- AI is central to Meta's thesis

- Investment in AI will degrade cash flow in the short term, but boost it in the long term.

- Target price for Meta

- AI is central to Meta's thesis

- Investment in AI will degrade cash flow in the short term, but boost it in the long term.

- Target price for Meta

Meta shares are up 22% in 2025, but that doesn't mean they're out of reach. The market still doesn't value Meta highly enough. How much are Meta shares worth?

Meta's business

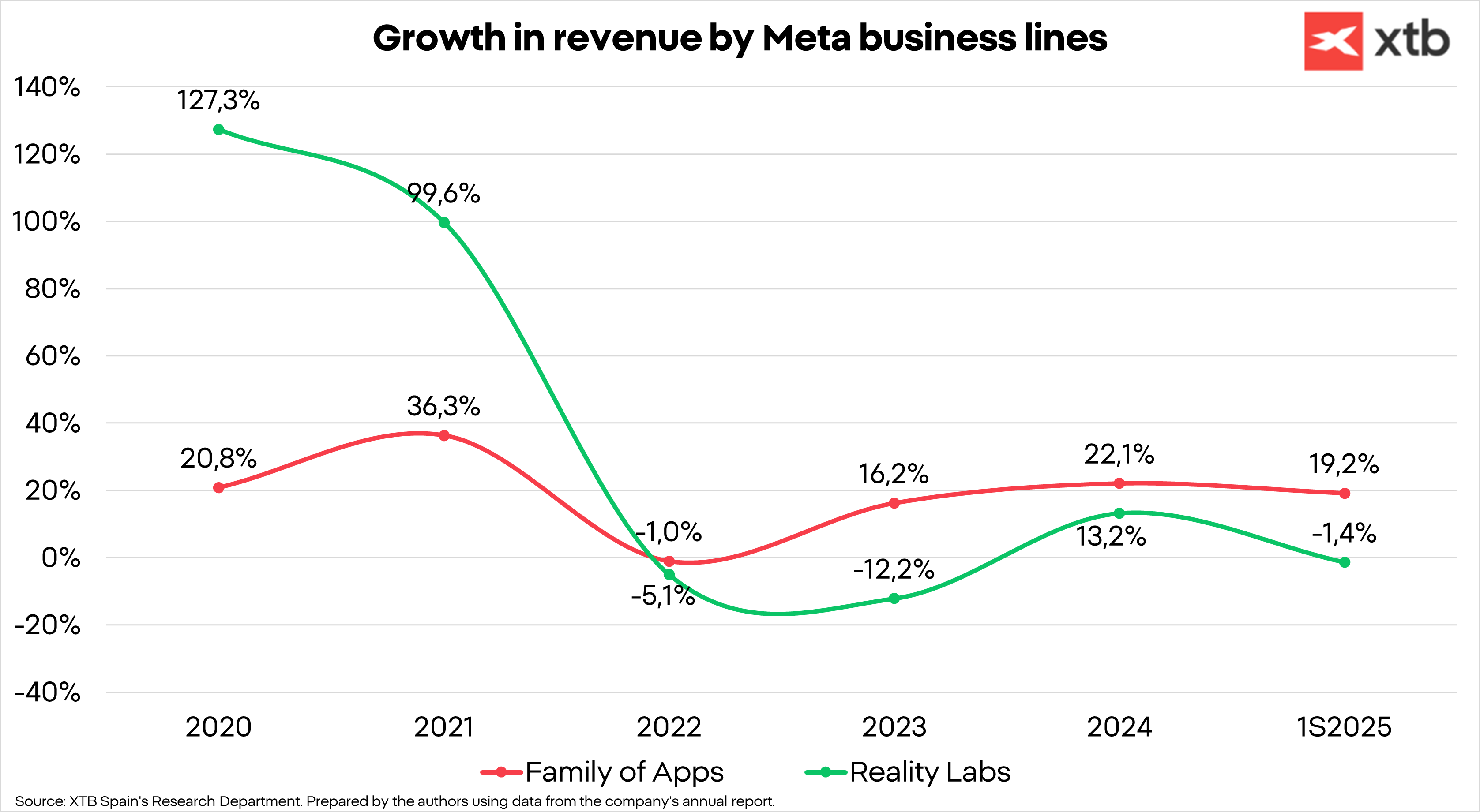

Meta divides its business into two different lines:

- Family of Apps (FoA): Meta apps are social networks that facilitate interaction between people in different ways. They represent 99% of revenue, and advertising accounts for 98%.

