Summary:

-

China and the US are to resume low-level talks regarding ‘trade talks’ later this month

-

Australian jobs report turns out mixed

-

Dollar slides as riskier assets are in demand

The US dollar has given back a lot of its previous gains as investors have switched to riskier assets in anticipation of a new phase of trade negotiations between China and the United States later in August. We were offered some informations this morning that China will dispatch Vive Commerce Minister Wang Shouwen to the US in order to resume trade negotiations. However, those talks are not expected to be high-level ones as they are rather intended to set the stage for deeper negotiations. Chinese Vice Minister will meet with an American group led by David Malpass, under secretary for international affairs at the Department of the Treasury, at the invitation of the US, the China’s Ministry of Commerce wrote in a statement. Notice that Malpass is considered to have no trade authority therefore one may expect that nay binding agreements are unlikely to occur. Either way, markets have cheered on the back of these revelations as they illustrate that there is still desire to hammer out an agreement to terminate the trade spat. As a result, the US dollar is trading well below this morning giving back its yesterday’s gains. Shortly after the news hit the wires the US10Y yield moved up more than 2 basis points mirroring a slight shift in investors’ minds. Instead, we are experiencing firm gains across EM currencies with the South African rand and Turkish lira leading the group. The former is up almost 1.5% while the latter is adding 1.1% as of 6:45 am BST on Thursday.

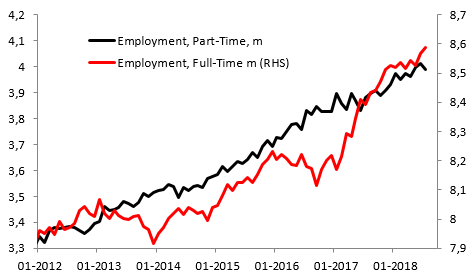

Australian jobs numbers for July were quite equivocal but the underlying full-time employment trend kept its pace. Source: Macrobond, XTB Research

The July’s employment release from Australia was undoubtedly one of the most important events overnight even as its results were overshadowed by the news regarding trade talks. The Australian economy shed 3.9k jobs last month, the loss solely driven by part-time employees whose the number declined 23.2k. This fall was offset to some extent by a decent 19.3k increase in full-time employment. The unemployment rate unexpectedly dropped to 5.3% from 5.4% but the the move was more than offset by a decline in the labour force participation rate which slid to 65.5% from 65.7%. On the surface, the data do not look encouragingly from the Aussie’s point of view albeit the one needs to notice that the underlying trend in employment (full-time) stayed robust giving hopes to see more wage bargaining in the foreseeable future. Anyway, any rate changes are off the table at least till the end of the first half of the next year. Despite quite equival numbers from the labour market the Aussie is the best major currency this morning fuelled by increased risk appetite. Note that Antipodean currencies are among the most oversold ones based on weekly CFTC reports. On that account one may suppose that both AUD and NZD could be well positioned for much more gains once the US dollar keeps sliding and trade tensions subside.

The Aussie dollar is rallying this morning driven by higher risk appetite. The first major obstacle could be faced by bulls in the vicinity of 0.7320. Source: xStation5

In conjunction with increased risk appetite one cannot be surprised that the Japanese yen is offered this morning sliding 0.1% against the dollar as of 6:58 am BST. As far as the JPY is concerned one needs to mention the story brought by MNI suggesting that the Bank of Japan could be setting the stage for a rate increase before hitting the inflation target of 2%. These conclusions are based on the monetary policy statement issued by the central bank last month where a majority of the nine-member policy board was to implicitly signal a need for higher rates owing to the costs of prolonged easing. While any changes in monetary policy there seem to be fairly distant as for now, the JPY deserves undoubtedly more attention in the weeks to come.This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.