Summary:

-

Equities across Asian countries increase

-

Italy’s populist government sets the budget deficit at 2.4% of GDP adding ‘it has yet to be set in stone’

-

Japanese data mixed with higher Tokyo inflation and retail sales and weaker industrial output

The last trading day this quarter has brought widespread gains across Asian equity markets with the Japanese NIKKEI (JAP225) outperforming its peers and gaining over 1.3% a bit more than 30 minutes before the market close. The main reason behind the NIKKEI’s outperformance seems to the weak yen being traded 0.15% lower against the dollar at the time of writing. Stocks in China have been on the rise as well with gains ranging from 0.8% to almost 1%. The stock market in Australia ended the last session this week with a rise of 0.7%. On the currency front we did not get too much to be excited about. In the morning the JPY and the NZD are the weakest currencies in the G10 basket with the latter falling despite a rebound in building permits for August - they jumped 7.8% on a monthly basis recovering a 10.8% slump seen in the prior month. As far as EM currencies are concerned, the South African rand, the Turkish lira and the Polish zloty are all higher against the dollar in early European trading but gains are not particularly meaningful. The euro is moving marginally higher at the same time after a steady slide it saw over the part hours in response to a deal reached in Italy over a budget for the next year.

Italy had the second largest public debt in Europe last year. Source: BBC

The populist government (Fiver Star and the League) informed yesterday evening it had agreed to set the budget deficit at 2.4% of GDP for 2019 thereby playing down Brussels’ guidelines. “The first reaction from the European Union was negative. The 2.4% puts Italy in breach of its obligations,” said an EU official from Brussels cited by Bloomberg. He also added that “the government in Rome had signaled it would push for a deficit of 1.9 percent” The lower deficit has been also the prime goal for Economy Minister Giovanni Tria who have repeatedly threatened to step down if the next year budget does not meet his goals. Having said that, it looks that he is unlikely to resign. According to a report by Repubblica Tria will stay on as finance minister to avoid ‘chaos’. Notice that the deficit exceeding 2% of GDP has been considered as too high as it can make it harder for Italy to fulfill demands of the European Union. What are the main proposals included in the new budget deal? The populist government wants to guarantee basic income for poor families of about 780 EUR a month (a projected cost of 17 billion EUR), to lower taxes to rates between 15% and 20% from 23% and 43% (a projected cost up to 50 billion EUR, and to abolish plans to raise retirement age over several years as well as to set minimum pensions. Let us notice that a League official said that the budget numbers are ‘not set in stone’ hence we may be offered some changes ahead. Even as the 2.4% deficit appears to be in accordance with the limit deficit of 3% set by the European authorities, it is just the maximum level and given fiscal conditions Italy stands right now the country was supposed to come up with the deficit not exceeding 2%. Let us notice that Italy had the second largest public debt in 2017. From a financial markets’ point of view one may expect the Italian bond market to open lower and with the numbers look not ‘locked in’ yet one needs to be prepared for heightened volatility until the things are sorted out altogether.

