Summary:

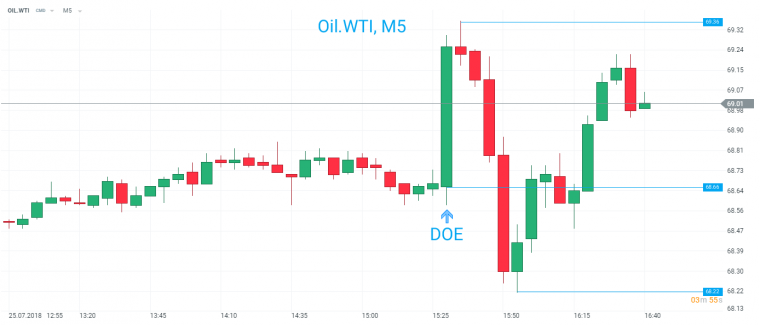

- Oil.WTI experiences volatile trade after large DOE draw

- Print of -6.1M below both the expected and API

- Price lacking clear direction in the time since the release

There’s been some volatile trade in the price of crude in the last hour or so, after the market surged higher initially following a large drop in the latest US inventory figures before sellers stepped in and sent the market sharply lower. As the dust settles it appears the overall reaction remains mixed, with tonight’s closing level worth watching as an indication of how longer term the market is set.

Looking at the data itself the headline DOE inventory print of -6.1M was well below the -2.6M expected and marks a sharp decline on last week’s +5.8M. The drop marks the 5th sizable decline in he past 7 weeks, with all the drops exceeding 4M barrels.Tuesday night’s API release can often be seen as a precursor to the DOE release and a print of -3.2M was closer to today’s figure but still remains above it.

There have been 5 of the past 7 occasions that have shown a drop in the DOE number, with the size of these declines also larger than the gains. Black line denotes 0. Source: xStation

Looking more closely at some of the components we can see that most parts were in fact supportive of price with the following listed in the form of actual vs expected:

- Gasoline: -2.3M vs -1.1M

- Distillates: -0.1M vs +0.6M

- Refinery utilisation: -0.5% vs +1.0% exp

It should also be noted that US production remained unchanged at 11m bpd.

Oil.WTI has exhibited highly volatile trade since the release, first surging higher by around 70 points before dropping over 100 to take out the lows. Buyers stepped in here and the market is now back a little higher on the day at the time of writing. Source: xStation

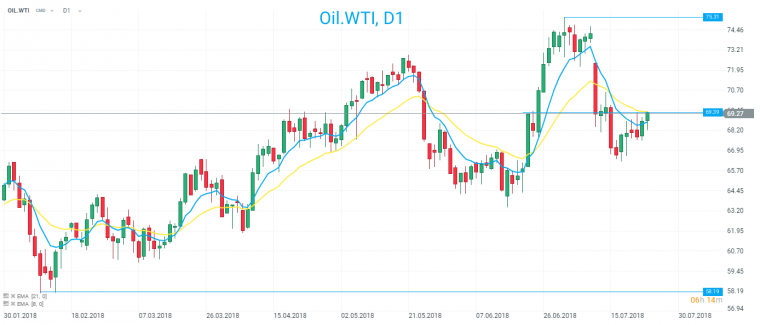

Oil.WTI remains at a potentially key level around 69.40 following the data. A close above this level would see price move back above the 21 EMA and could pave the way for a sustained push to the upside. Source: xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.