Summary:

-

US500 and US100 both make new record highs

-

US30 continues to be the laggard

-

Google drops after Trump tweet

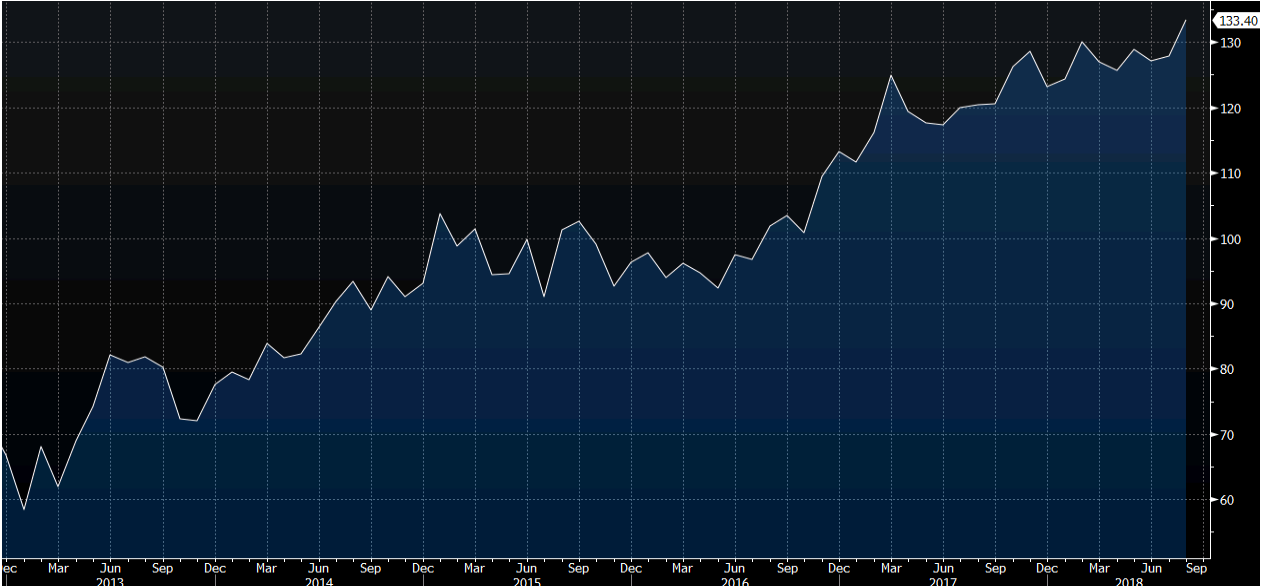

There’s been more gains seen for US indices in the first hour or so of the cash session with the US500 and US100 both making new all-time highs. Bouyed by some more solid data with the US August conference board consumer confidence coming in at its highest level since November 2000 (133.4 vs 126.6 expected) and with some tentative steps taken towards progress on trade the outlook remains seemingly favourable for equities at present.

Consumer confidence in the US continues to excel, with the conference board measure for August reaching its highest in many years. Source: Bloomberg

The US500 moved above the 2900 level to make a new record peak of 2905 and with the market remaining firmly above the breakout level of 2878 and sitting on 2 days of solid gains there appears little of concern for the bulls at present. Price would have to close on a daily time frame below 2878 before this breakout would be negated, and unless that happens then the path of least resistance appears to remain higher. The 8 and 21 EMAs remain in a positive orientation and from a purely technical perspective there’s little to go on for shorts with the inverted hammer last week proving a false dawn and in the absence of any further possible reversal signal price could be set for more gains.

The US500 has broken above its previous peak of 2878 and while price remains above this level then the breakout is valid and the path of least resistance could be seen to be higher. Source: xStation

It’s a similar picture for the US100, with the more tech focused index actually outperforming the US500. The US100 has shrugged off the damage done to Netflix and Facebook on their latest earnings updates, with the other FAANG stocks, Apple (120 points) and Amazon (63 points) accounting for roughly two-thirds of the broader index’s gains in the month of August. The peak from late January that has only just been recaptured for the US500 has been broken above on several occasions for the US100 with the latest advance possibly seen as the 4th rally that has taken out the prior peak. Note that while each of these impulses have broken higher they have not made an extended push, with the last 3 thrusts showing gains of a little over 100 points before falling back below the prior peak.

The US100 has taken out its prior peak on 4 occasions since the January high now. However, the past 3 breaks higher have only seen limited gains before falling back lower. Source: xStation

The last of the FAANG stocks that we haven’t mentioned yet is Google and while the US100 has made another push higher there has been some selling seen in the internet search engine giant. Trump tweeted earlier suggesting that he believed that Google searches for “Trump news” were improperly showing the results. While this isn’t major, in signalling out the firm he could well look to take further action and as we’ve seen before, Trump tweets can have negative implications for stock prices - especially if there’s the threat of further action against the firm.

Trump took aim at Google in an earlier message on social media. The stock has seen some mild selling off the open in reaction. Source: Twitter

Trump took aim at Google in an earlier message on social media. The stock has seen some mild selling off the open in reaction. Source: Twitter

Google shares have dipped a little lower today but they remain in a broader uptrend with price clearly above the 200 day SMA. The all-time high at 1291 is somewhere to look to above as possible resistance while the breakout level at 1190 has since acted as support on dips lower. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.