Summary:

-

Ripple settles down after making an incredible rally last week, what drove the cryptocurrency higher?

-

Swiss Bankers Association (SBA) releases guidelines aimed at bolstering the availability of financial services to cryptocurrency companies

-

Brazilian largest independent broker is going to launch a crypto exchange

It was the incredible week for Ripple traders as their cryptocurrency spiked almost 100% just in a few days. The same move was not experienced in other major virtual currencies suggesting that there could have been some special factors driving the digital currency so high. Looking for reasons standing behind such the rally we may point out one major factor as well as some side effects thereof. The major event the Ripple community was talking about last week was the so-called xRapid solution. What is this? The new product being developed by the company is aimed at helping banks speed up transactions by using the cryptocurrency XRP. The upward move in the cryptocurrency price came after Sagar Sarbhai, head of regulatory relations for Asia-Pacific and the Middle East at Ripple, told CNBC a week ago that he is “very confident that in the next one month or so you will see some good news coming in where we launch the product live in production”. The company describes that its new product uses XRP as a “bridge” allowing payment providers and banks to process faster cross-border transactions. Admittedly, the price of Ripple did not move immediately after the news came out but there is no doubt that the information revealed by the firm is another case of Ripple showing its dominance in real world relationships with financial companies. Let us remind that the company has started collaboration with various high-profile financial institutions including Santader or American Express. While the xRapis could have been the prime reason the so-called FOMO effect may have helped push the prices yet higher resulting in the astounding rally.

Ripple spiked at the end of the last week. The price has stabilized since then and one cannot rule out the continuation of the ongoing increase even up to $0.97. Source: xStation5

Looking beyond the Ripple-related thread it is worth taking a look at the Switzerland Bankers Association (SBA) which released a set of guidelines intended to bolster the availability of financial services to cryptocurrency companies. The organization added that the guidelines are a response to growing concerns that an unwillingness of many banks to provide financial services to such particular firms may drive an exodus of crypto start-ups from Switzerland. Strategic adviser of the SBA underlined “We believe that with these guidelines, we’ll be able to establish a basis for discussion between banks and innovative startups, making the dialogue simpler and facilitating the opening of accounts.”

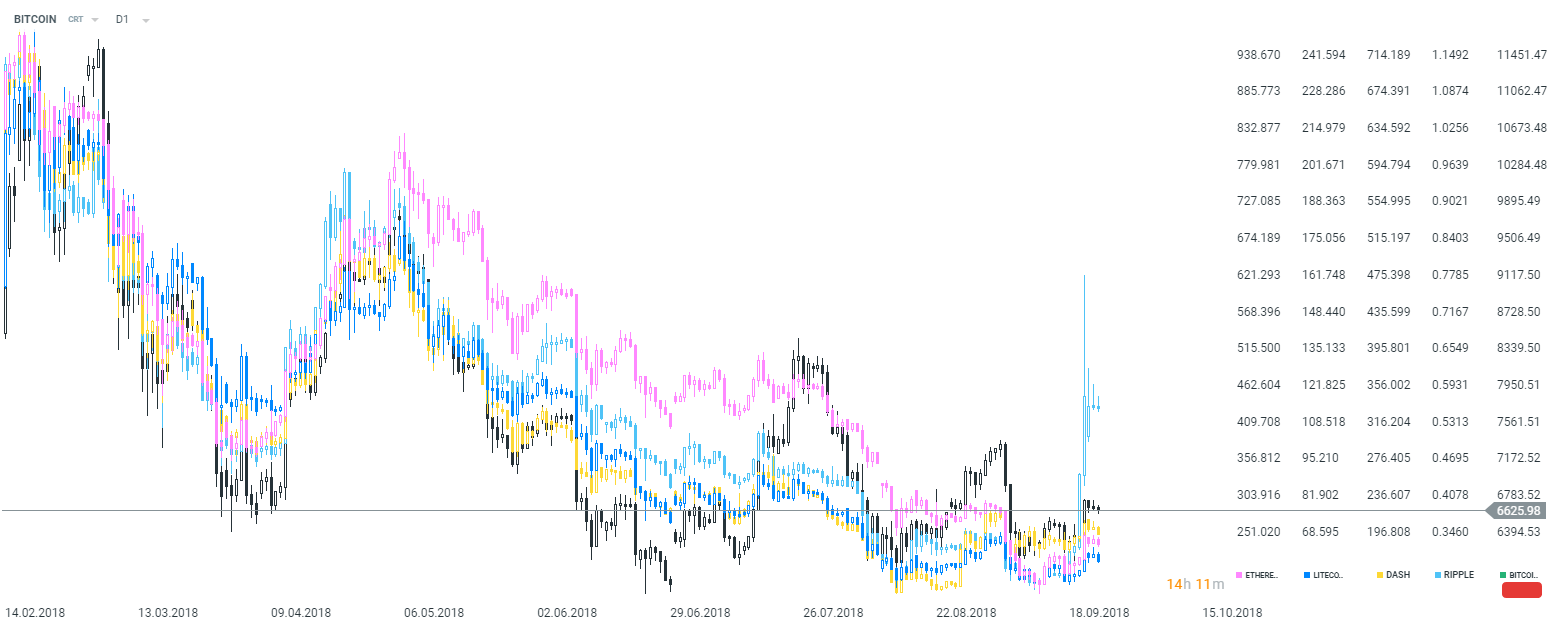

While Ripple surged of the past several days, the other major cryptocurrencies did not see the move at the same scale. Source: xStation5

While Ripple surged of the past several days, the other major cryptocurrencies did not see the move at the same scale. Source: xStation5

According to Bloomberg reports the parent company of the Brazilian’s largest independent broker is setting up a cryptocurrency exchange (XDEX) in coming months. Some leaks have signalled that the new exchange will support trading in Bitcoin and Ethereum. The reason why the broker decided to take such a step was the fact that 3 million Brazilians already own some BTC holdings. This number could be impressive when we compare it with the number of inhabitants having holdings in stocks which is around 600k.

Unlike Ripple Bitcoin has been remarkably calm of late staying within the triangle pattern. The major obstacle might be still localized in the vicinity of $6800. Source: xStation5

Unlike Ripple Bitcoin has been remarkably calm of late staying within the triangle pattern. The major obstacle might be still localized in the vicinity of $6800. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.