- Delayed US labour market data released on Wednesday

- Revisions for 2025 could paint dark picture of US jobs market

- Fed rate cuts under the microscope

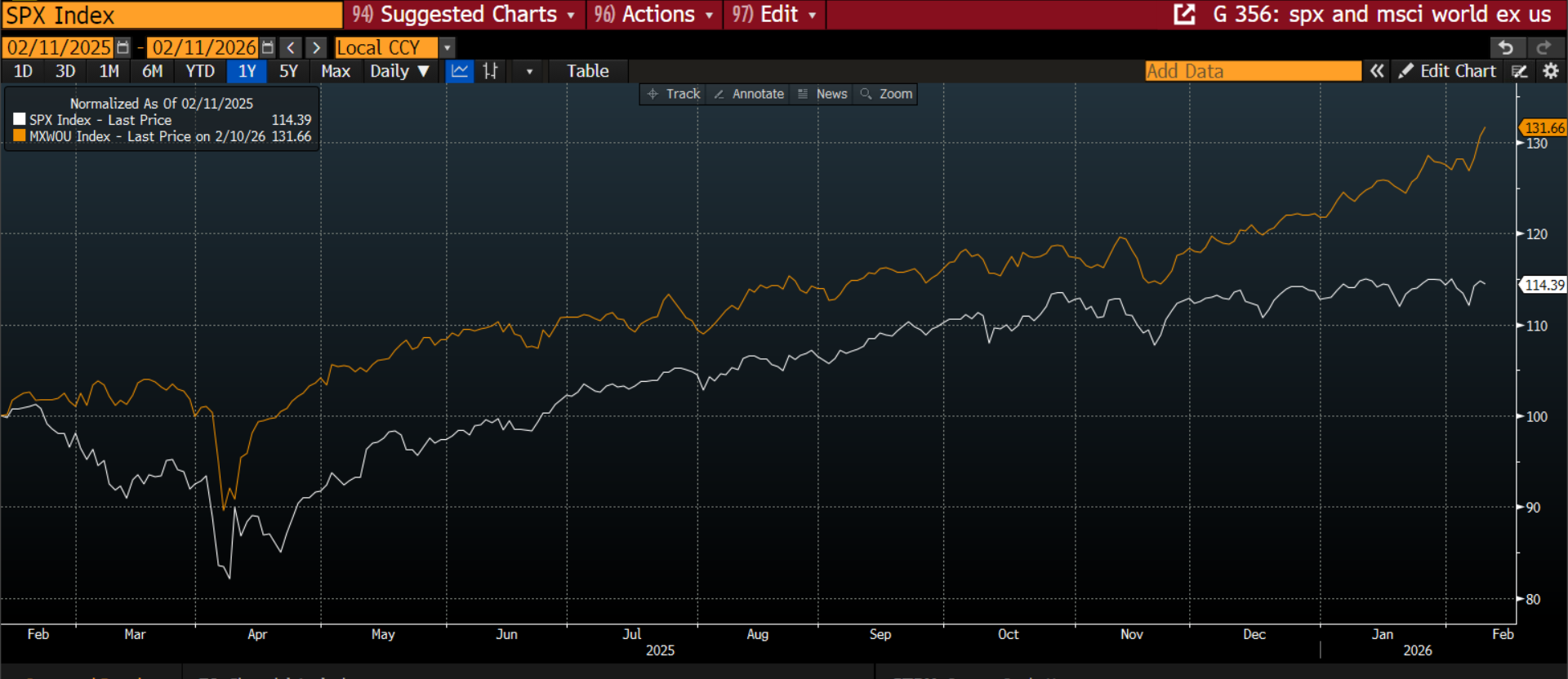

- US stocks may continue to outperfrom globally, as dollar struggles

- Delayed US labour market data released on Wednesday

- Revisions for 2025 could paint dark picture of US jobs market

- Fed rate cuts under the microscope

- US stocks may continue to outperfrom globally, as dollar struggles

The focus on Wednesday will be the delayed release of the US labour market report for January. This is the second of three important data releases from the US this week. Disappointing retail sales data for December weighed on US stocks and led to a retreat in US Treasury yields on Tuesday. Sentiment towards the US stock market rally could depend on the US labour market holding up, as fears about an economic slowdown could spook investors.

