Quanta Services is one of the largest companies in the world providing comprehensive engineering and construction services for the energy and telecommunications sectors. With many years of experience, Quanta plays a key role in the execution of some of the most complex and strategic infrastructure projects in North America and globally.

In the face of the rapid development of artificial intelligence, the expansion of data centers, and the rollout of 5G and 6G telecommunications networks, Quanta Services' role as a reliable infrastructure partner is taking on a new dimension. The company supports the expansion and modernization of transmission networks, power systems, and telecommunications infrastructure, responding to the growing demands of the market and investors.

Thanks to its unique ability to deliver services from planning and design, through construction, to maintenance and modernization, Quanta Services is well-prepared to meet the challenges of the digital and energy transformation shaping the future of the global economy.

In this paper, we will present an analysis of Quanta Services’ operations, discuss market trends, and assess the company’s prospects in the context of increasing demand for critical infrastructure.

Company Profile – Quanta Services

Quanta Services is one of the world’s leading companies specializing in comprehensive engineering, construction, and maintenance services for the energy, telecommunications, and critical infrastructure sectors. The company offers a wide range of services, including the design, construction, and maintenance of transmission networks, power lines, telecommunications installations, and data center infrastructure.

Quanta works with both traditional electricity providers and telecommunications companies, data center operators, and other entities investing in the development of digital and energy infrastructure. Thanks to its flexibility and large-scale operations, the company undertakes extensive linear projects as well as complex infrastructure installations not only across the United States but also internationally.

In response to the rapid development of the data center market and the growing need for modern telecommunications infrastructure, Quanta Services continually expands its competencies. In 2022, the company acquired Dycom Industries, a firm specializing in the construction and maintenance of fiber-optic telecommunications networks, which enabled Quanta to offer its clients a full range of services in the digital infrastructure and data center domain.

This acquisition strengthened Quanta's position as one of the key players in the data center infrastructure sector, allowing the company to execute comprehensive projects—from design and construction to the ongoing maintenance of advanced fiber-optic networks, which form the foundation of efficient and scalable IT solutions.

Infrastructure dedicated to data centers and telecommunications is becoming an increasingly important component of Quanta Services’ offering. The rapid growth of AI technologies, cloud computing, and the implementation of 5G and 6G networks is driving demand for modern and efficient fiber-optic networks and high-performance data center infrastructure.

Engineering and Infrastructure Industry: Energy, Telecommunications, and Data Center Infrastructure

Quanta Services operates at the intersection of several key infrastructure sectors that are the backbone of the modern digital and energy economy. The engineering industry encompasses comprehensive design, construction, and maintenance services for energy and telecommunications infrastructure, which are essential for the functioning of contemporary societies and businesses.

Energy – The Foundation of Digital and Industrial Infrastructure Development

The energy segment is one of the main pillars of Quanta Services' business. The company specializes in building and modernizing transmission and distribution networks that enable the stable and efficient delivery of electricity to consumers across the United States. In the face of the global energy transformation, involving the growing share of renewable energy sources (RES) and the need to reduce CO₂ emissions, modernizing energy infrastructure is not only a necessity but also a significant market opportunity.

Telecommunications – Expanding Fiber-Optic Networks in the 5G and IoT Era

The second core pillar of Quanta Services' business is the telecommunications sector, which has seen dynamic growth in recent years. A key trend is the massive expansion of fiber-optic networks, which are the backbone of modern digital communication. Fiber-optics enable the transmission of vast amounts of data at very high speeds and low latency, which is essential for the development of 5G technology and cloud-based solutions.

The growing demand for fast and stable internet connections is driven by the rise of remote work, the expansion of streaming services, and the need for digitization across both public and private sectors. As a result, the telecommunications industry faces the challenge of rapidly deploying fiber-optic infrastructure in urban and rural areas, generating high demand for design and construction services.

Data Center Infrastructure – A Key Growth Driver for Quanta Services

The fastest-growing segment of Quanta Services’ operations is data center infrastructure, which is gaining strategic importance amid the digital transformation and the global boom in artificial intelligence, cloud services, and Big Data. Modern data centers—the "brains" of the digital economy—require advanced infrastructure, including extensive fiber-optic networks, backup power systems, cooling solutions, and comprehensive electrical and mechanical installations. Building such facilities is a complex endeavor requiring high engineering competence, experience, and operational flexibility.

Recognizing the scale and potential of this segment, Quanta Services has significantly strengthened its position in the data center infrastructure space in recent years—among other initiatives, by acquiring a specialized company from this market. This has enabled Quanta to offer a full range of services from design and construction to systems integration and comprehensive operational support.

