U.S. Treasury Secretary Bessent summarized today the agreement reached with Beijing. In his comments to the Financial Times, he said: "The United States and China will sign the deal in the coming week and are confident it will hold (...). An agreement has been reached that — ceteris paribus — we have achieved an equilibrium within which both sides can operate over the next 12 months."

- The U.S. and Chinese leaders have reached a state of balance, but Bessent warned that China would no longer be able to use critical minerals as a tool of coercion. He added that China made a serious mistake by taking action on rare earths.

- Under the one-year deal, China agreed to postpone the implementation of its rare earth regulations and to purchase large quantities of U.S. soybeans.

- Bessent also noted that all issues related to permissions have been resolved, and that the transaction should be finalized very soon.

- As part of the agreement, China will allow American investors to take control of TikTok’s U.S. operations.

The 'Trade Deal' Is (As For Now) Done

The meeting between Donald Trump and Xi Jinping lasted 1 hour and 40 minutes — shorter than the planned 3–4 hours — as Xi was in a hurry to attend the APEC summit. Trump announced a potential visit to China in April 2026 and rated the talks a “12 out of 10.” The question is: what do we really know?

- China agreed to postpone for one year the export restrictions on rare earths announced on October 9, and Trump expects the truce to be renewed annually. However, previous Chinese export controls from April — covering samarium, gadolinium, terbium, and dysprosium — remain in effect.

- Beijing will resume imports of U.S. soybeans, and both sides agreed to suspend reciprocal port fees. China will also start purchasing U.S. energy, including potentially LNG from Alaska’s $44 billion reserves. In turn, the U.S. signaled readiness to increase oil and gas exports.

- In exchange for China’s concessions and its pledge to combat opioid trafficking, Trump reduced tariffs related to fentanyl from 20% to 10%, bringing the overall tariff rate on China down from 57% to 47% — still higher than those applied to India and Brazil. Washington will also delay by one year the expansion of its trade restriction list for Chinese companies.

- Both sides avoided sensitive issues such as Taiwan and Russian oil, focusing instead on the war in Ukraine — agreeing that further escalation would harm both sides and that de-escalation is the goal, especially given the limited time available.

- This thaw marks an early stage in a long-term rivalry. Interestingly, the RAND Corporation recently concluded that “victory over China is no longer possible” and that the U.S. should seek peaceful coexistence.

- If either side begins to feel stronger, tensions could resurface. For now, markets have likely gained 10–12 months of calm, though renewed escalation cannot be ruled out. The U.S. also emphasized that Blackwell AI technology remains off-limits to China.

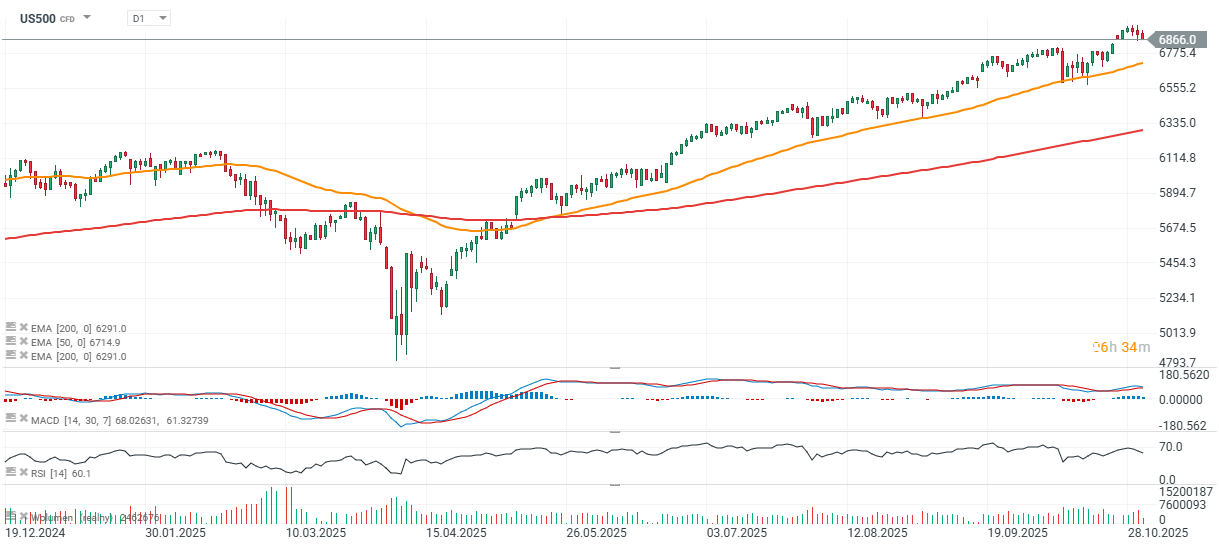

As we can see, the trade deal with China hasn’t acted as a short-term catalyst for the S&P 500. It had been largely priced in over the past few weeks, and the framework of the agreement itself came as no surprise to Wall Street. The US500 futures contract is on track to close its third consecutive session in decline.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.