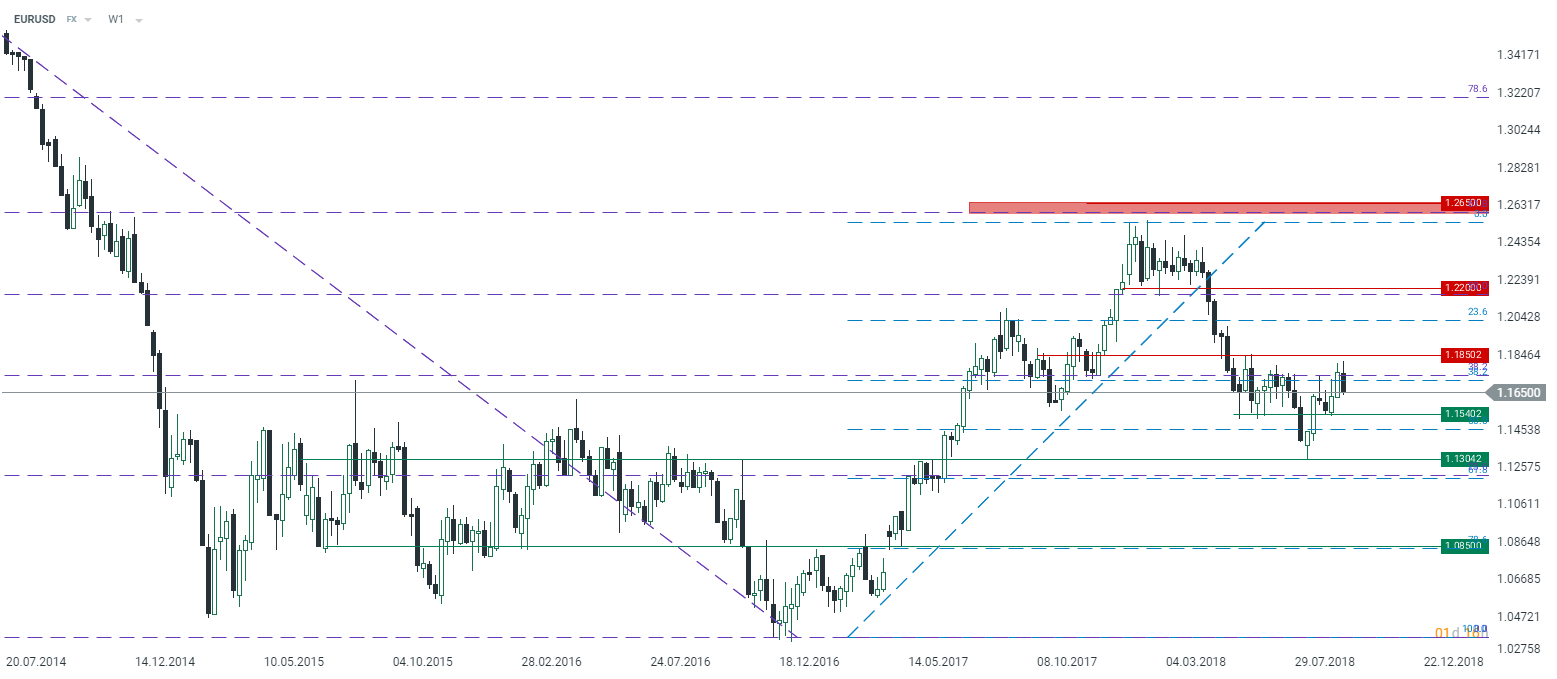

Technically the EURUSD could be heading lower toward 1.1540 where a notable technical support could be localized. With the widening risk premium one may expect the euro could remain under pressure in the near time. Source: xStation5

Technically the EURUSD could be heading lower toward 1.1540 where a notable technical support could be localized. With the widening risk premium one may expect the euro could remain under pressure in the near time. Source: xStation5

Beside the Italian thread it is worth mentioning some data from the Japanese economy. First of all, Tokyo inflation for September came in at 1.3 YoY beating the median estimate of 1.1% YoY. Moreover, headline inflation (stipping out food and energy) also beat the consensus showing a 0.7% YoY increase compared to a 0.6% pick-up. The jobless rate moved down to 2.4% in August from 2.5% while the job-to-application ratio stayed unchanged at 1.63. Retail sales for August came above expectations producing a 2% YoY rise compared to a 1.5% rise expected. The sole disappointment came from industrial production where we we offered an increase of 0.6% YoY missing the median estimate of 1.5%. The net effect for the yen was negative which helped buttress the Japan’s stock market.

The NIKKEI is flirting with its all-time high of around 24150 points being shored up by the rising USDJPY. However, given the wild pace of the latest bullish swing one needs to be aware that some corrective moves could arise before long. Source: xStation5

The NIKKEI is flirting with its all-time high of around 24150 points being shored up by the rising USDJPY. However, given the wild pace of the latest bullish swing one needs to be aware that some corrective moves could arise before long. Source: xStation5

In the other news:

-

The US 10Y bond remains in demand with the yield moving slightly above 3.04%, note that US pension funds could create the additional demand making some changes their allocation as the quarter comes to an end

-

Fed’s Powell admits asset prices are high and equity prices are at the historical levels

-

BoC’s Poloz reiterates the central bank will continue to rise rates gradually to a more neutral level

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.