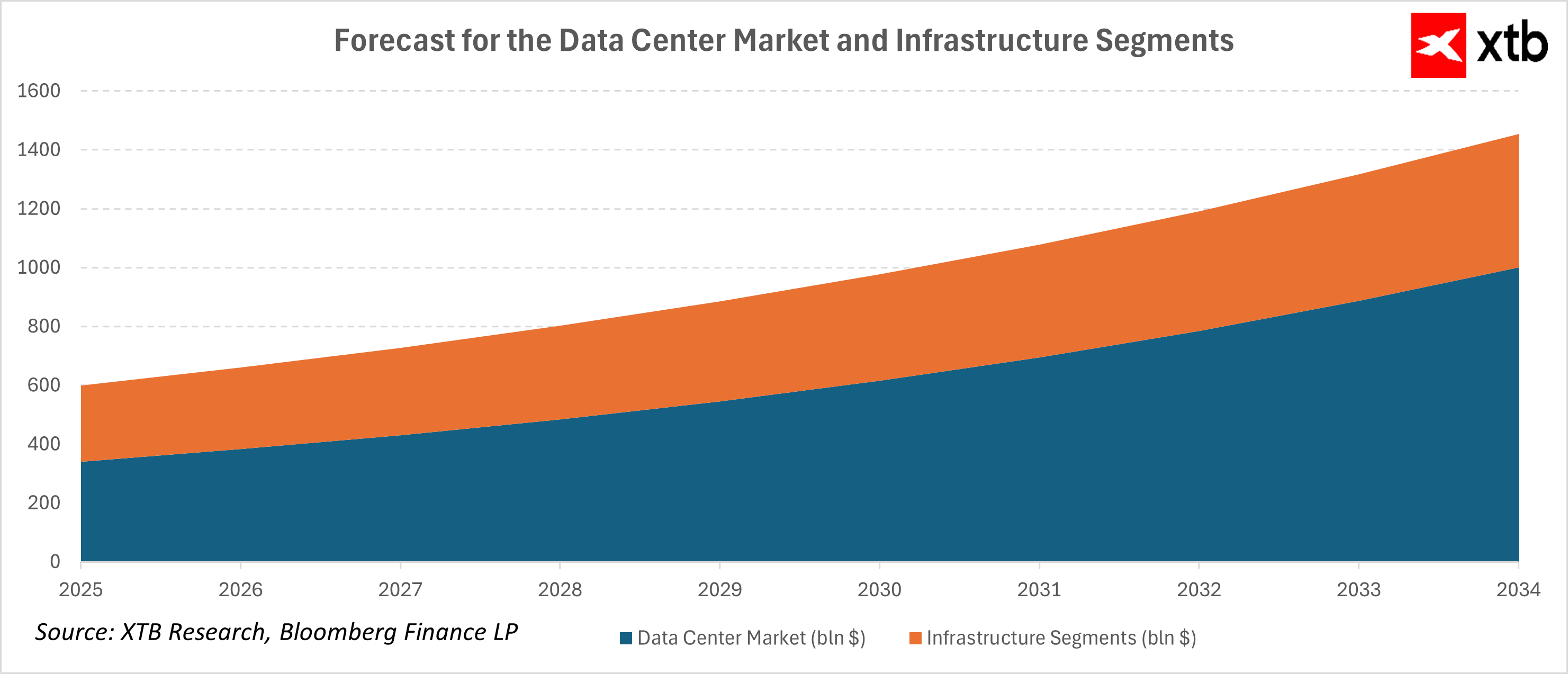

The scale of upcoming opportunities is confirmed by market forecasts. According to estimates, the global data center infrastructure market is expected to reach $1 trillion by 2034, growing from $340 billion in 2025. A particularly significant segment is data center construction, which accounts for a large share of the total market value. This segment is projected to grow from $258.6 billion in 2025 to over $454.5 billion in 2034. This area presents huge opportunities for companies like Quanta Services, which specialize in engineering, installation, and infrastructure support for highly complex technical facilities.

Given such dynamic growth, Quanta Services is ideally positioned to fully capitalize on this global trend and become one of the main beneficiaries of the digital infrastructure revolution.

Trends and Challenges in the Engineering Industry

The infrastructure industry is closely tied to rapid technological development, regulatory changes, and increasing environmental expectations. The energy transition, expansion of 5G/6G networks, digitization of services, and the rise of AI are all driving continuous demand for modern infrastructure. At the same time, companies face challenges such as pressure to shorten project timelines, rising material and labor costs, and the need to invest in innovation and automation.

