- Tax dispute dents decent set of earnings

- Looking beyond the tax issue…

- Strong content slate boosted engagement

- How to spend it: buybacks on the cards as free cash flow rises

- M&A on the cards

- Downside for Netflix’s share price could be overdone

- Tax dispute dents decent set of earnings

- Looking beyond the tax issue…

- Strong content slate boosted engagement

- How to spend it: buybacks on the cards as free cash flow rises

- M&A on the cards

- Downside for Netflix’s share price could be overdone

Netflix’s share price is lower by more than 6% in afterhours trading on Tuesday night, after the company reported lower than expected net income, due to a one-off payout to settle a tax dispute in Brazil. This cost the company more than $600mn, which Netflix had to pay in this tax year.

Tax dispute dents decent set of earnings

This dented an otherwise strong set of earnings. Although Netflix does not release subscriber figures in their earnings reports anymore, revenues were in line with analyst estimates at $11.51bn for last quarter, and if it was not for the unexpected tax bill from Brazil then net income would have come in above expectations.

Although this issue was known, the market did not expect it to hit earnings, which is why the share price has come under downward pressure on the back of this news. Netflix also said that margin growth for 2025 will take a hit from the tax bill, although there should be no other long-term effects.

Looking beyond the tax issue…

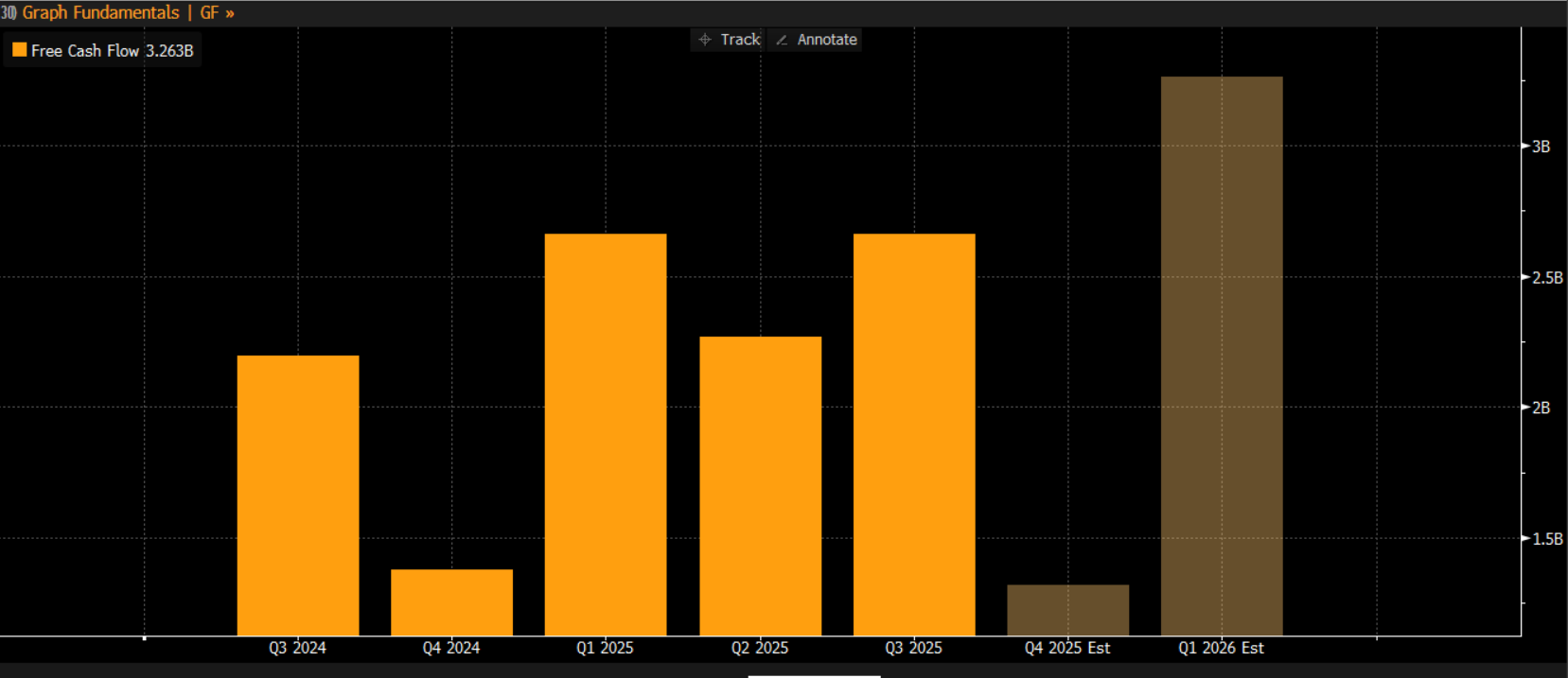

If one looks beyond the Brazil issue, there was much to cheer about in this earnings report. Firstly, free cash flow was stronger than expected at $2.6bn, as you can see in the chart below. The company also upgraded its free cash flow estimates for FY 2025 to $9bn, previously analyst estimates were $9.76bn. It is impressive for Netflix to increase free cash flow at the same time generating a high quality slate of programming.

Strong content slate boosted engagement

Netflix said that consumer engagement was strong due to the success of Happy Gilmore 2, the new season of Wednesday, and the international hit, K-pop Demon Hunters. This led to record subscriber engagement, which should put to bed fears that YouTube and other free streaming services could dampen demand for the world’s largest streaming media service. This is why revenues grew by 17% compared to a year ago.

There are also high hopes for Q4, with the release of the finale of Stranger Things, the new Frankenstein movie and the latest Knives Out satire. Thus, the future is bright for Netflix.

How to spend it: buybacks on the cards as free cash flow rises

There was one question that immediately needed to be answered on this earnings call: what to do with all that free cash flow? The CEO said that some of the money will be used to buy back shares and to invest in more programming. This should act as a sweetener for investors, once the dust has settled and people have got over the net income shock.

M&A on the cards

However, the CEO also left the door open to M&A activity. Ahead of this earnings report, analysts did not expect Netflix to say that it would get involved in any deal with Warner Brothers to buy some of its assets. However, on Tuesday night, there is a chance that Netflix could buy some of the assets that are for sale. The CEO sat on the fence, he said that Netflix would be choosy, and the company does not need a deal to achieve its longer-term goals. However, it does suggest that the next few months could be an interesting time for Netflix. Although any deal would eat into Netflix’s free cash flow position, which could weigh on the stock price, it could also solidify Netflix’s position as the world’s largest streaming platform, which is good news for the long-term health of the Netflix share price.

Downside for Netflix’s share price could be overdone

As mentioned, the big move to the downside in the Netflix share price after hours on Tuesday could trigger weakness in the stock price on Wednesday. However, this is a solid earnings report, and the Brazil issue is a one-off, so the downside move in Netflix’s share price could be faded in the coming days.

Chart 1: Netflix free cash flow (quarterly): a nice upside-surprise

Source: XTB and Bloomberg

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.