-

Lecornu Resigns: French PM Sébastien Lecornu steps down after less than a month, marking a historic low in political stability.

-

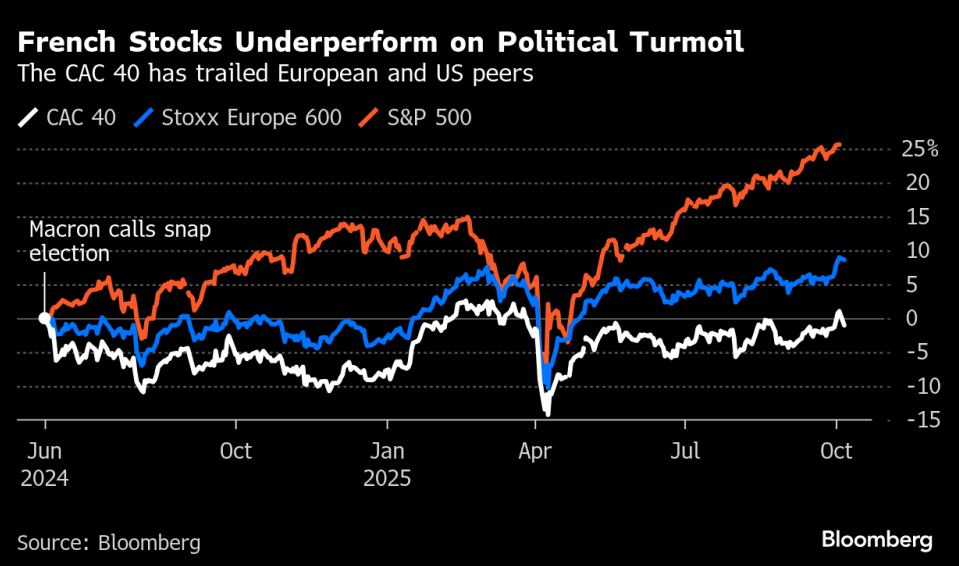

Market Turmoil: The crisis drove the CAC 40 down 2%, weakened the Euro, and sent the French-German bond yield spread to a high of 86 bps.

-

Snap Polls Likely: Political paralysis heightens the expectation of early parliamentary elections to resolve the deadlock.

-

Lecornu Resigns: French PM Sébastien Lecornu steps down after less than a month, marking a historic low in political stability.

-

Market Turmoil: The crisis drove the CAC 40 down 2%, weakened the Euro, and sent the French-German bond yield spread to a high of 86 bps.

-

Snap Polls Likely: Political paralysis heightens the expectation of early parliamentary elections to resolve the deadlock.

French Prime Minister Sébastien Lecornu has resigned amid an intensifying political crisis, stepping down just one day after President Emmanuel Macron announced the new cabinet line-up and less than a month into his tenure. This marks the third prime minister to lose their post due to an inability to push key reforms through a fractured parliament. The events have sharply rattled French financial markets and sparked a fierce domestic political debate. Notably, Lecornu becomes the shortest-serving French Prime Minister in history, underscoring the severe uncertainty clouding the nation's future.

Reasons for Lecornu's Resignation

Lecornu tendered his resignation less than 24 hours after Macron unveiled a government in which most positions were filled by politicians from the preceding cabinets. This decision drew widespread criticism from an opposition that was expecting genuine change. In his statement, the former Prime Minister cited growing political polarisation and the impossibility of effectively executing his duties.

He highlighted the difficulty in pushing through a budget that includes unpopular spending cuts and tax hikes—measures demanded by Brussels in the face of the Eurozone’s largest deficit.

Political and Social Backlash

Lecornu's resignation triggered an immediate wave of reactions across the French political establishment. Socialist leader Olivier Faure claimed that Macron's bloc was disintegrating and that the government had lost legitimacy.

Key opposition figures, including Marine Le Pen and Jean-Luc Mélenchon, called for the dissolution of the National Assembly and even suggested impeaching the President. Jordan Bardella of the right-wing National Rally openly stated that restoring stability is only possible through early parliamentary elections.

Financial Markets React Sharply

The Prime Minister's departure immediately hit the French capital market. The CAC 40 index fell by as much as 2% today, with banking stocks suffering the most. The euro also depreciated to $1.1650.

French bond yields spiked, with the spread relative to German Bunds widening to 86 basis points (bps)—its highest level since the turn of December and January. Economists are increasingly warning that the political upheaval will further complicate budget negotiations, potentially causing the deficit to grow faster than projected.

The yield spread between French and German bonds highlights increasing uncertainty. Source: Bloomberg Finance LP

French banks are the biggest losers. Only a few companies on the CAC 40 index are trading positively today. Source: Bloomberg Finance LP, XTB

Despite a wide bull market across global financial assets, the French market remains weak, a trend linked to the early election announcement in June 2024. Source: Bloomberg Finance LP

Future Outlook

The government faces a deadline of October 13th to present the full draft of the budget bill. This latest prime ministerial resignation deepens the political crisis, making the scenario of early parliamentary elections an increasingly frequent topic in political commentary and market analysis.

For the coming weeks, the lack of a clear political direction and investor confidence will be the most significant factor determining France's economic and political future.

The situation is also spilling over into the wider European context, reflected by the EURUSD pair. The pair tested the $1.1650 vicinity today, its lowest level since September 25th. Should this crucial support level be breached, the pair could head toward its late August lows, further increasing pressure on the European Central Bank (ECB) to consider renewed interest rate cuts. At present, the market prices only a few percentage points chance of an ECB rate cut by the end of the year, and no more than a 30% probability of a cut within the currently forecasted horizon.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.