Nvidia's (NVDA.US) highly anticipated report significantly beat Wall Street expectations in both revenue and earnings per share. Revenue from the Data Center (AI) segment rose powerfully and guidance was extremely bullish. As a result, the stock is up nearly 6% after the Wall Street session and is approaching the area of psychological resistance, $500 per share.

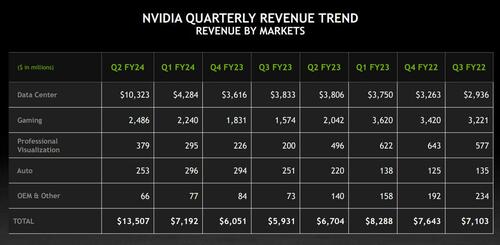

- Revenues: $13.51 billion vs. $11.04 billion forecast and $6.7 billion in Q2 2022 (101% y/y growth)

- Earnings per share (EPS): $2.7 vs. $2.07 forecast and $0.51 in Q2 2022

- Data center revenues: $10.32 billion vs. $7.99 billion forecasts and $4.28 billion in Q1 (171% y/y increase)

- Gaming revenues: $2.49 billion vs. $2.38 billion forecast (24% y/y growth)

- Professional Visualization revenues: $379 million vs. $318 million forecast (24% decrease y/y)

- Automotive revenue: $253 million vs. $309.4 million forecasts (15% increase y/y)

- Adjusted gross margin: 71.2% vs. estimated 70% (45.9% increase y/y)

- Company estimates Q3 revenue at $16 billion with 2% variance with forecasts consensus of $12.5 billion

- The board of directors approved an additional $25 billion for share buybacks, which Nvidia plans to continue in the current fiscal year. In Q2, it repurchased 7.5 million shares for $3.28 billion (easing market concerns somewhat around recent share sales by some company affiliates and the company's 'overvaluation' after 'astronomical' increases)

The results literally blew away analysts' expectations and confirm that demand for AI solutions remains huge. Revenue from the data center market was driven mainly by orders from major Internet companies and cloud providers. Data center computing performance grew 195% y/y and a dizzying 157% q/q largely due to Hopper chip architecture. Nvidia's growing computing power positions the company as a major beneficiary of the AI trend, not only now but also in the coming quarters - there is no competitor on the horizon that can threaten the position.

The company's higher-than-forecast result from the gaming segment is mainly due to its RTX 40-series graphics cards. Results from automotive surprised forecasts mainly through weakness in China, but rose y/y thanks to higher sales of autonomous driving models. However, the market sees Data Center results as key, and these literally shocked Wall Street expectations. The results surprised but even more strongly surprised analysts with euphoric forecasts. Third-quarter revenue is expected to be $16 billion, well above the highest expectations of $15 billion. Gross margins are expected to be 71.5% (non-GAAP).

Revenue from the Data Center segment (GPU chips for the AI sector) is emerging as the absolute base of the company's overall business. Source: ZeroHedge, Nvidia

Tomorrow, Nvidia (NVDA.US) shares are likely to test levels above $500 per share after US market open. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.