Nvidia earnings: is interest starting to wane?

This Wednesday, Nvidia will release earnings for the last quarter. The market is expecting another monster report. Revenues are expected to be $24.6bn, compared with $22.1bn in the prior quarter. Net income is expected to be $13.9bn, compared with $12.8bn in the prior quarter. What is not to like about Nvidia’s earnings reports? The AI giant keeps delivering bigger and bigger revenues, and its stock price is close to a record high ahead of the report.

But, whisper it, is the market getting bored of Nvidia’s mega earnings reports and its domination of the GPU market? Signs that it is include lower options trading volume in Nvidia shares in the week before the latest earnings release. Last week’s total Nvidia options trading volume was 47% lower than the week before the previous earnings report in February. This suggests that the market is not only focused on the AI darlings as the global stock market rally broadens out.

Added to this, volatility is lower. As you can see in the chart below, 30-day volatility in Nvidia is lower than the peak reached in March. A lower level of volatility suggests that going forward, movements in Nvidia’s share price could be lower than they have been in the past.

Chart 1: Nvidia 30-day volatility

Source: XTB and Bloomberg

For example, the average move in Nvidia’s share price in the 24 hours after an earnings release has been 8.5% in the past 8 quarters. However, if our hunch is correct, then even if Nvidia does meet analyst estimates, the stock price may not move as much as it has done after previous earnings reports.

Nvidia: a victim of its own success

Analysts are bullish ahead of this earnings report, and they have upgraded their forecasts for Nvidia’s revenues, earnings per share, net income and EBITDA in the last 4 weeks. This might mean that Nvidia will need to exceed already high expectations to sustain the rally in its share price. Some estimate that Nvidia revenues will need to exceed expectations by $1bn to appease the market. Thus, the bar is high ahead of Nvidia results.

Risks start to accumulate ahead of the earnings report

Added to this, the market will be focused on the commentary from Nvidia and the future guidance. If this is deemed weaker than expected, the market could view this as a disappointment.

Some traders may prefer to take a backseat and instead wait for the future when Nvidia will inevitably deliver ‘disappointing’ results, either because the bar is set too high, or because competitors start to eat into its market share. While we don’t think that will happen in this earnings report, it could happen in the future.

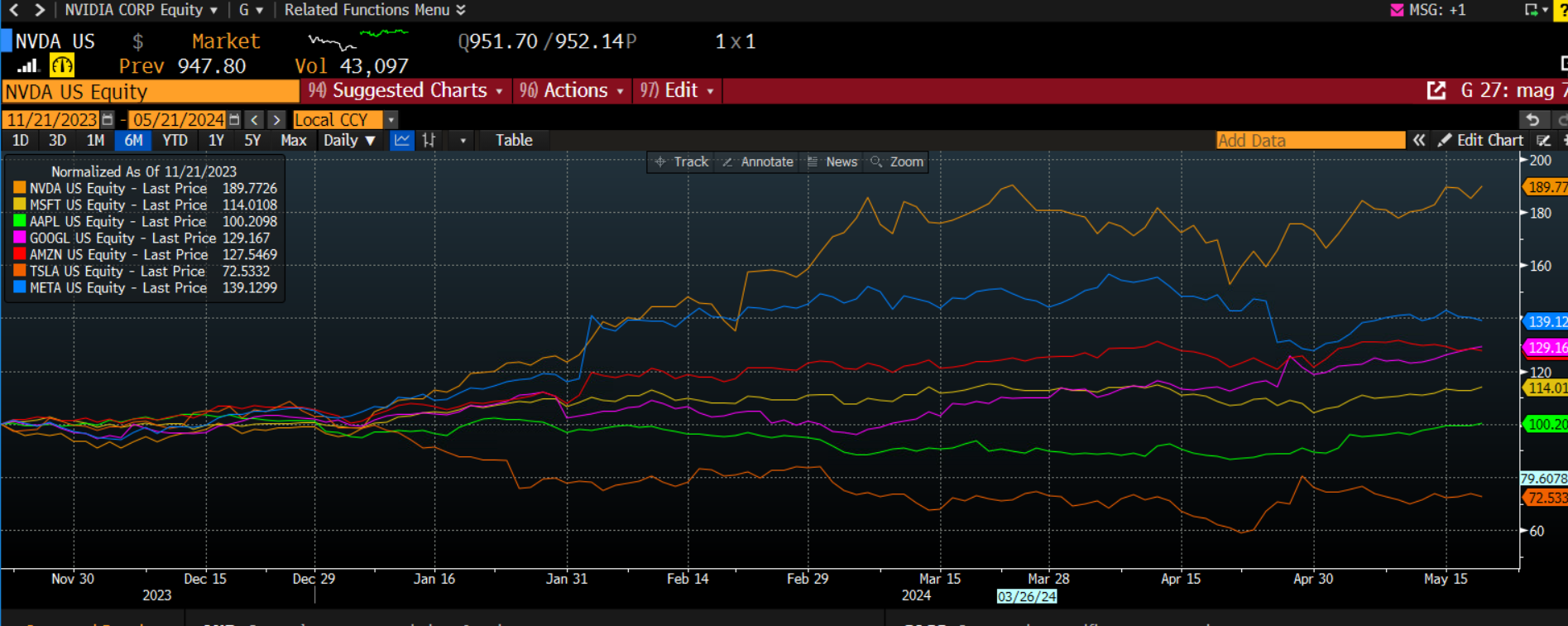

Stock market rally broadens out beyond tech

For most of the last 12 months, Nvidia has dominated the major US blue chip indices, however, in recent weeks the stock market rally has broadened out. Nvidia’s share price is up 90% YTD, however, it is no longer the top performing stock in the S&P 500 so far this year. Super Micro Computers and Vistra Corp are outperforming Nvidia YTD. In the shorter term, Nvidia is not even in the top 10 best performing US blue chip stocks in the past month. Stocks including Teradyne, Vistra, Moderna and Globe Life are outperforming Nvidia in the short term.

A record high stock price could be on the cards

While there are tentative signs that investors are losing some of their interest in Nvidia, the stock is still at an interesting junction. Nvidia’s share price rallied at the start of this week, but it is trading sideways on Tuesday. It is close to its record high of $950. Options activity suggests that some in the market are looking for Nvidia’s share price to set fresh records in the immediate aftermath of its earnings release. There has been an increase in the number of traders buying call options that expire at the end of this week that have a strike price of $1000. Added to this, the put/ call ratio is 0.76, which suggests that there are more Nvidia calls being traded ahead of the earnings release than puts.

Conclusion

Nvidia’s earnings report is important for overall market sentiment in the near term. However, there are signs that interest in Nvidia could be waning as the share price approaches a record high and after it has rallied more than 90% so far this year. The stock market rally is broadening out, both at a sector and a regional level compared with Q1. Added to this, although its 12 month forward P/E ratio is only 37 times earnings, which is lower than the forward P/E ratio for other tech giants such as Tesla and a touch lower than Amazon, it is still significantly higher than the average P/E ratio for companies on the S&P 500, which is currently 25 times earnings.

A mixture of high expectations, competition fears, and a higher-than-average P/E ratio could see interest in Nvidia wane in the coming weeks. Nvidia is an amazing stock, and it has deserved all of the attention that has been showered on it in the past year. However, at this stage, we all know that it is vital for the global AI infrastructure build out and that it controls the GPU market. It is natural that the market is looking for the next big stock, and one that might be less expensive.

Chart 2: Nvidia outperforms the Magnificent 7

Source: XTB and Bloomberg

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.