Financial Analysis

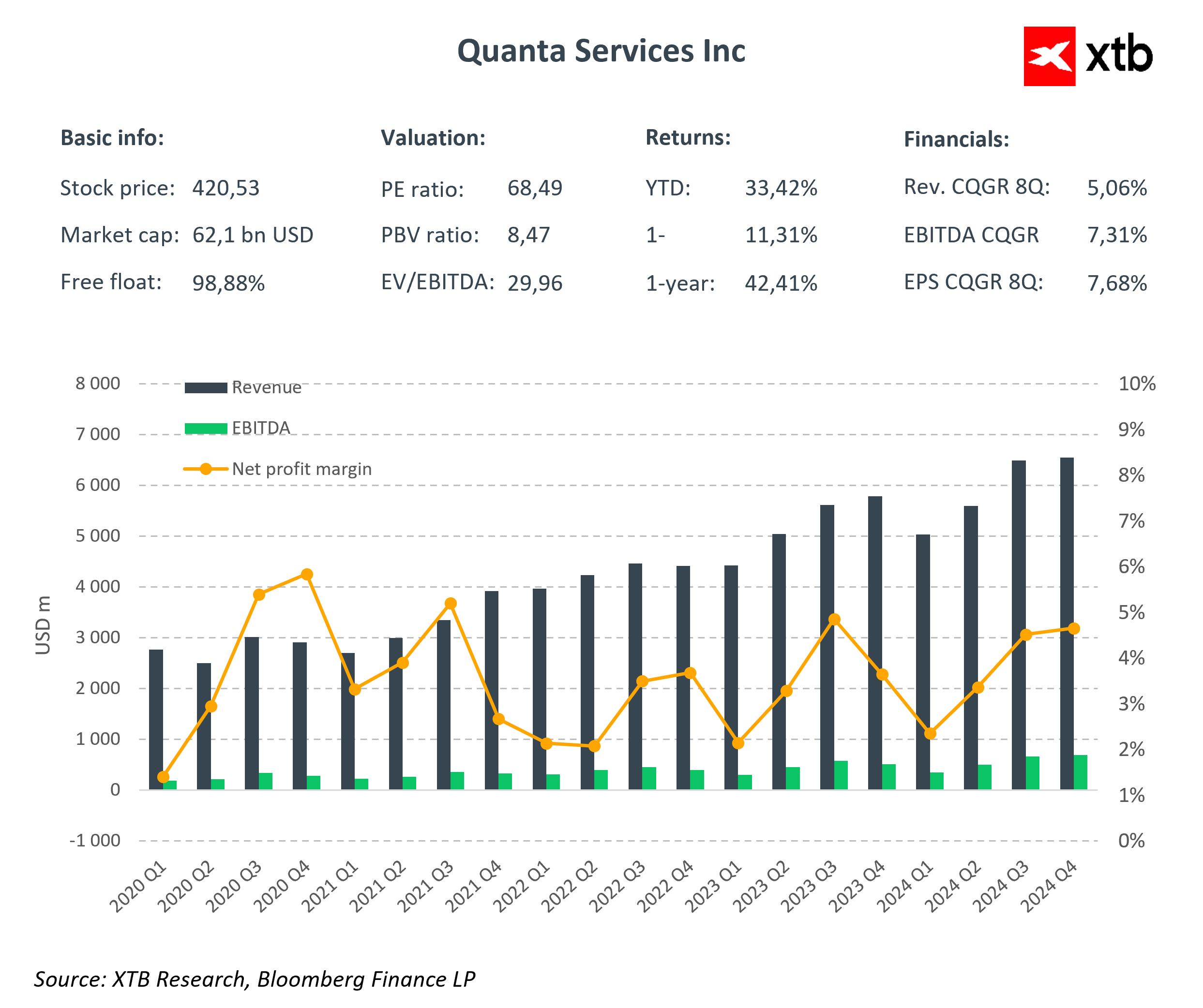

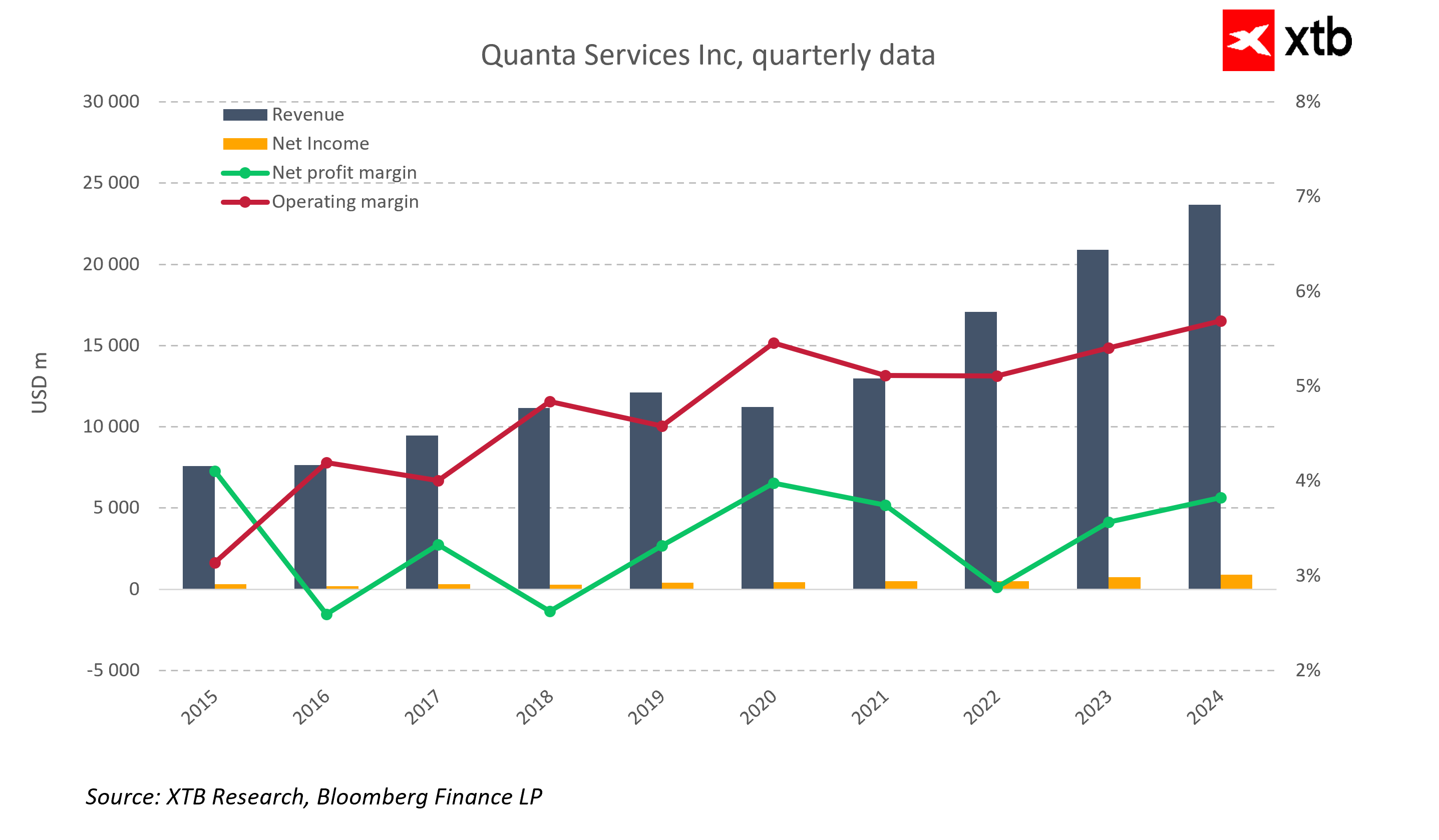

In recent years, Quanta Services has been rapidly strengthening its position as a leader in the critical infrastructure sector. The company, whose operations focus on services for the energy, telecommunications, and digital infrastructure sectors—including data centers—has recorded an almost uninterrupted increase in revenue, growing from $7.57 billion in 2015 to $23.67 billion in 2024. This represents more than a threefold increase over the course of a decade, achieved despite challenges related to the pandemic, raw material cost volatility, and macroeconomic uncertainty.

The COVID-19 pandemic and supply chain disruptions (2020–2021) did not undermine the company’s foundations—Quanta maintained positive financial results and continued its strategic investments. The company's performance was particularly strong in areas such as distributed energy, grid modernization, and the increasing demand for digital infrastructure, which helped offset cost pressures and market volatility.