- Reality Labs: This is Meta's secondary segment, which includes investments in experimental technologies, the metaverse, and virtual reality headsets, such as Meta Quest. In this area, Meta also sells hardware, i.e., the headset itself. This segment is reporting significant losses for Meta, but we believe it has interesting potential in the future. So much so, that it is the most advanced company in this field and has just launched new everyday Ray-Ban glasses with integrated AI.

Among its apps, including Facebook, Instagram, WhatsApp, Threads, and Messenger, we have to highlight Instagram. This app has grown enormously in recent years and is changing its content format. Reels, which are short videos, achieve 2.25 times more reach than a single-photo post and 1.36 times more than a photo carousel, according to a Buffer study. They were included in Q3 2020 and by Q1 2022 they already accounted for 20% of Instagram usage time, while they reached 50% in Q1 2024, and we believe they have continued to increase.

Meta boasts the most popular social networks and a total of 3.48 billion daily active users, representing just over 60% of the global population with internet access. If we exclude China, which has WeChat and doesn't allow access to other social networks, we're talking about approximately 76.5% of the population with internet access and 42.74% of the global population (49.5% without China).

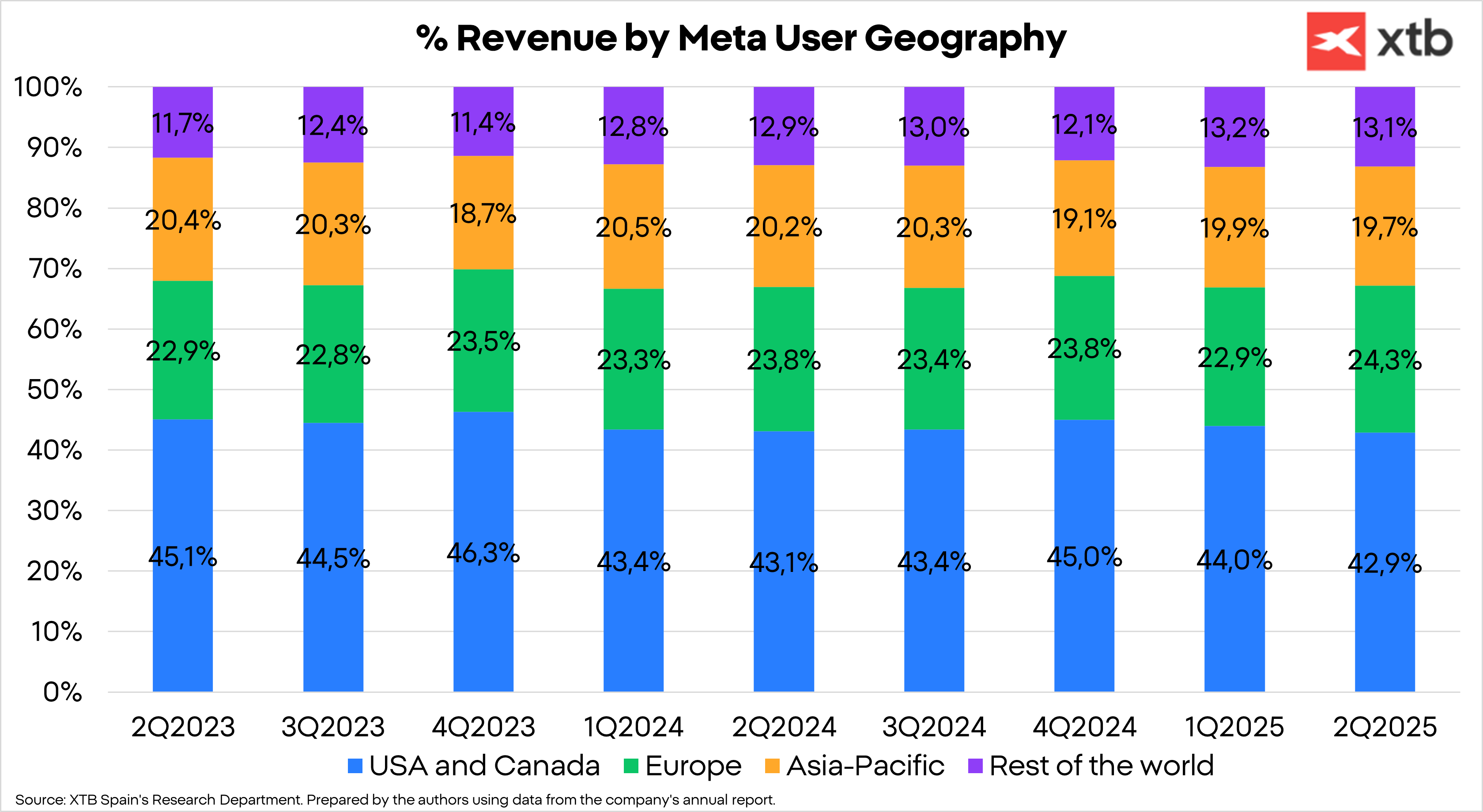

Geographically, the United States and Canada remain Meta's primary revenue source, although regions such as Europe and the Rest of the World are gaining some share due to increased revenue growth in recent years.