Watch payroll revisions

Today’s focus is not merely the January payrolls figure. Each January, the Bureau of Labor Statistics in the US release their annual revisions for the year before. Economists believe that there will be an 825,000 reduction in US job creation for 2025. If analysts are correct, this would be a huge downside revision that could wipe out all US job gains for 2025. This would suggest a much weaker jobs market in the US than currently expected, and it could have a big impact on the future direction of US growth.

Immigration and downside payrolls revisions

The interesting thing is that downward revisions of this size tend to occur during recessions, yet the US economy is not in a recession, and growth is robust. Q4 GDP is expected to be 2.9%, after a rapid 4.4% pace of expansion in Q3. Does this suggest that this is 1, the early signs that something bad is brewing in the US economy? 2, could this be the effects of AI and productivity gains? 3, is this an unusual cycle, which could mean that economic data is not behaving as we expect?

There is a case to be made that the rapid tightening in US immigration since the end of 2024, which has accelerated under President Trump, could be behind the slowdown in US jobs growth. At the same time as jobs growth is expected to have slowed sharply in 2025, the unemployment rate, which is based on a different survey compared to the payrolls report, has also been trending higher in the last 18 months, although the unemployment rate remains at a low level historically. Thus, the payrolls report tell us a grim story about the US labour market, which looks like a hiring desert, yet the unemployment rate is only ticking up slowly. This adds to the view that reduced immigration is having a large impact on the US jobs market.

Unemployment rate crucial for the future of Fed policy

In the coming months it will be important to look at the unemployment rate to see if demand for labour is keeping up with supply. If the unemployment rate continues to tick higher, then it would suggest a deteriorating picture, which could have a large impact on economic policy in the future.

We expect that the revisions will steal most of the show from this labour market report, but it is still worth looking closely at the January figures. Payrolls are expected to expand by 65k for last month, which would be the highest rate for 4 months. The unemployment rate is expected to remain steady at 4.4% and wage growth is also expected to come in at 3.7%, down a notch from December.

The market impact

Investors are eagerly anticipating this labour market report to see if a weak jobs picture can boost rate cut expectations and turbo-charge the US stock market, which has lagged global indices so far this year. After the weaker than expected retail sales report for December, the interest rate futures market has increased the number of rate cuts it expects from the Federal Reserve to 2.4. US interest rates are now expected to end the year at 3.03%, last week, the market expected rate to end the year at 3.14%.

If we get a weaker than expected labour market report, then we could see the number of rate cuts expected by the Fed move closer to 3. If this happens then the dollar could take a hit. The dollar is weakening as we lead up to this key data release, and USD/JPY is down by close to 1.7% since the start of this week. Some analysts are predicting that the dollar could fall by another 10% if the Fed cuts rates three times this year. The pace of monetary policy easing in the US could accelerate when the next Fed chair takes over from Jerome Powell in May. The first cut is expected in June, with another priced in by October. However, a weakening labour market and a potential dovish Fed chair could see a further cut in 2026.

The shifting AI trade and economic data

The US stock market struggled on Tuesday. Even though the Dow Jones ended higher on the day. The S&P 500 and the Nasdaq both closed lower, as wealth managers and financial data firms struggled as more AI tools hit the market. If we get a weak payrolls report, then extra Fed easing may temporarily sooth some of the sectors worst affected by AI challenges to their business models, for example software firms, and investment managers.

However, if the labour market signals that US growth is weakening then we don’t know how the AI trade will perform in an environment where there are real concerns about US economic growth. Could the prospect of an economic slowdown accelerate the use of AI tools as consumers and businesses look to preserve cash? If yes, then this could have a major impact on stocks. The radius of companies that could be negatively impacted by the uptake in AI tools is growing week by week, causing long term disruption to stocks. In the short term, this means that the AI trade may continue to focus on the losers, rather than the winners, which supports US equity underperformance for the medium term.

Chart 1: S&P 500 and MSCI World index ex US

Source: XTB and Bloomberg

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.