The September edition of the STEO (Short-Term Energy Outlook) report highlights a decrease in oil prices, increased inventories, and growing OPEC+ activity, as well as an opposite trend in natural gas, where higher prices are expected due to limited supply amid rising LNG exports. At the same time, the report signals clear support for consumers thanks to lower gasoline prices, but also a sustained transformation towards renewable energy.

Electricity production in the USA is expected to increase by 2.3% in 2025 and by 3.0% in 2026. The main source of growth is photovoltaics, whose increasing share in the energy mix reflects a sustained trend of energy transformation. In the coming years, this will be a factor limiting emissions and reducing dependence on fossil fuels.

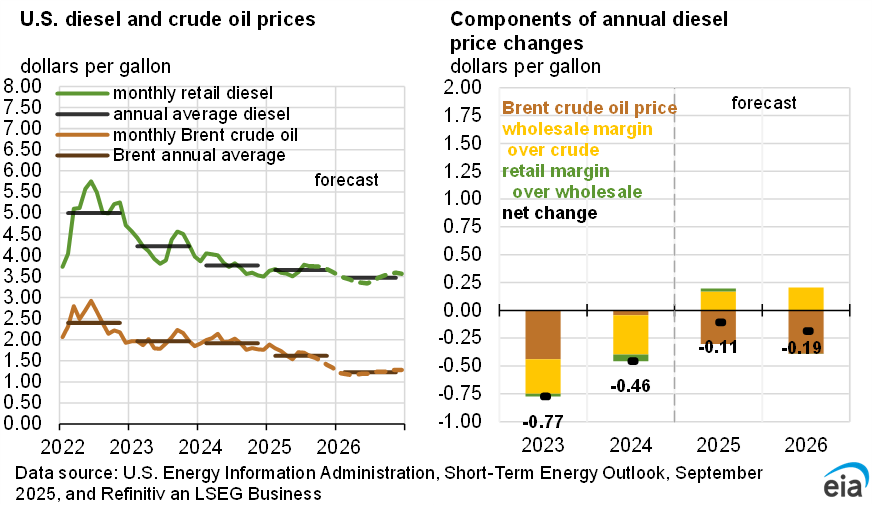

Oil and Gasoline

Forecasts indicate a decrease in Brent prices from around $68/b in August to $59/b in the fourth quarter of 2025, and then to $50/b at the beginning of 2026. The average oil price in 2026 is expected to be $51/b. The main factor is increased inventories in the markets resulting from OPEC+ increasing production by 2 million barrels per day during the period 3Q25–1Q26. Only later in 2026 is a supply reduction possible.

The average gasoline price in the USA in 2025 is expected to be $3.10/gal, and in 2026 to fall to around $2.90/gal. The exception will remain the West Coast region, where prices will stay above $3/gal. The price drop means that the share of fuel expenses in personal income will fall below 2%, which will be the lowest level since at least 2005 (excluding the pandemic year 2020). This supports household purchasing power and is a pro-consumption factor.

Oil production in the USA in 2026 is expected to decrease by about 1%, while natural gas extraction will remain stable. The change in commodity price relations favors shifting drilling activity towards gas-rich areas, showing the evolution of the upstream sector's strategy.

OIL.WTI (D1)

Source: Xstation

The chart shows the price remaining in a broad downward trend, with quotations moving in a descending channel marked by red lines. Currently, the price is rebounding from the support zone in the 60–61 USD area. However, until a breakout above 61.8 FIBO occurs, the supply pressure maintains the advantage, and only a sustained break above this level would open the way to 70–72 USD. A drop below 60 USD would increase the risk of deepening the move towards 57 USD, and in the longer term even 52 USD.

Natural Gas

Forecasts assume an increase in Henry Hub prices from $2.91 per British thermal unit in August to $3.70 per British thermal unit in the fourth quarter of 2025 and around $4.30 per British thermal unit in 2026. The reason is production constraints in the USA amid rising LNG exports. As a result, gas becomes a relatively more expensive commodity, increasing costs for industry and energy.