Investment in AI and the keys to Meta

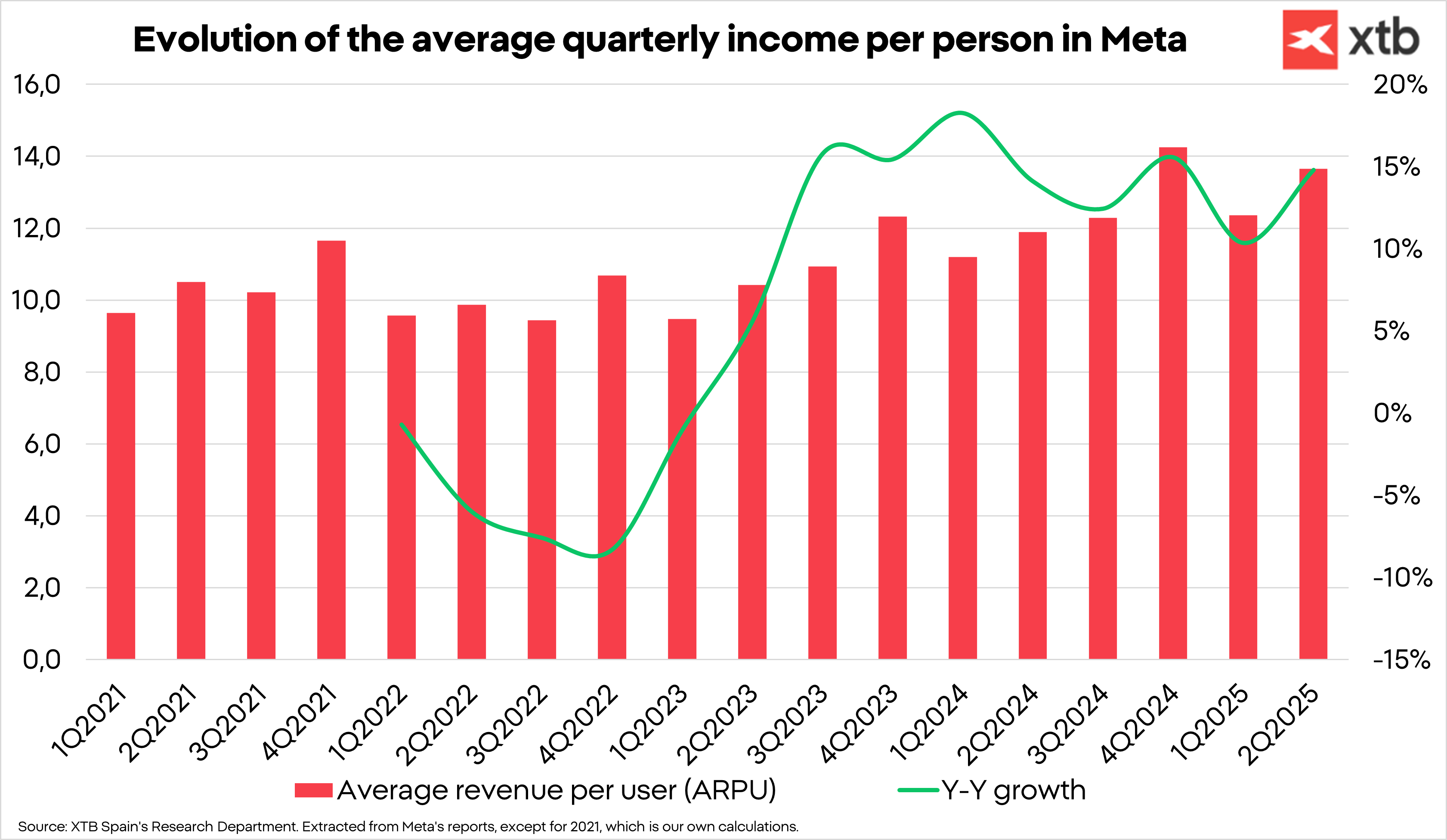

ARPU, the average revenue per user of Meta's platforms, continues to grow in quarters and has seen a rebound in the second quarter of 2025. However, we believe this is just the beginning.

Average price growth is strong, after several quarters of declines. This near-double-digit average price growth and the increase in the number of users are what's driving Meta's double-digit growth. The only region we believe is reporting excessively low average price growth per ad is Asia-Pacific, although we believe it still has significant potential. This market includes India, which is one of the regions we expect to boost this metric because it's a market that's starting to become attractive to brands.

Impressions have slowed their growth rate, and we attribute this to the decrease in the number of hours spent on social media worldwide. This variable is crucial, as the price charged per ad depends on the number of interactions and impressions it receives. However, we saw a strong rebound in the last quarter, and we believe AI is already beginning to have an impact.

AI is a fundamental part of Meta's thesis. Meta's revenue is determined by the number of users, user interactions with ads, and the price of those ads. To increase both interactions and ad prices, it is necessary to offer the right ad to each user. To do this, the company is already using AI models to identify user usage patterns and understand which content generates the most engagement. This way, it can also offer the most relevant ads to users, increasing the likelihood that they will interact with them. This will allow for improved ad targeting and, therefore, an increase in the return on advertising investment for advertisers, which will lead to price increases for Meta.

On the other hand, by 2026, the process is expected to be further automated for advertisers, so that any business can allocate their available budget and Advantage+ (Meta's AI-powered tool for advertisers) will automatically create the complete marketing campaign with images and videos. This represents significant cost savings for advertisers, who will be able to reduce their departmental staff or cut spending on external agencies. This means unlocking a market of more than $400 billion annually that until now has been overlooked because Meta was a complement, not a substitute.

