Summary:

-

US indices trading near recent lows after soft manufacturing data

-

S&P500 (US500 on xStation) threatening to break below key long support

-

Goldman Sachs called to open lower as Malaysia file criminal charges

Friday’s session ended up being a bad one for US stock markets with sizable declines seeing benchmarks fall back near recent lows. So far today there’s been little to suggest that a recovery lies ahead and if the forthcoming US session sees another wave of selling then things could well go from bad to ugly into year-end. Despite the recent sell-off which began in October, US stocks aren’t actually faring too badly in 2018 on the whole. The US500 is only down by a little over 2% year-to-date so it’s hardly been disastrous but if we rewind a few months the market was at record highs and against this backdrop the outlook appears worse.

While the US500 just about managed to avoid its lowest weekly close of the year, the market is clearly back under pressure. The region from here down to the February lows of 2530 could be seen as key support and a break below would open up the potential for a larger decline, with a symmetrical target coming in around 2114 - not far from the level seen on the 2016 election. Source: xStation

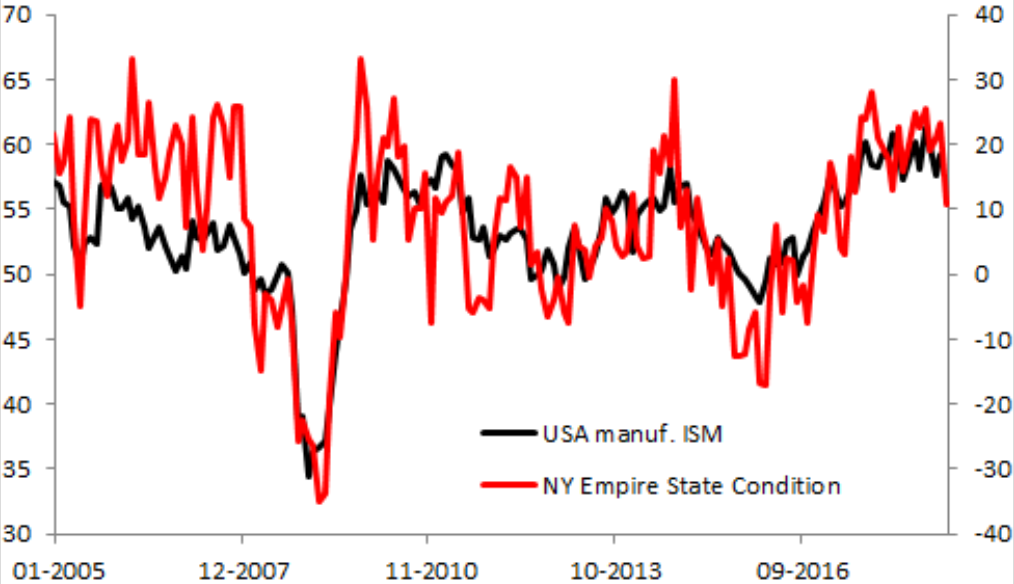

Price is no doubt precarious around these levels and a negative reaction to this week’s Fed decision could well prove to be a tipping point should it occur. The Fed is clearly the biggest event of the week for stocks but there are some smaller releases which can provide some insight into the US economy. This afternoon’s we got the latest Empire state manufacturing index, which came in below a forecast 20.1 at 10.9. The reading for December is the lowest since May 2017 and marks a pretty sharp drop on the 23.3 seen previously. Another worrying sign was the slump in new orders which fell to 14.5 from 20.4 last month.

The latest Empire State release showed a larger than expected drop and could be seen to signal that the more widely viewed ISM manufacturing gauge is set to turn lower also. Source: XTB Macrobond

Looking at individual shares in the US, Goldman Sachs is making headlines for the wrong reasons after Malaysia filed criminal charges against the bank in connection with an investigation into suspected corruption and money laundering at state fund 1MDB. A Goldman Sachs spokesman said the charges were "misdirected" and the bank would vigorously defend them. The bank continued to cooperate with all authorities in their investigations, he said.

Goldman Sachs has been under scrutiny for its role in helping raise $6.5 billion through three bond offerings for 1MDB, which is the subject of investigations in at least six countries. The stock is called to open lower by around 2% and possibly back below the 170 handle.

Goldman Sachs has now erased all of its gains since the 2016 election, after which many were quick to declare banks as some of the biggest winners from Trump’s victory. In recent weeks the stock has accelerated lower after breaking below 210 and the market is called to open in the red this afternoon. Source: xStation

Goldman Sachs has now erased all of its gains since the 2016 election, after which many were quick to declare banks as some of the biggest winners from Trump’s victory. In recent weeks the stock has accelerated lower after breaking below 210 and the market is called to open in the red this afternoon. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.