Summary:

-

Industrial production beats but manufacturing PMI misses

-

US indices remain in the red on the day

-

US500 in danger of lowest weekly close in 9 months

Coming not long after the solid retail sales data, we got two more sets of economic releases from the US which painted a somewhat mixed picture on the economy. The first of these was industrial production which showed a M/M increase of 0.6% and well above the 0.3% expected. However this beat doesn’t look so good when you consider that the previous reading was revised lower by 300 basis points and now stands at -0.2% after being +0.1% previously. At the same time there was also the most recent manufacturing production numbers which showed a flat reading of 0.0% when a rise of +0.3% was expected.

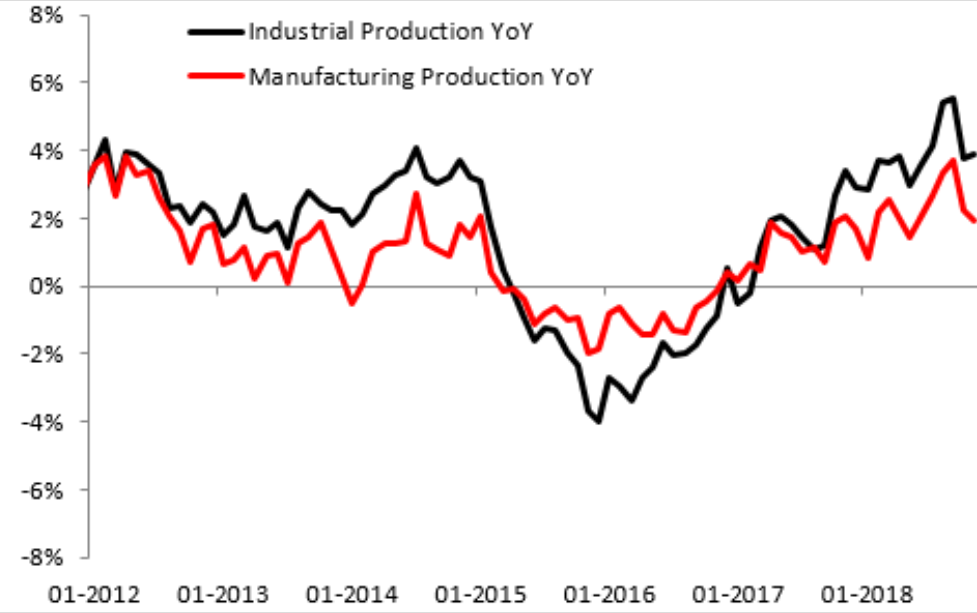

Looking through the monthly fluctuations it appears that both industrial and manufacturing production are pulling back lately after a strong run higher since 2016. Source: XTB Macrobond

Shortly after the production figures the flash manufacturing PMI for December was released, and this metric slumped to its lowest level in 13 months. A print of 53.9 was well below the 55.3 seen previously and also marks a fair sized miss on the expected 55.1. The prior reading was also revised lower from 55.4 for good measure. Simultaneously there was also the services equivalent which fell to an 11-month low of 53.4 compared to median forecast of 54.7. Here, we also got another revision but in this case it was to the upside and now reads 54.7 from 54.4 previously.

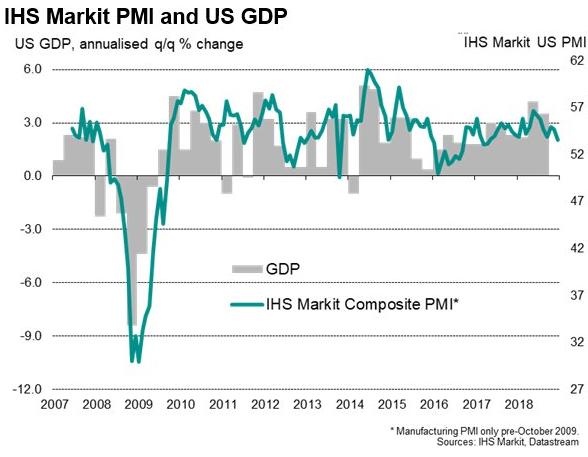

Combined the flash PMIs showed their weakest growth since May 2017. They indicate an annualised 2.0% GDP growth rate in December. Source: IHS Markit, Federal Reserve

It’s been a bit of an up and down week for the US stock market, but when all is said and done price is in danger of closing at its lowest level since March. Monday saw the US500 tumble below the 2600 handle and in doing so take out the October low but bulls stepped in to buy the dip. Forays higher in the past 3 days have been met with pretty firm rejections and today the market is in danger of revisiting the lows. Last week saw a large bearish engulfing candle on W1 and the current one is showing a doji at present with the signs not looking too promising for longs. The year-to-date lows of 2529 could well see a retest if there’s another push lower and if these are broken below then there’s scope for a sizable move lower.

The US500 has had an up and down week but as the dust settles the market is in danger of ending at its lowest level since March. YTD lows of 2529 could be revisited in the not too distant future if buyers don’t step in here. Source: xStation

The US500 has had an up and down week but as the dust settles the market is in danger of ending at its lowest level since March. YTD lows of 2529 could be revisited in the not too distant future if buyers don’t step in here. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.