Palo Alto Networks has completed its acquisition of CyberArk, a significant development for the entire cybersecurity market. The deal strengthens the company’s position and allows it to offer even broader solutions for protecting data and systems. This step demonstrates that Palo Alto Networks aims to be a leader in securing modern enterprises, especially in an era of artificial intelligence growth and remote work.

Why is this important?

The acquisition of CyberArk by Palo Alto Networks is significant for several reasons, both from a market and strategic perspective. First, identity security is becoming a crucial component of protecting companies in the age of digitalization, cloud computing, and process automation. Attacks on user accounts, systems, and devices are now one of the most common ways hackers breach organizations, and CyberArk has expertise in minimizing this risk. Combining the two companies allows for comprehensive solutions covering all elements of client systems, which increases protection effectiveness and reduces the risk of major incidents.

Second, the deal strengthens Palo Alto Networks’ position as a cybersecurity leader. It enables the company to compete more effectively with other major market players, offering not only network and cloud protection but also advanced tools for access control and identity security. This significantly increases the company’s appeal to clients seeking a single partner for comprehensive system protection.

Third, the acquisition has investment and strategic implications for the capital market. It enhances Palo Alto Networks’ growth potential in a rapidly expanding market segment, which may translate into long-term stock value growth. Additionally, it shows that the company actively responds to evolving cybersecurity challenges and is expanding its offerings in a direction increasingly demanded by businesses worldwide.

In practice, this means that investors, clients, and the market at large are dealing with a company that not only defends against threats but also helps shape the future of the industry, positioning itself as a leader in protecting modern digital enterprises.

What does this mean for the markets?

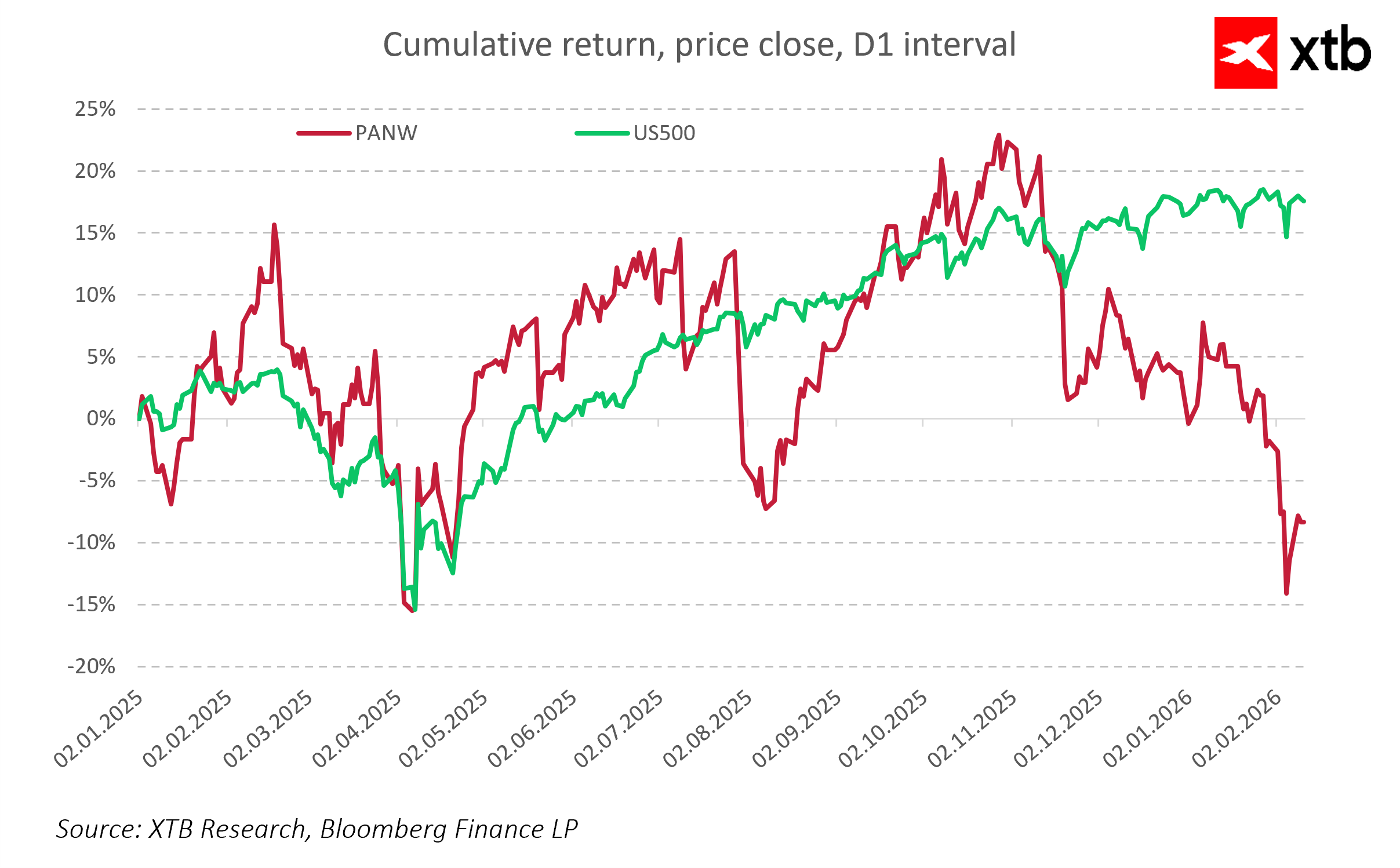

For the markets, the acquisition signals the strengthening of Palo Alto Networks’ position. The company enhances its growth potential in the cybersecurity sector and gains an advantage in the identity security segment, which is becoming increasingly important for businesses globally. Investment success will depend on how well the company integrates CyberArk’s products and technologies and how efficiently it leverages new business opportunities. In the short term, stock price fluctuations may occur, but in the medium and long term, investors can expect a stronger market position for the company and potential stock value growth.

Key Takeaways

-

Stronger identity security: The Palo Alto and CyberArk combination enables protection of user and machine accounts across organizations, minimizing the risk of attacks and data breaches.

-

Improved customer experience: CyberArk products remain available, and the new integration allows companies to manage security more easily and respond to threats faster.

-

Growth potential for the company: The acquisition expands Palo Alto Networks’ opportunities in the identity security segment, which could lead to higher stock value over time.

-

Market confidence: Technology integration and an expanded offering demonstrate that the company actively addresses changing client needs in the digital and AI era.

-

Long-term stability: Investment success depends on smooth integration, but potential benefits include strengthened market position and competitive advantage.

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Navigating Middle East uncertainty and tariff risks

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.