Salesforce (CRM.US) stock fell over 10.0 % on Thursday as news of the surprise departure of co-CEO Taylor and weak financial outlook overshadowed upbeat quarterly figures.

-

The cloud-software company earned $1.40 per share, easily beating FactSet expectations of $1.22. Revenue of $7.84 billion, slightly topped market estimates of $7.83 billion.

-

For the current quarter, Salesforce expects revenue in the region of $7.93 billion to $8.03 billion, a range whose midpoint is the Wall Street consensus call of $8.02 billion. On the other hand, the company forecast earnings per share in a range of $1.35 to $1.37 per share compared to analysts’ estimates of $1.34 per share.

-

Company noticed that corporate technology purchasing decisions were receiving “greater scrutiny” and there was a high level of uncertainty among customers about the demand environment.

-

Salesforce announced that co-Chief Executive Bret Taylor, who had been co-CEO for about one year, will stay with the company only until Jan. 31, 2023 as he intends to join a startup. Marc Benioff will remain as the sole CEO of the company.

-

" With Taylor leaving we can see Benioff potentially getting more aggressive on M&A in the cloud landscape as more private and public vendors struggle in a softer macro backdrop. This is all about the battle vs. Microsoft (MSFT) for market share in the cloud and collaboration space with CRM in a strong position to further build out its product footprint over the coming years." said Wedbush analyst Daniel Ives in a report.

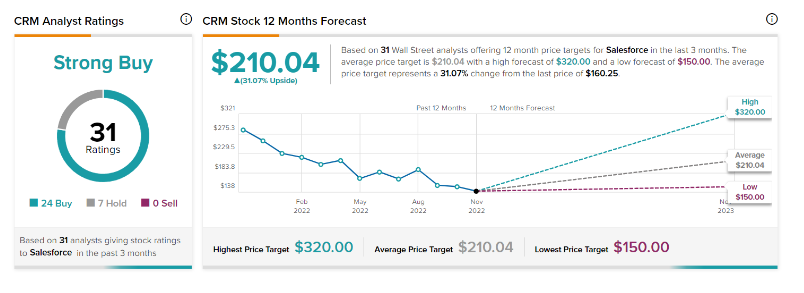

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Despite the difficult macroeconomic environment, the company's quarterly results surprised on the upside mainly thanks to rising demand for cloud-based services. Company plans to increase investments and expand its offer in order to increase its market share which should support long-term growth.

Salesforce (CRM.US) stock launched today's session sharply lower as buyers once again failed to break above the major resistance zone around $159.55 which is marked with previous price reactions and 78.6% Fibonacci retracement of the upward wave launched in March 2020. If current sentiment prevails, downward impulse may deepen towards support at $126.00, where the lower limit of the 1:1 structure is located or even to pandemic lows at $116.50. Source: xStation5

Middle East conflict ramps up a gear as energy price spike rips through markets

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.