The Wall Street AI giant Nvidia (NVDA.US) will release fiscal Q1 2026 earnings today, after the session on Wall Street. What to expect and will strong business momentum drive technology sector and Nasdaq 100 higher?

Key dates for today

-

Earnings Release: Wednesday, May 29 at 4:20 PM ET

-

Earnings Call with CEO Jensen Huang: 5:00 PM ET

Overview of expectations

Wall Street is anticipating a record quarter for Nvidia, but expectations are sky-high and the margin for error is narrowing.

- Revenue is expected to surge to between $43.1 billion and $43.3 billion, up approximately 66% from $26 billion a year ago. Nvidia’s own guidance is slightly more conservative at $43.0 billion, plus or minus 2%.

- Analysts forecast adjusted earnings per share (EPS) of $0.89, representing a 45.9% increase year-over-year from $0.61 in Q1 FY2025.

- Data center revenue, the key engine of growth, is forecast to rise 74% year-over-year to approximately $39.4 billion, although this is a deceleration from the 93% growth pace seen in the fourth quarter.

- Non-GAAP gross margins are expected to fall to 71.0% from 73.5% in the prior quarter. This drop reflects the higher costs associated with the scale-up of Blackwell chip production and broader AI system infrastructure, including new rack and cooling technologies.

Key Themes to Watch

AI demand and supply chain

One of the primary focuses this quarter will be Nvidia’s execution on the rollout of its Blackwell architecture. After technical issues—including overheating and synchronization flaws—halted production earlier this year, partners like Foxconn, Dell, and Inventec have reportedly resolved the bottlenecks. Shipments of Blackwell-powered GB200 AI racks resumed late in Q1, and Nvidia will need to provide clear commentary on its ability to scale production into the second half of 2025.

Despite the delays, demand remains robust. Hyperscalers such as Microsoft, Meta, and Alphabet continue to increase their capital expenditures on AI infrastructure, while sovereign buyers in Saudi Arabia and the UAE are also increasing orders.

China trade restrictions and its impact

U.S. export restrictions continue to weigh on Nvidia’s China strategy. The inability to ship H20 AI chips, designed to comply with previous U.S. curbs, has caused a $700 million revenue hit in Q1 FY2026 and is projected to impact Q2 and Q3 by an estimated $9 billion combined. Nvidia responded with 10–15% GPU price hikes to offset the tariffs, but those increases will be tested for customer tolerance and margin recovery.

A recent $5.5 billion inventory write-down tied to chips designed for China underscores the significance of the issue. CEO Jensen Huang has been vocal in his criticism of U.S. policy, warning it may forfeit a $50 billion market to domestic Chinese rivals.

Guidance in focus

Second-quarter revenue guidance will be pivotal. Wall Street expects guidance in the range of $45.8–$45.9 billion. Full-year FY2026 revenue is projected to reach $198.8 billion, a huge leap from $130.5 billion in FY2025. EPS for the year is expected at $4.32. However, any signs of conservatism, whether due to supply chain limitations, geopolitical risk, or delayed customer purchases ahead of the Blackwell Ultra NVL72 release later this year, could shake investor confidence. In particular, Barron’s columnist Tae Kim has suggested that both Q1 and Q2 estimates may be too aggressive, given customer hesitancy to commit ahead of the Ultra variant.

Things to Watch

-

A gross margin miss below the 71% range would reinforce fears that production costs are not yet under control. The company

-

Weaker-than-expected guidance, especially if Nvidia points to continued H20-related losses or production shortfalls, could lead to a negative stock reaction.

-

Supply-demand mismatches remain a concern. While Blackwell demand is very strong, it cannot backfill the H20 losses due to production constraints, per analysts at Morgan Stanley.

-

Some enterprise customers may be delaying purchases ahead of the faster, next-gen Blackwell Ultra release in the second half of the year.

Despite strong performance, Nvidia’s valuation remains below historical norms. The stock is currently priced at appx. 30 times forward earnings, compared to a 5-year average of 40. The Nasdaq 100, by comparison, trades around 26 times forward earnings. This valuation gap suggests upside potential remains, but only if Nvidia continues to meet or exceed expectations.