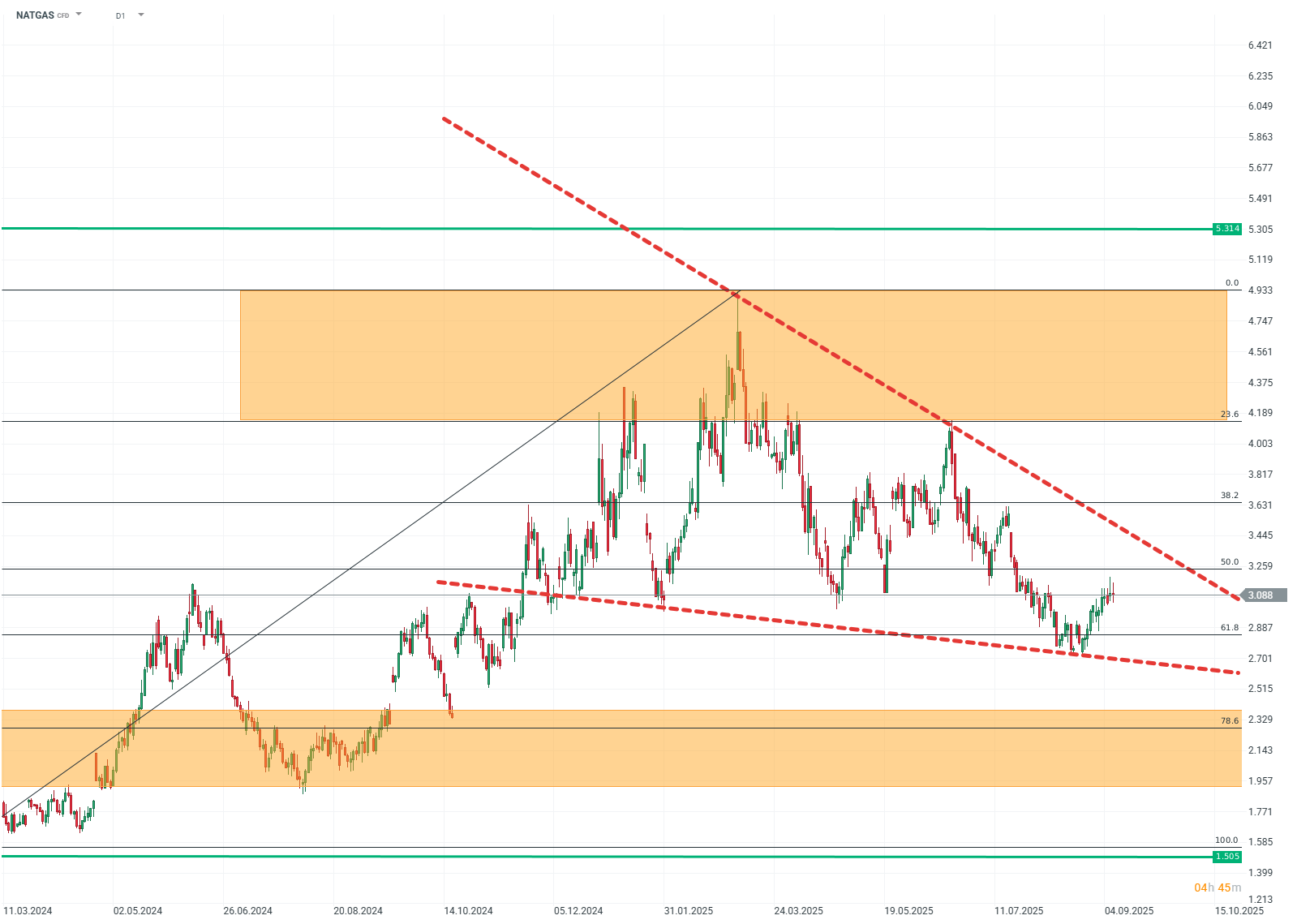

NATGAS (D1)

Source: Xstation

The chart shows a descending wedge, in which the price has been moving in a downward trend since the beginning of 2025. Currently, the price is rebounding from strong support at 61.8 FIBO, but as long as quotations remain below the 3.25–3.30 USD zone (50% FIBO and the downward trend line), sellers have the advantage – only a breakout above this level would open the way to test 3.63 USD and potentially 4.20–4.75 USD, while a return below 2.85 USD increases the risk of further decline towards 2.30 USD.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.