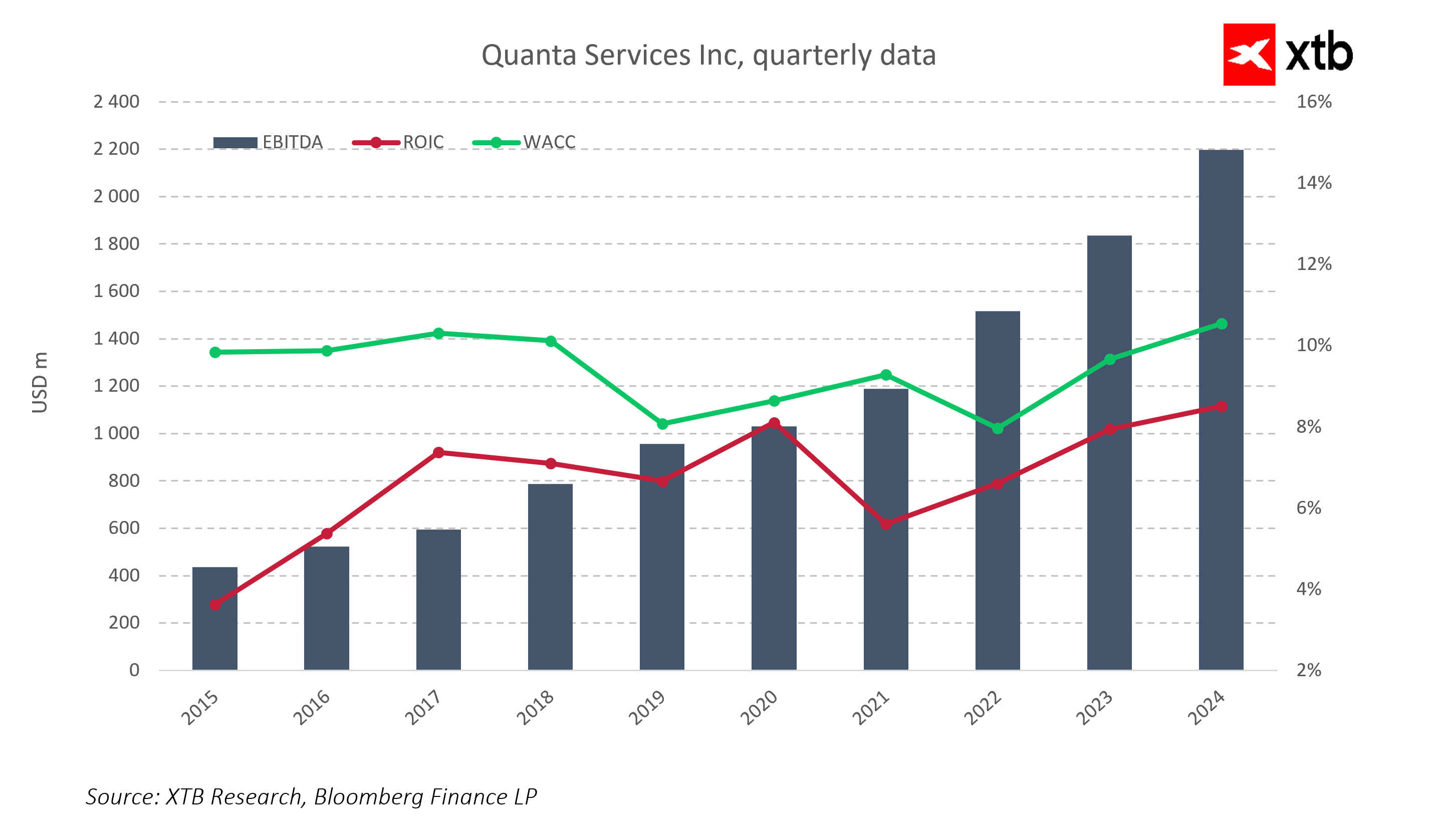

Since 2022, Quanta Services has entered a new phase of growth, which is reflected not only in rising revenues but also in a significant improvement in operational efficiency. EBITDA increased from $435 million in 2015 to an impressive $2.2 billion in 2024, highlighting the company’s dynamic development and its ability to generate growing operational profits. At the same time, operating margin rose from around 3% to nearly 5.7%, and the net margin, despite periodic fluctuations, stabilized above 3.8%. This improvement in profitability is primarily the result of several key factors: effective cost control on project execution, optimization of operational processes, and a strategic focus on high-value segments such as digital infrastructure and advanced energy solutions. Additionally, the company's growing experience and improved project management have led to more efficient resource utilization, minimizing losses and boosting profitability.

Looking ahead, the outlook for further margin expansion is promising. As the company continues to grow in more specialized and technologically advanced areas—such as data center infrastructure and energy transition solutions—further profitability improvements are likely. Innovation, process automation, and economies of scale should further enhance operational efficiency, thus strengthening margins.

At the same time, Quanta Services is improving both operational and investment efficiency, although return metrics such as ROIC remain close to the weighted average cost of capital (WACC). This indicates a balance between profit generation and financing costs, reflecting a stable business model, but also suggesting room for further improvement in investment efficiency. Maintaining or increasing ROIC above the cost of capital will be critical for continuing to create shareholder value and confirming Quanta Services' ability to effectively deploy invested capital.

