- Wall Street indices finished yesterday's trading higher. S&P 500 gained 0.10%, Dow Jones moved 0.24% higher and Nasdaq jumped 0.29%. Small-cap Russell 2000 was a laggard with an almost-0.5% drop

- Indices from Asia-Pacific traded mixed today - indices from Japan, South Korea and China dropped while indices from Australia and India gained

- DAX futures point to a slightly higher opening of the European cash session today

- Reserve Bank of New Zealand left interest rates unchanged at a meeting today, with the main interest rate staying at 5.50%. RBNZ forecast point to official cash rate of 5.63% in March 2024 (prev. 5.58%) and 5.66% in December 2024 (prev. 5.50%)

- RBNZ Governor Orr said that risk to inflation is still more to the upside and that discussion on hiking rates was held at the meeting today

- BoJ Adachi said that positive wage-inflation cycle has not happened yet but should chance of it happening increase, Bank of Japan may begin discussions on negative rates exit

- Fed's Goolsbee said that has some concerns over keeping rates too high for too long and that Fed should be less restrictive once it believes it is on path to 2% inflation

- Australian CPI inflation decelerated from 5.6 to 4.9% YoY in October (exp. 5.2% YoY). On a monthly basis, CPI was 0.4% MoM lower, compared to 0.3% MoM increase in September

- API report pointed to a 0.817 million barrels drop in oil inventories (exp. -2.0 million barrels). Gasoline inventories dropped 0.898 million barrels (exp. +0.2 mb) while distillate inventories increased by 2.806 million barrels (exp. +0.4 mb)

- Cryptocurrencies are trading higher today - Bitcoin gains 0.5%, Ethereum trades 0.2% higher and Dogecoin gains 0.9%

- Energy commodities trade a touch higher - oil gains 0.2% while US natural gas prices are up 0.3%

- Precious metals trade mixed - gold gains 0.2%, silver drops 0.2%, platinum declines 0.3% and palladium jumps 0.5%

- NZD and JPY are the best performing major currencies, while AUD and USD lag the most

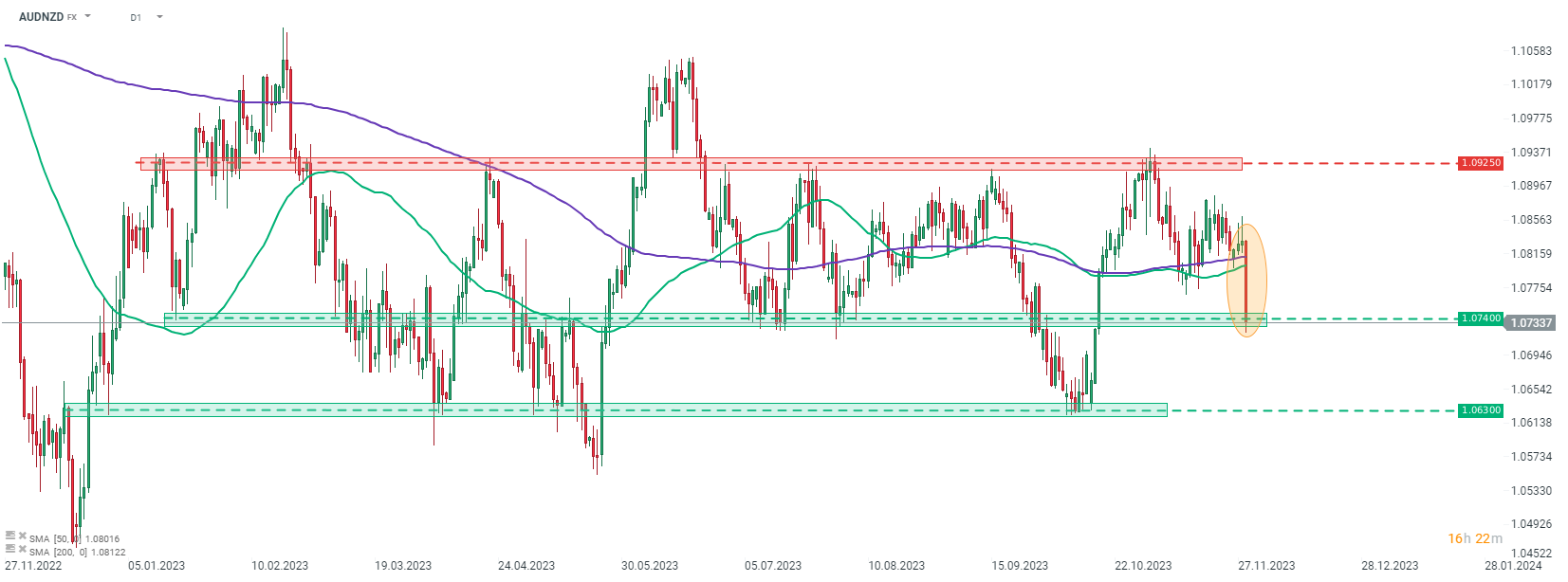

AUDNZD is slumping today as NZD got a boost from hawkish RBNZ narrative while AUD is slumping after deeper-than-expected slowdown in CPI in October. Source: xStation5

AUDNZD is slumping today as NZD got a boost from hawkish RBNZ narrative while AUD is slumping after deeper-than-expected slowdown in CPI in October. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Spring Statement fails to calm UK bond market,

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.