-

On the first day of the new week, indexes in the Asia-Pacific region are trading mixed.

-

The Chinese market is seeing a slight rebound, with indices gaining between 0.15-0.25%. In contrast, Australia's S&P ASX 200 is leading the declines, losing 0.50%. Japan's Nikkei 225 loses 0.05%.

-

Futures on the Old Continent are pointing to a lower opening of the cash session, as are index futures from the US. The US500 and US100 are losing 0.40% and 0.50%, respectively.

-

Japan's year-on-year producer price index (PPI) came in at 0.8%, compared to forecasts of 0.9% and 2.0% a month earlier. On a month-on-month basis, the PPI recorded a decline of -0.4%, compared to a forecast of 0% and -0.3% a month ago.

-

The United States conducted two more airstrikes in Syria against facilities used by Iran's Islamic Revolutionary Guard Corps and affiliated groups in response to continued attacks on US forces in Syria and Iraq.

-

Goldman Sachs revised its stance on Chinese stocks by lowering its recommendation of Chinese companies. The bank cited low earnings growth and a potential reduction in the companies' attractiveness due to factors such as a slowdown in the housing sector and high debt levels.

-

This week, on November 15, there will be a meeting between US President Joe Biden and Chinese leader Xi Jinping. It will be the first face-to-face meeting in a year at the Asia-Pacific Economic Cooperation summit in San Francisco. Markets expect warming relations between the two major powers.

-

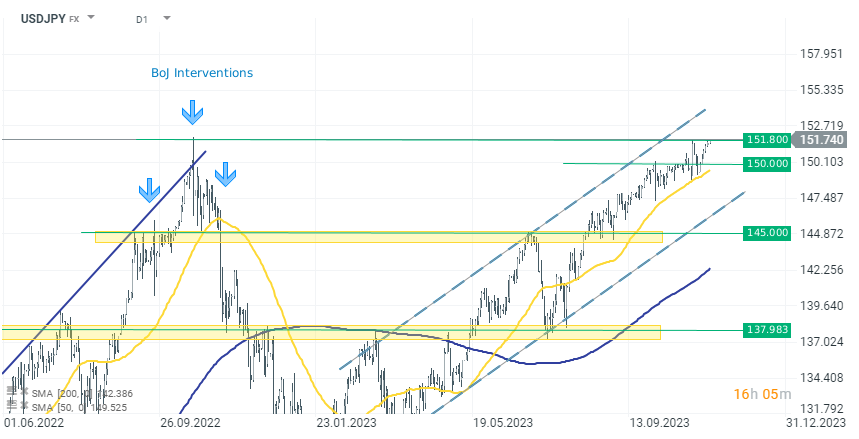

In the first part of the day in the forex market we do not see much change, but the dollar behaves slightly weaker against most currency pairs. Nevertheless, the USDJPY is gaining 0.20%, and the rate is trading at 151,700.

-

US bond yields are gaining to the level of 4.66%.

-

The cryptocurrency market is seeing a slight correction. Bitcoin retreats 0.50% to the $36600 level, as does Ethereum, which is trading at $2045.

-

Over the weekend, we saw relatively larger increases on altcoins against Ethereum and Bitcoin.

The Japanese yen is losing to the U.S. dollar today, with USDJPY gaining 0.20% to the level of 151.750. The rate is on the verge of its last peak at the end of October 2022, when USDJPY set its maximum at 151.800, followed by BoJ intervention. Source: xStation 5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.