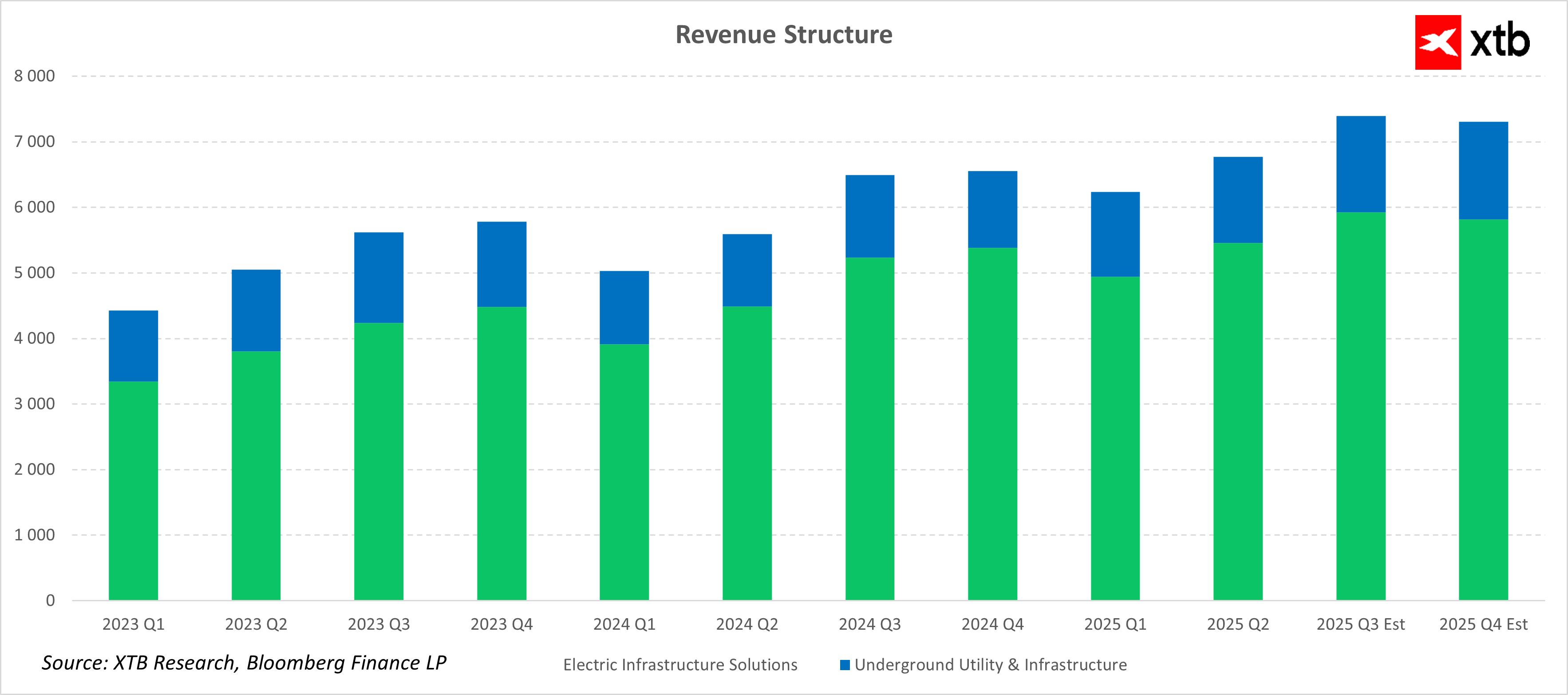

Quanta Services' revenue structure demonstrates a clear diversification of income sources, with the Electric Infrastructure Solutions segment dominating, accounting for an average of around 75% of total revenues. This is the company’s primary growth engine, showing consistent and dynamic development across successive quarters. The increasing demand for modern energy infrastructure, including electric grid development and investments in renewable energy, supports continued growth in this segment, whose revenues are expected to exceed $22 billion in 2025.

The Underground Utility & Infrastructure segment, while accounting for a smaller portion of total revenue, is also showing positive growth. This segment covers a broad range of work related to the construction and modernization of underground infrastructure, which is becoming increasingly important due to growing urbanization needs and the modernization of aging infrastructure networks. Forecasts suggest this segment will reach approximately $5.5 billion in revenue by 2025.

It is also worth emphasizing the company’s increasing involvement in data center infrastructure development, which represents a segment with enormous potential. The market value of this sector is expected to exceed $450 billion by 2034, which could become a key driver of future operational and financial growth.

The outlook for Quanta Services remains very optimistic. Investments in energy transition, the development of 5G infrastructure, modernization of power grids, and the digitization of public services are creating solid foundations for further growth. With its broad know-how, operational scale, and experience in executing complex projects, the company is well-positioned to capitalize on the upcoming infrastructure transformation trends—both in North America and across global markets.