Meta's competitive advantages

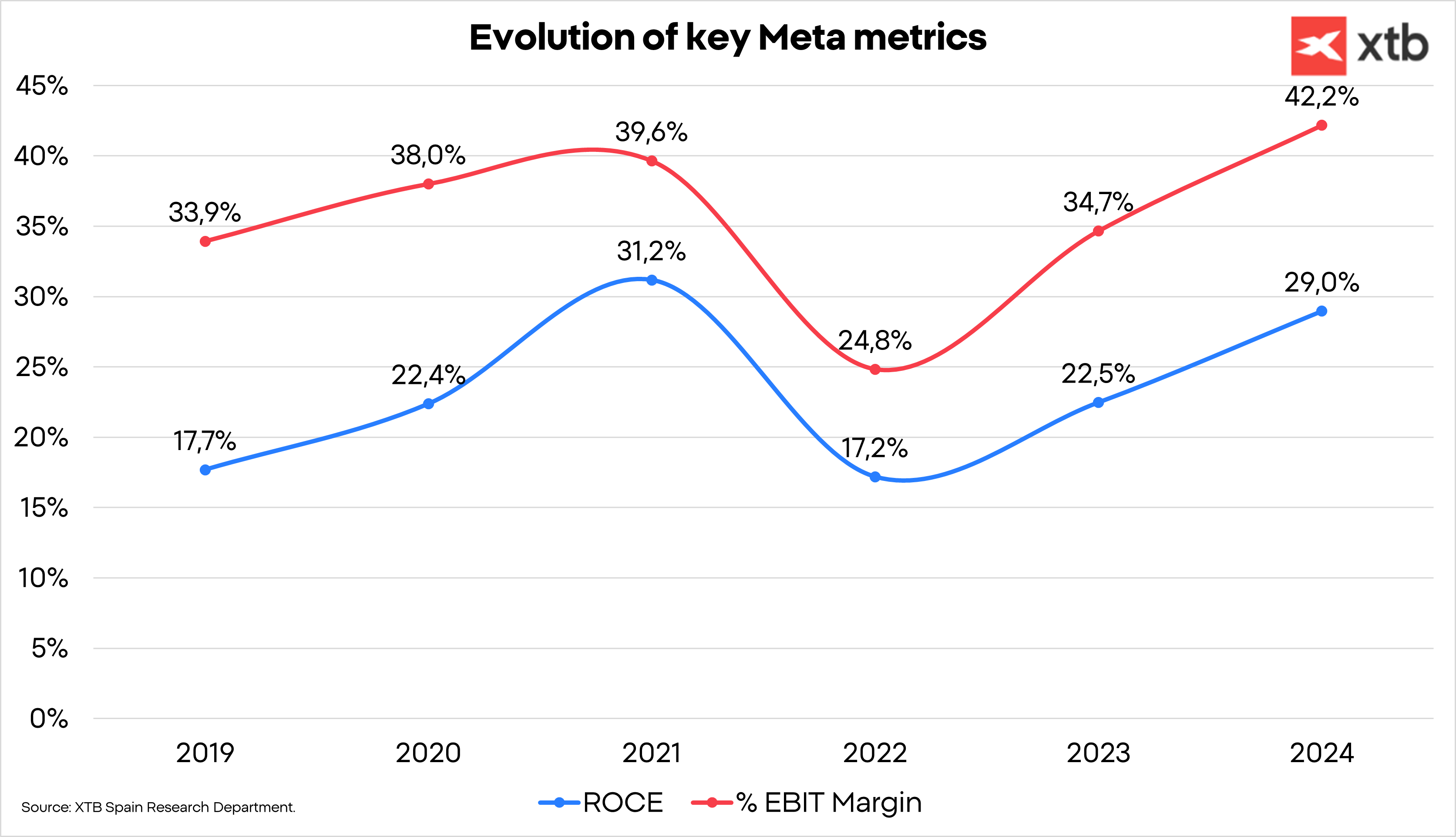

Meta has two key competitive advantages that allow it to achieve high margins and the ability to invest in alternatives that are currently unprofitable thanks to the cash generation of its core business. These competitive advantages are:

- Network effect: The network effect refers to the increase in value of a network of people as it grows and more people join it. It's typical of social media, so Meta, with the largest social networks in the world, benefits from it. Facebook and Instagram are valuable to users because they can find their family, acquaintances, and relevant posts. Therefore, the larger the network, the more valuable it is for users, which is key for advertisers to choose Meta's networks to invest their advertising budgets.

- Economies of scale: As the network grows, the cost is spread across more users, resulting in a drop in the cost per user. This allows for increased margins as the business grows.

