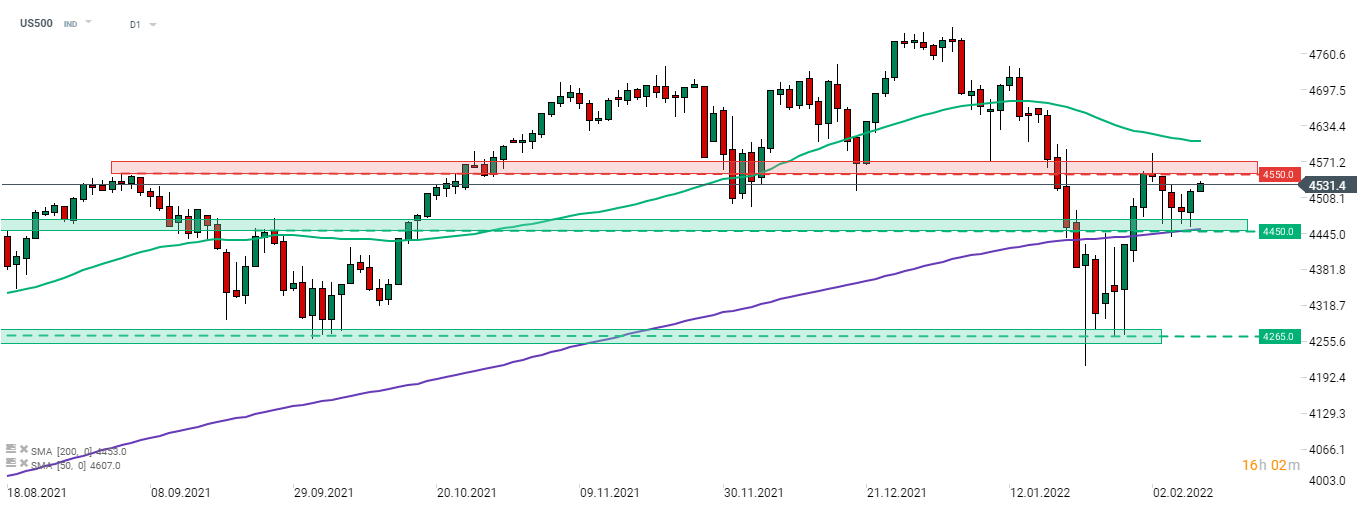

US500 bounced off the support zone in the 4,450 pts area, marked with 200-session moving average and previous price reactions. US index is now eyeing a test of the resistance zone ranging above 4,550 pts handle. Source: xStation5

US500 bounced off the support zone in the 4,450 pts area, marked with 200-session moving average and previous price reactions. US index is now eyeing a test of the resistance zone ranging above 4,550 pts handle. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.