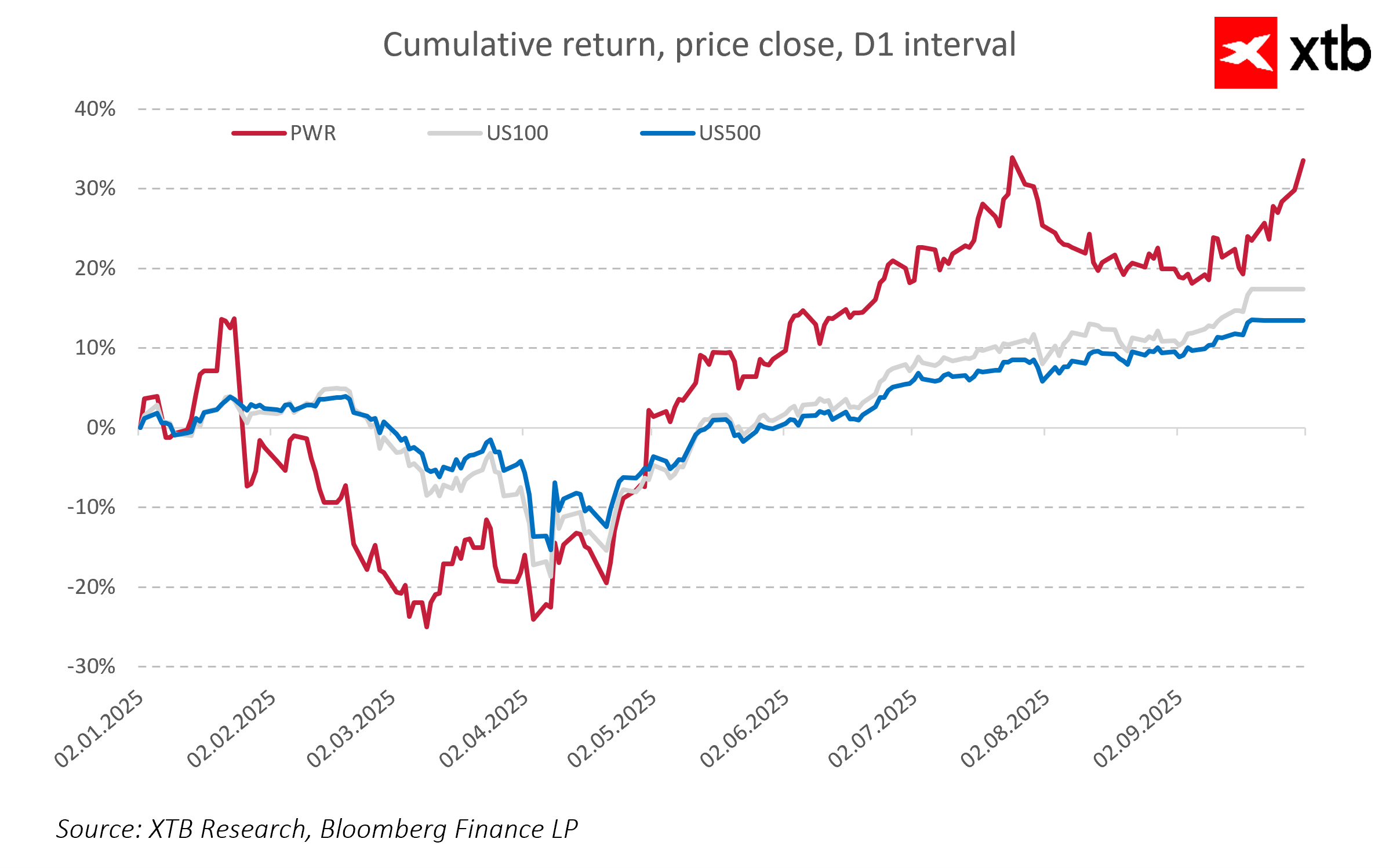

Compared to the broader market, Quanta Services stands out not only for its strong business fundamentals but also for its impressive stock performance. Since the beginning of 2025, the company’s stock has gained 33.42%, significantly outperforming major market indices such as the S&P 500 and Nasdaq 100. This is a clear signal that investors are responding positively to the company’s strong financial performance and recognizing its long-term growth potential.

The strong upward trend in the company’s share price reflects growing market confidence in Quanta Services' ability to effectively leverage key infrastructure megatrends, such as the energy transition, digitization, 5G development, and the rapid growth of the data center sector.