Strategic considerations

-

Execution on Blackwell ramp-up will define investor sentiment for the rest of the year.

-

Demand visibility and production forecasts for the second half of 2025 must be clear and confident.

-

Management commentary on trade policy, sovereign orders, and next-gen AI chip development will be critical during the earnings call.

Earnings call focus areas

Investors will listen closely to CEO Jensen Huang’s tone and messaging during the earnings call. Key themes to expect include:

-

Status updates on Blackwell Ultra (NVL72) launch timelines.

-

Supply chain robustness and shipping cadence for GB200-based systems.

-

Revenue strategy in China under new U.S. restrictions and possible Saudi Arabia expansion perspectives

-

Long-term vision for retaining leadership in the AI compute stack amid rising geopolitical and competitive pressures.

-

Strategic risks and potentially rising costs due to rising tariffs - is the risk real?

Nvidia’s Q1 2026 earnings report may not deliver the explosive upside of prior quarters, but it represents a vital checkpoint. With revenue growth still torrid, margin compression temporary, and AI demand broad-based, the fundamentals remain strong. However, geopolitical friction, delayed customer purchases, and fragile supply chain dynamics mean the company must deliver on execution and guidance.

Jensen Huang’s commentary will either reinforce investor conviction or inject new caution into the AI trade. Either way, this is one of the most consequential earnings reports of the quarter—and perhaps the year.

Nvidia (D1 interval)

Looking at D1 interval, we can see a 'bearish' head and shoulders pattern on NVDA. As for now, price approached a major resistance zone at 71.6 Fibonacci retracement of the last downward wave. If we see a breakout, the stock may find a next resistance zone at $150. On the other hand, $120 - $127 level is the first short-term support zone (61.8 Fibo, EMA200), while the 'neckline' (a major long term support) is now at $100 per share.

Source: xStation5

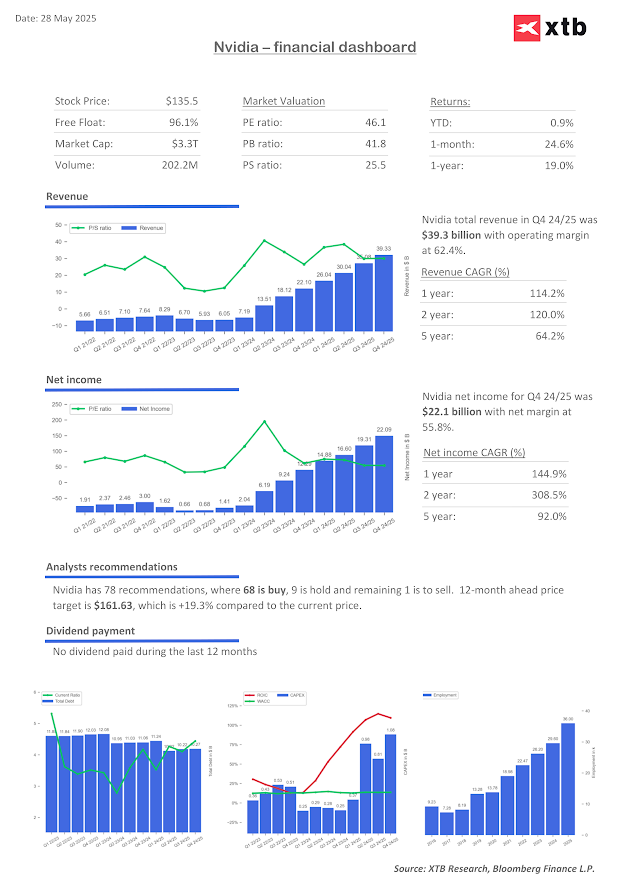

Nvidia valuation

Looking at the valuation, we can see that Nvidia is definitely not a 'cheap stock' right now, however its business is still on the 'surge'. If the company, earnings show continued strength with no very negative surprises from margins (which will fall almost for sure due to Blackwell ramp-up), we can expect that Wall Street appetite for new ATH on Nvidia will persist.

Source: XTB Reserach, Bloomberg Finance L.P.

Source: XTB Reserach, Bloomberg Finance L.P.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.