Summary:

-

Brexit back at the forefront of GBP traders' minds

-

Headline risk remains high going forward

-

FTSE set for another weekly gain

The news flow this week has been dominated by Brexit, with the latest developments filling many column inches as Boris Johnson appears to have played his hand ahead of the return of MPs from their summer recess next week. The decision by the PM to prorogue parliament caused plenty of controversy and clearly toed the line as far as flouting the constitution goes, but in effect all it has done is shorten the timeline for those looking to prevent a no-deal Brexit. Intricate legalities surrounding the decision will be scrutinized in a forensic manner with Scottish courts scheduled to have a substantive hearing on the issue on Tuesday, but in all likelihood this won’t change the current state of play.

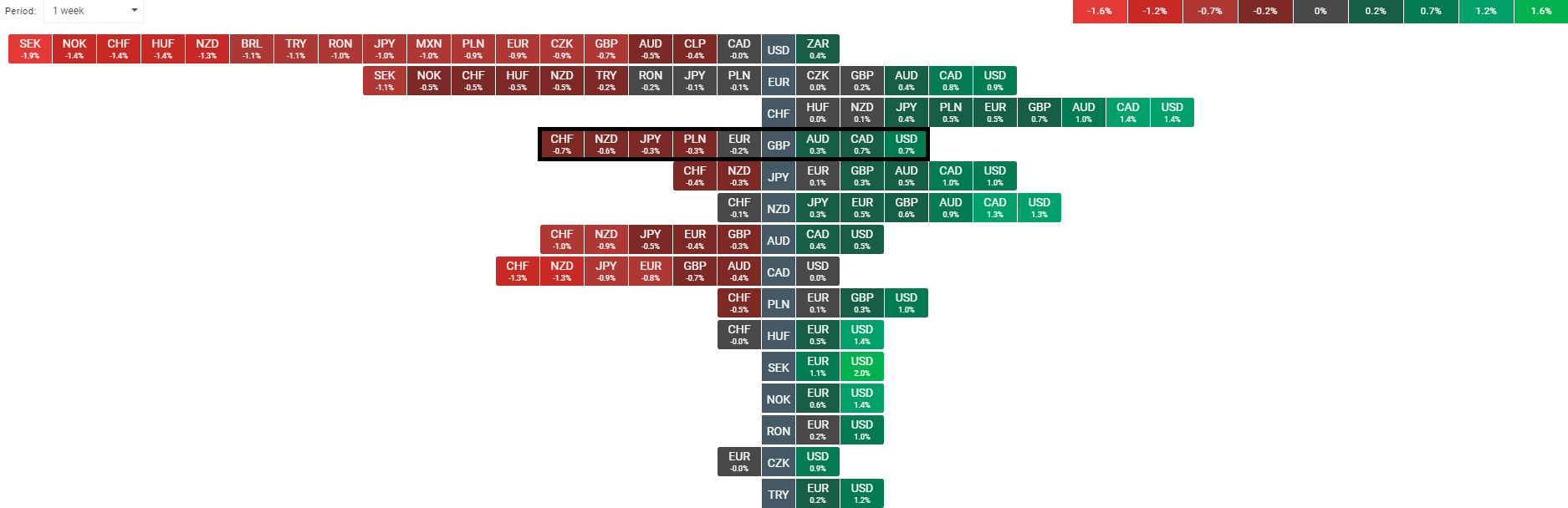

Despite all the headlines, the pound is actually little changed on the week on the whole, falling lower against the US. Source: xStation

Heightened volatility can be expected in the pound in the coming weeks with the currency set to remain highly sensitive to headline risk, with the focus being on the strategy chosen by the opposition in an attempt to take no-deal off the table. Predicting the next political move is inherently risky - as we’ve seen time and again with Brexit - but if pushed to make a forecast, the most likely outcome remains a “new” deal passing through parliament before October 31st, which in reality would look a lot like the current Withdrawal Agreement with a few twists, including most importantly, a rephrasing of the “backstop”.

Speculative positioning in the pound remains pretty extreme on the short side and there’s unsurprisingly been a clear increase in the appetite for protection to downside risks in the options’ market in recent weeks. Having said that, the risks to the pound moving lower are well-versed and widely publicised and given this, there is some logical support behind taking a contrarian position and looking for a recovery in the coming weeks.

FTSE set for 2nd consecutive weekly gain

Following a testing few weeks for UK blue-chips, the FTSE is on course to post a 2nd weekly gain in a row, boosted by a marked improvement in global risk sentiment. After last Friday’s rout and further negative news over the weekend, stock benchmarks began the week on the back foot, but since then there’s been a steady improvement and the FTSE 100 is working on a 3rd consecutive day of gains. How markets react to news can often reveal an underlying strength or weakness and the way investors have bought into what could be described as wishful reports of US and China de-escalating their trade war, while seemingly disregarding last week’s additional tariffs is clearly a boon for stock market bulls. The summer months are typically volatile with clear trends often lacking, but as we now move into September equities appear well placed to resume their year-to-date gains despite the mounting concerns from not only trade tensions but also inverted yield curves and slowing economies. For how long this is sustainable remains to be seen but for now it seems that the bulls have wrestled back control of the tape.

UK stocks are trading higher for the 3rd day in a row. The FTSE continues to oscillate around the 200 day SMA with support seen around 7000 and resistance 7300. Source: xStation

UK stocks are trading higher for the 3rd day in a row. The FTSE continues to oscillate around the 200 day SMA with support seen around 7000 and resistance 7300. Source: xStation

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.