Revenue Forecast

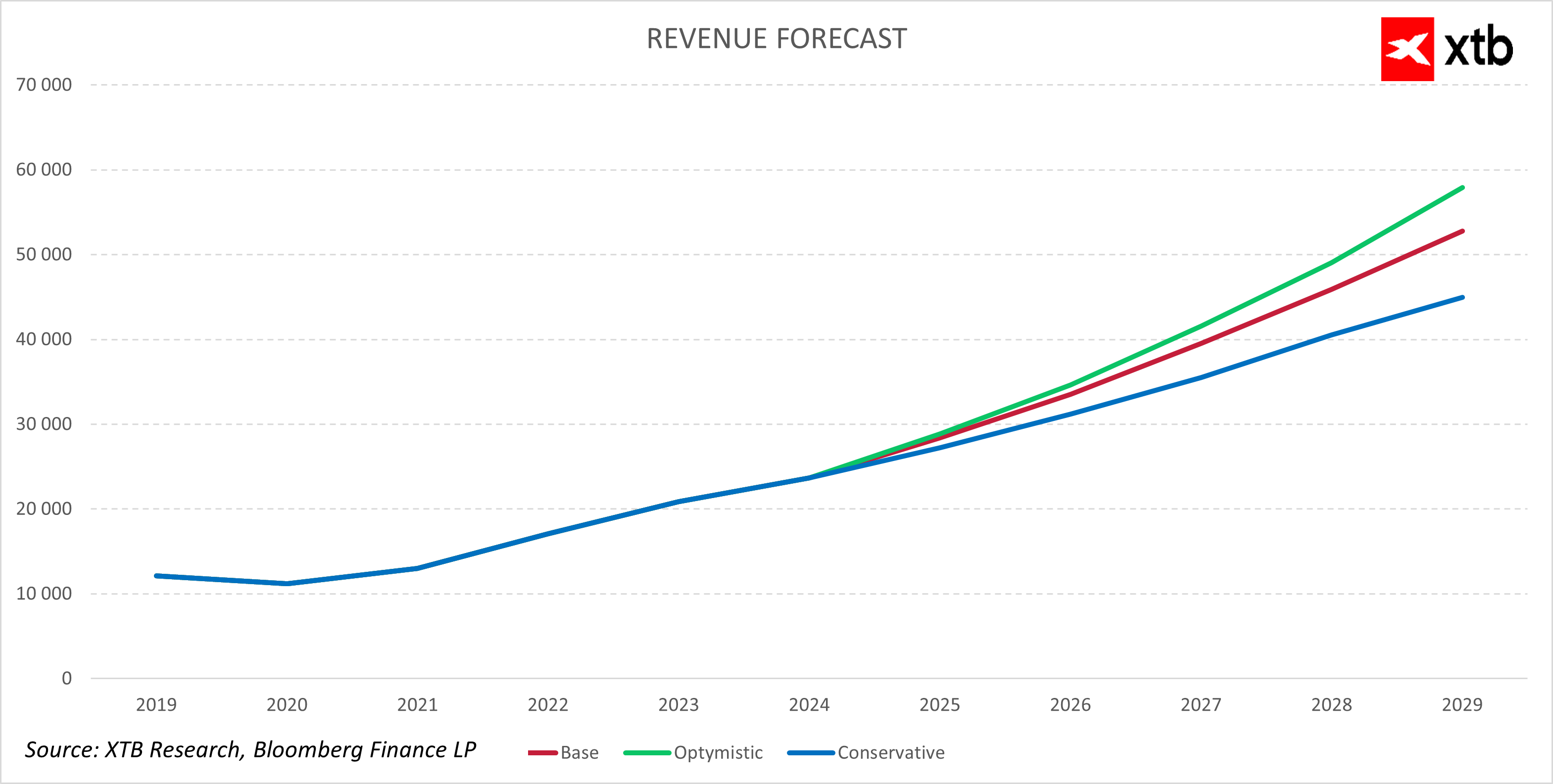

Quanta Services stands at the threshold of significant growth, driven by increasing demand for modern energy and digital infrastructure—including investments in electric grids, the expansion of 5G networks, and the development of data centers. Forecasts indicate stable revenue growth, though the pace may vary depending on market dynamics and the scale of ongoing infrastructure investments. Of particular importance are rising investments in the modernization of electric and underground networks, as well as the development of data center infrastructure, which is becoming an increasingly important part of the company's operations. At the same time, Quanta Services faces regulatory challenges, fluctuations in material costs, and competitive pressure, all of which impact financial stability and profitability. These factors shape a range of potential development scenarios for the company.

In the base-case scenario, Quanta Services' revenue grows steadily from approximately $23.7 billion in 2024 to over $52 billion by 2029. This growth is driven by sustained demand for infrastructure modernization and digitization services, supported by the expansion of 5G technology and increasing data center investments. In this scenario, the company maintains a healthy balance between revenue growth and operational efficiency.

In the optimistic scenario, Quanta Services experiences more dynamic growth, especially in the early years of the forecast period, with revenue increasing from $23.7 billion to over $57 billion by 2029. This scenario is fueled by an acceleration in energy transition investments, 5G network expansion, and rapid growth in data center infrastructure. This growth is accompanied by margin improvement, driven by enhanced project efficiency and a greater focus on high-value-added segments.

In the conservative scenario, revenue growth is more moderate, reaching around $45 billion by 2029. This projection assumes greater uncertainty tied to infrastructure market cyclicality, rising material and labor costs, and slower investment pace in key sectors. Competition and regulatory hurdles may further limit expansion. Despite these challenges, the company still achieves steady growth, though at a more cautious pace.

Valuation Outlook

Let’s take a look at Quanta Services Inc.’s valuation using the Discounted Cash Flow (DCF) method. Please note that this valuation is for informational purposes only and does not constitute investment advice or a precise stock valuation.

The company’s robust revenue growth is primarily driven by increasing infrastructure investments in North America—especially in data center development, a segment with tremendous potential, projected to surpass $450 billion in market value by 2034. The construction and modernization of power grids, the rollout of 5G technology, and the digitalization of public services further fuel demand for the company’s offerings.

In the initial years of the forecast, revenue growth accelerates significantly, reflecting the rising need for comprehensive infrastructure solutions to support expanding data centers and critical systems. As these investments evolve, Quanta also benefits from improved operational efficiency and the expansion of its service offering into higher-value-added technologies.

A natural slowdown in growth and increased competition are expected in the later years of the forecast, leading to a stabilization of the revenue growth rate. Nonetheless, a strong contract base, geographic diversification, and advanced technical capabilities allow Quanta Services to maintain high profitability and operational flexibility.

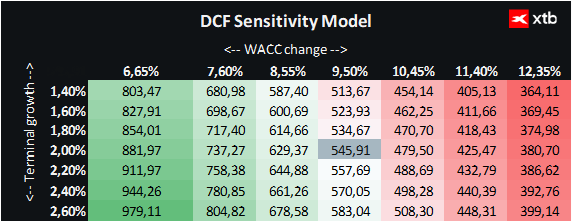

In the valuation model, we assume a constant weighted average cost of capital (WACC) of 9.5% throughout the forecast period, reflecting the infrastructure sector's characteristics and the company’s debt profile. The terminal value was estimated using a conservative growth rate of 2%.

Based on the DCF model, we estimate the theoretical value of Quanta Services’ stock at approximately $545.91, which, compared to the current market price of $420.53, indicates a potential upside of around 30%. This valuation reflects the company's attractive prospects, particularly in light of its pivotal role in the development of data center infrastructure and the broader infrastructure transformation trends in North America.

Chart Outlook

From a technical analysis perspective, Quanta Services’ stock is clearly trending upward, as confirmed by key indicators such as rising moving averages and positive momentum oscillator signals. Investor optimism is supported by favorable financial forecasts for the coming years, which point to improved performance and the growing importance of infrastructure transformation.

Stock market check in: defense stocks steal the limelight

NY Fed Survey: higher inflation expectations, but also higher equity price expectations 📄🔎

Micron Bets Billions on AI. Here’s What’s Driving the New Semiconductor Supercycle! 📈

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.