Summary:

-

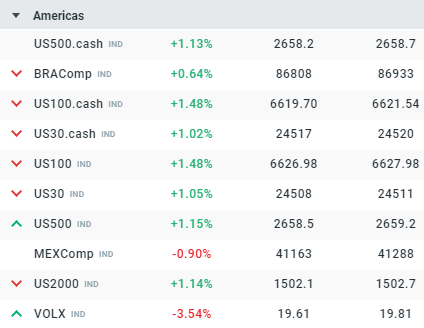

US indices set to open higher

-

US100 the biggest gainer and up by almost 1.5%

-

Price above the H1 Ichimoku cloud as short-term trend turns higher

Stock markets in Europe have begun the week on the front foot as they look to recover from some heavy recent declines. The US indices are also trading firmly higher ahead of the Wall St. open as traders return after a quiet end to last week due to the Thanksgiving holiday. Positive news on the geopolitical front can be attributed as a driver of the gains with the Italian budget tensions showing some signs of easing. The big event this week will be the G20 summit in Buenos Aires which begins on Friday and hopes of a thawing in the frosty relationship between Trump and Xi could well see further gains ahead.

US indices are firmly higher ahead of the cash open with the US100 (+1.5%) leading the charge and back above 6600. Source: xStation

US indices are firmly higher ahead of the cash open with the US100 (+1.5%) leading the charge and back above 6600. Source: xStation

The best performing US index at the time of writing is the US100, which has rallied up near last Tuesday’s high in recent trade. The high of the day at 6654 could now be seen as potential resistance but if longs can push up above it then there’s scope for further gains into the 6755 region. Price has got back above the Ichimoku cloud on H1 following these gains and this could be seen as a sign that the short term trent has turned higher.

The US100 is now back above the cloud on H1 and the trend in the near-term may now be seen to have turned higher as long as the market remains above it (currently 6550-6580). Source: xStation

Like all technical indicators the H1 cloud isn’t right 100% of the time and the last move above it only resulted in a rally of around 100 points (as measured from the top of the cloud). However, the previous 2 occasions saw larger gains in excess of 310 and 220 points respectively and if this move gains traction this afternoon and takes out the highs of 6654 then a comparable move may occur. It is also worth pointing out that these rallies have been counter tren from a longer term perspective with the market dropping lower overall. This has meant that selling breaks to the downside would have worked better and if a trader remains bearish on this market then a move back below the cloud (6550-6580) could provide an entry opportunity.

Two of the last three moves above the cloud have led to sustained rallies and if price can get above daily highs at 6654 then another sizable move higher could ensue. Source: xStation

Two of the last three moves above the cloud have led to sustained rallies and if price can get above daily highs at 6654 then another sizable move higher could ensue. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.