- Switching costs: This defensive moat arises when the cost of switching services for the customer is greater than the benefit they receive from switching to another alternative. Although in Meta's case it's not that high, we believe it could gain momentum when AI-driven automated campaigns are implemented, causing advertisers to forgo other alternatives, even if the cost may be somewhat lower.

Meta Valuation: What is the target price for Meta shares?

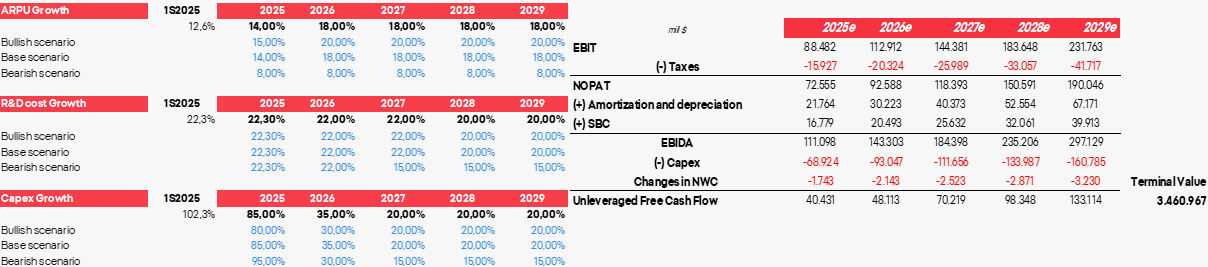

For our valuation, we developed three scenarios based on the three key variables: ARPU, R&D expenditure, and capex. The base case reasonably reflects Meta's new AI-powered developments, which will increase impressions, the potential for market share capture from marketing agencies, and increased profitability for advertisers. Furthermore, the company is beginning to monetize WhatsApp, and we believe it will continue to expand that market. We have also assumed that RL revenues will remain constant despite increased costs.

- We have assumed a discount rate of 8% and a tax rate of 18%.

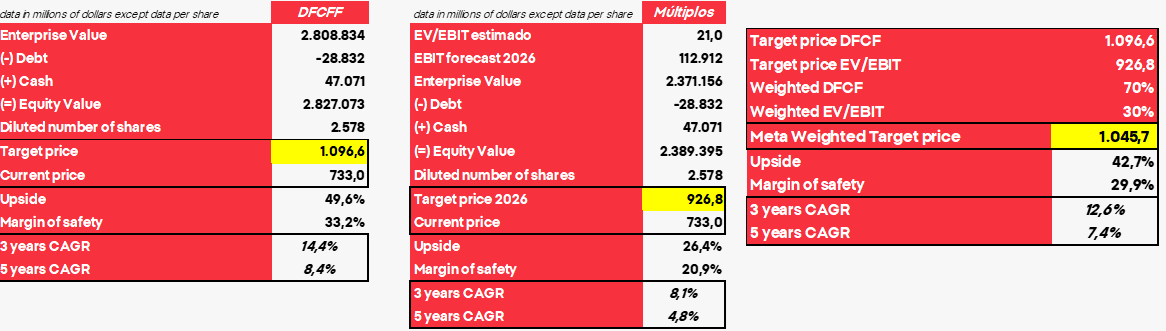

- The base case scenario gives us a potential discount of almost 50% in cash flows, but a 26.4% discount in valuation multiples.

- The final valuation gives us a target price for Meta of $1,045.7, which represents a potential upside of just over 40%.

- Although the CAGR isn't particularly high, we believe Meta remains a great company with competitive advantages that will allow it to remain one of the best companies in the world and continue to expand its business.

- Ultimately, Meta's investment thesis isn't to take advantage of a specific market situation, but rather to buy a quality company at reasonable prices and with management that has skin in the game.

The optimistic scenario gives us a target price of $1,232.7, which represents a potential upside of 68%. Meanwhile, the pessimistic scenario gives us a target price of $561.3, which would give a downside potential of -23%.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.