-

Cannabis sector companies performed poorly in 2019

-

Enormous inventories could satisfy more than 2 years of current demand

-

Cannabis edibles and alternates to hit the market in mid-December 2019

-

Provinces plan to boost number of retail stores

-

USCANNA halted downward move and started to trade in range

Canada became the first major developed economy to fully legalize recreational use of cannabis in October 2018. Legalization paved the way for the foundation of a cannabis industry. While initial expectations were high, the first post-legalization year turned out to be tough. In this commentary we will focus on what caused USCANNA index to drop over 50% in the past 6 months and is there any chance for a rebound next year.

Unfulfilled promise of massive profits

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCannabis-related stocks surged in the late-2018 and early-2019. BITA Global Cannabis Giants index (USCANNA on xStation) jumped almost 70% in between 21 December 2018 and 21 March 2019. Share prices of companies were supported by promises of gargantuan profits and M&A activity in the sector. However, reality turned out to be more sour. Splitting issuance of licenses for producers and retailers between federal and provincial agencies turned out to have bad consequences. Provincial agencies, responsible for issuance of license for retailers, were slow to review applications while federal agencies did just fine reviewing licenses for producers.

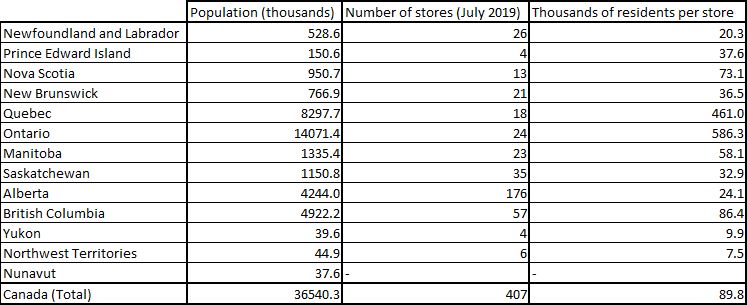

While recreational cannabis use is legal in Canada, it does not mean that buying the product is easy. There were just 407 brick-and-mortar shops selling cannabis in July 2019. Insufficient number of shops is the biggest problem in Ontario and Quebec - two provinces account for over 60% of Canada’s population but host just around 10% of all cannabis shops. Source: Statistics Canada

While recreational cannabis use is legal in Canada, it does not mean that buying the product is easy. There were just 407 brick-and-mortar shops selling cannabis in July 2019. Insufficient number of shops is the biggest problem in Ontario and Quebec - two provinces account for over 60% of Canada’s population but host just around 10% of all cannabis shops. Source: Statistics Canada

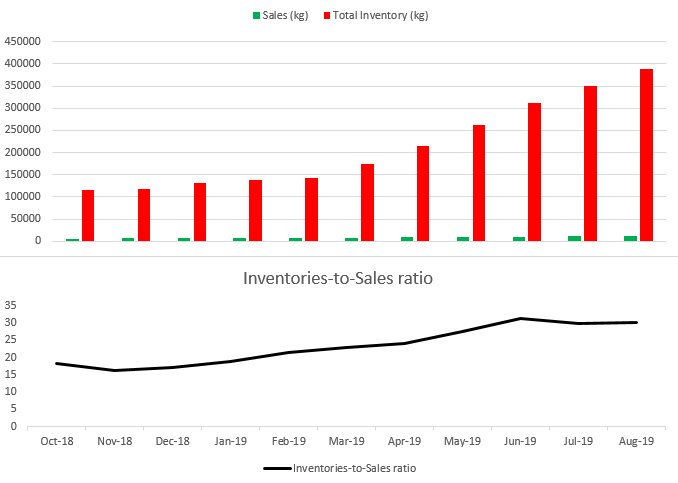

Canadian companies are sitting on enormous cannabis stockpiles

Investments caused production capacity to increase while small number of retail stores made product hard to sell. As time passed, cannabis inventories in Canada started to grow. Result? Cultivators, processors, distributors and retailers held close to 400 tonnes of cannabis in their inventories at the end of August 2019 - figure over 30 times higher than sales for the month. As producers struggled to sell their product, prices were lowered putting pressure on margins. Supply glut also caused some companies to postpone investments in production facilities and put aside merger plans. As one can see, significant decline in valuations of the cannabis companies was completely justified from a fundamental point of view. However, new cannabis law could turn the tide for the sector.

Insufficient number of retail shops limits cannabis sales in Canada. Cultivators, distributors and retailers held almost 400 tonnes of the product in stockpiles at the end of August 2019. This puts inventories-to-sales ratio for the month at over 30! However, postponement of investment projects and introduction of Cannabis 2.0 could help drag down inventories. Source: Health Canada

Insufficient number of retail shops limits cannabis sales in Canada. Cultivators, distributors and retailers held almost 400 tonnes of the product in stockpiles at the end of August 2019. This puts inventories-to-sales ratio for the month at over 30! However, postponement of investment projects and introduction of Cannabis 2.0 could help drag down inventories. Source: Health Canada

Edibles could help drag down inventories

The so-called Cannabis 2.0 act went live in mid-October. The act allows marketing of cannabis derivative products, like for example edibles and beverages. According to a survey conducted by Deloitte, around 24% of Canadian adults are either consuming cannabis edibles already or are interested in trying those alternate cannabis products after they are legalized. This puts the number of potential consumers at close to 7.5 million! These products require bigger amounts of cannabis to prepare therefore their rollout could drag down inventories. Moreover, new products are unlikely to cannibalize sector’s revenue as Deloitte survey shows that just 25% of current users and 16% of potential users is willing to substitute cannabis with cannabis derivatives. The remaining part of the respondents either does not know (31% in both categories) or is willing to buy new products in addition to the products they use already (44% of current users and 53% of potential users).

What’s next for the sector?

Cannabis edibles were legalized in mid-October but actual sale of the product is not expected to begin until mid-December 2019. Having said that, new product offering should not have much of an impact on the 2019 results but could play a significant role in 2020. While rollout of alternate cannabis products can be seen as an opportunity for the sector, one should not forget that legalization in 2018 was seen as an opportunity as well. A lot will depend on whether the number of retail stores increases as even the best product is worth nothing if you cannot sell it. It is estimated that lack of retail stores limited cannabis sales in Canada by around a half during the past year. Fortunately, there is a scope for a change as some provinces, including Ontario, plan to increase the supply of retail licenses significantly next year.

USCANNA has been trading in a downward move for around 8 months already. Pressure eased recently and the index began to move sideways in the 435-460 pts range. One cannot rule out the possibility of the index trading sluggishly until earnings reports for Q1 2020 are released as those will show whether Cannabis 2.0 act is boosting companies’ results. Levels to watch in case of a break out of the consolidation range are determined by the limits of the Overbalance structure (resistance at 507 pts and support at 411 pts). Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.