Summary:

-

Netflix (NFLX.US) rose for the third day after a period of declines

-

Subscriber growth slowdown concerned Netflix shareholders

-

The company tests new payment solution

-

The stock broke above the medium term resistance zone

Netflix (NFLX.US) has been trading in a downtrend since the release of the second quarter earnings. However, the news surfaced this week suggesting that the company is testing a new payment solution that may greatly boost its revenue. In this analysis we will take a look at what company aims to do and why did the latest earnings report deteriorated sentiment so much.

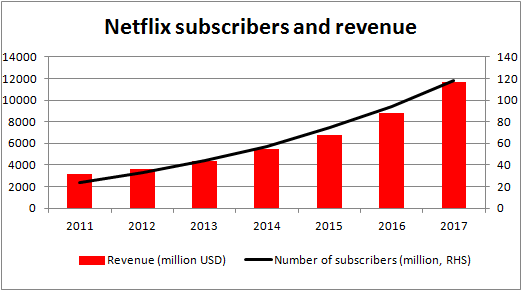

Netflix managed to break its revenue records in each subsequent quarter throughout past few years. Source: Bloomberg

Let’s start with the latest earnings report. The company reported a $3.91 billion revenue in the second quarter of 2018. This is quite a noticeable increase against $3.7 billion in the first quarter of the year and a significant jump from $2.79 billion in the second quarter of 2017. Figures concerning the net income look even more impressing as Netflix managed to boost income by over 32% on QoQ basis and by more than 480% on annual basis. While the company beat expectations in terms of earnings it provided a minor miss when it comes to the revenue.

However, it was not the case when it comes to the sentiment deterioration we have mentioned at the beginning of this analysis. What really concerned investors was a miss in the subscriber addition figures. According to the FactSet estimates Netflix was expected to add 1.23 million subscribers in the US and 5.11 million globally. Earnings report revealed that just 674,000 new US subscribers and 4.47 million new clients worldwide were added in the period from April to June. Moreover, the company issued a guidance saying that it expects 5 million people to subscribe for the first time in the third quarter of 2018. The median estimate pointed for a 6 million addition. Given that streaming revenue, fueled mostly by subscription payments, accounts for as much as 97% of Netflix total revenue a prolonged slowdown in the subscribers growth may translate into weaker revenue and profit dynamics in the subsequent quarters.

Netflix enjoyed a stable and rapid growth of both revenue and number of subscribers. Source: Bloomberg, Statista

So as we have already explained what was the cause of the short term downtrend the stock has been trading in recently, let’s move to this week’s news. According to TechCrunch, an American technology online publisher, Netflix is testing the payment solution that would enable company to stop using App Store for collecting payments. The information is said to be confirmed by the company. Speaking in detail, Netflix is conducting tests of a solution that would redirect customers, that try to renew or sign up for subscription, to the web app outside of App Store. The solution is being tested in some of the European, Asian and Latin American markets (33 countries in total) and the “experiment” is said to last until the end of September.

Why does it matter?

The new app would allow customers to pay their subscription fees directly to Netflix, what means that Apple’s intermediation will be omitted. Given that currently Apple takes a 30% cut of every new subscription purchased through App Store (this rate lowers to 15% after a year of subscription payments) one can see how greatly Netflix revenue could be boosted in the process. Of course, it will probably be connected to increase in costs for the company as the current custom payment solution would probably require a revamp to serve bigger number of users. Nevertheless, the savings will most likely exceed the cost. To picture the scale of possible savings consider that Netflix was the App Store’s top non-gaming app by revenue in 2017, according to the SensorTower mobile app store marketing intelligence service. The gross revenue Apple received from Netflix app exceeded $500 million in the previous year. Apart from that, there is one more reason to say that such shift would be beneficial for Netflix in the long term. Namely, Apple is said to be developing its own subscription-based streaming service therefore Netflix’s usage of the App Store services could be viewed as potential funding of its future rival.

Netflix (NFLX.US) began to underperform following the Q2 earnings release (orange circle on the chart above). The stock started recouping losses after TechCrunch report was published. Despite trading over 26% below ATH achieved on 21st of July the company is still one of the best performing S&P 500 components in 2018 with almost 80% YTD gain. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.