Summary:

- DOE crude oil inventories: -9.9M

- Largest drawdown since September 2016

- Oil.WTI jumps back near highest level of the year

A massive drop in the weekly crude oil inventory release has provided further support to the rally seen in the oil price since last Friday’s OPEC meeting with Oil.WTI trading back within striking distance of its 2018 peak. The headline decline of 9.9M barrels was even larger than last week’s sizable drop of 5.9M and represents the largest decline since September 2016.

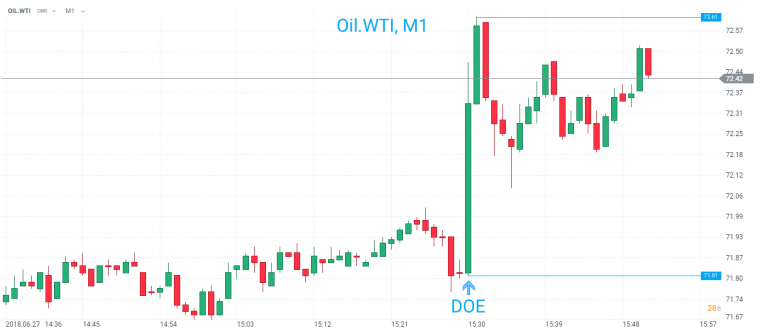

Oil.WTI has added to its recent gains since the large DOE draw, with the market surging higher by 80 ticks in the minutes following the release. Source: xStation

Last night’s API had set a pretty high bar for a large drop with a print of -9.2M but today’s number shows and even larger drop. Looking at the Gasoline (+1.2M vs +1.3M exp) and Distillates (0M vs +1.6M exp) components there was mild positives although they pale into significance compared to the headline number. Refinery utilisation rose to +0.8% from +0.1% previously and US production remained flat at 10.9M.

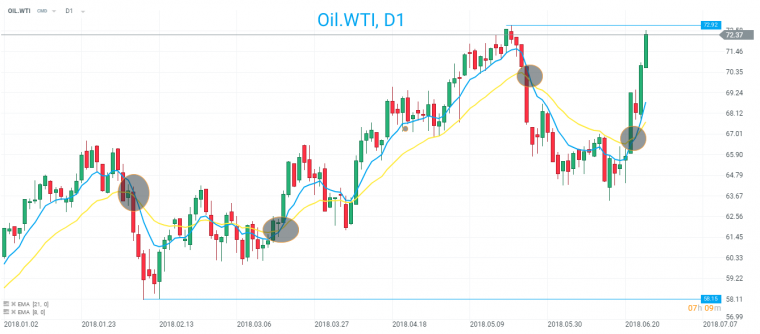

It is of little surprise that the initial market reaction saw oil jump higher with OIL.WTI surging to a 1-month high and moving back near its 2018 peak of 72.92 made back in May. The recent price action has been very constructive with the market recovering strongly from the recent declines. The EMAs have moved back into a positive orientation (8 above 21) and if the prior swing high at 72.92 can be broken then there is scope for a larger extension to the upside.

The EMAs have moved back into a positive orientation and the market could be set to resume its upside with near-term resistance at the 2018 high of 72.92. A break above there could see a larger move higher. Source: xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.