Summary:

-

Oil.WTI down 3% on the day and back below $70/barrel

-

Market near 1-month low after larger than expected build (+6.5M vs +1.6M exp)

-

US production dropped more than expected but this may be weather related

There’s been some pretty heavy selling in the crude oil markets today, with both Brent (Oil on xStation) and WTI (Oil.WTI on xStation) dropping by more than 2.5%. Both oil benchmarks were already trading lower on the day before a much larger than expected build in the weekly US inventories added to the downside pressure.

Oil.WTI dropped more than 120 ticks in the 20 minutes following the release after already being lower on the day. Source: xStation

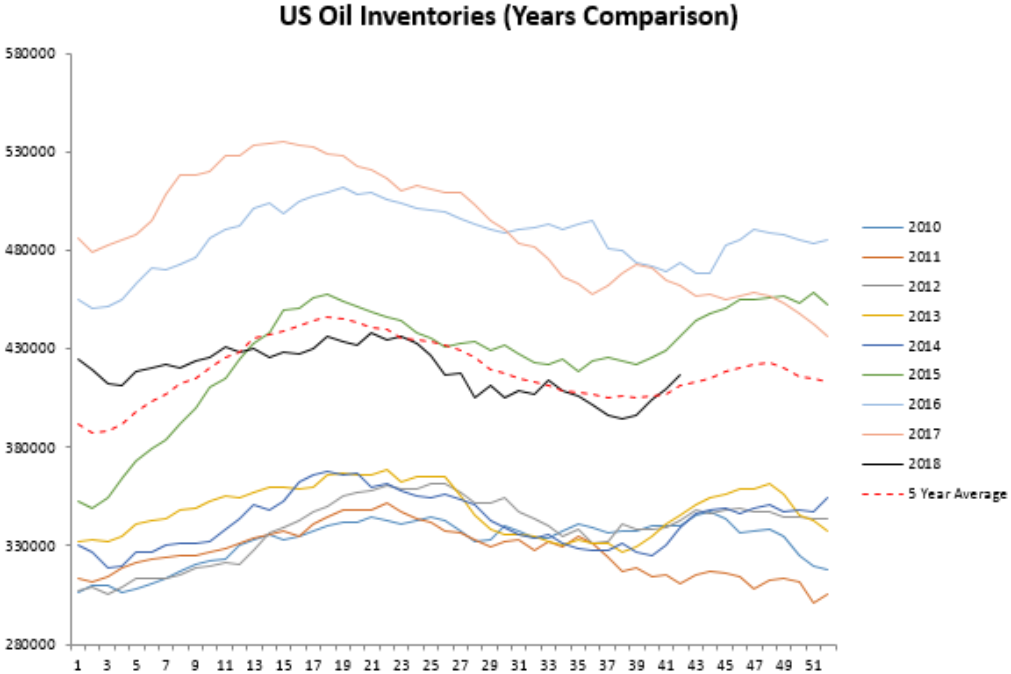

The headline EIA inventory number showed a build of 6.5M compared to a consensus forecast of +1.6M and last night’s API of -2.1M. This is the third week in a row that there’s been a big build in this number and the current levels of inventory are now back above the 5-year average.

Oil inventories rose strongly once more in the past week and they now are back above their 5-year average. Source: XTB Macrobond

Oil inventories rose strongly once more in the past week and they now are back above their 5-year average. Source: XTB Macrobond

As well as the weekly change in the headline figure there are several sub components to the report which can affect how it impacts price. The following are shown in the format of actual vs expected unless otherwise stated.

-

Gasoline: -2.0M vs +1.0M

-

Distillates: -0.8M vs -1.4M

-

Refinery utilisation: 0.0% vs -0.5% exp

-

Production 10.9M vs 11.2M prior

These figures are a little less negative for the price of Oil compared to the headline with the drop in US production in particular are possible positive. A drop of 0.3M is pretty large for this metric but it could well be explained by the recent hurricane and bad weather on the East coast of the US and the gulf of Mexico.

Today’s closing level could be key going forward with an end of day price below 70.15 opening up the possibility of break lower with 67.50 and 64.00 the levels to look to should this occur. Alternatively if price ends above 70.15 then this support will appear to have held and further upside may lie ahead. Source: xStation

Today’s closing level could be key going forward with an end of day price below 70.15 opening up the possibility of break lower with 67.50 and 64.00 the levels to look to should this occur. Alternatively if price ends above 70.15 then this support will appear to have held and further upside may lie ahead. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.