US100 extends losses by another 2%, dipping below 25,000 for the first time since December 2025.

The tech sector is currently facing a sharp decline, primarily driven by a "buy everything" fatigue as the market transitions into a phase where not every artificial intelligence player is guaranteed to win. This sector-wide pressure was intensified by underwhelming first-quarter forecasts from Advanced Micro Devices (AMD), which saw its shares plunge 16%.

The weakness extended across the semiconductor and software landscapes, with Micron Technology falling 9%, Broadcom shedding 5%, and Oracle dropping 4%. Even leading infrastructure names like Nvidia and CrowdStrike have faced recent selling pressure. While Microsoft found some stability, the broader tech sector remains the S&P 500’s worst performer, down over 2% as investors await pivotal earnings from Alphabet and Amazon to determine the next trend.

Jobs data also weighs on the overall sentiment. The private payrolls rose only by 22,000 according to the newest ADP report, missing by a huge margin the expected 45,000. Moreover, the reading would be negative if it wasn’t for a surge in hiring in education and health services, with the previous month's downward revision further contributing to the shaky labour market outlook.

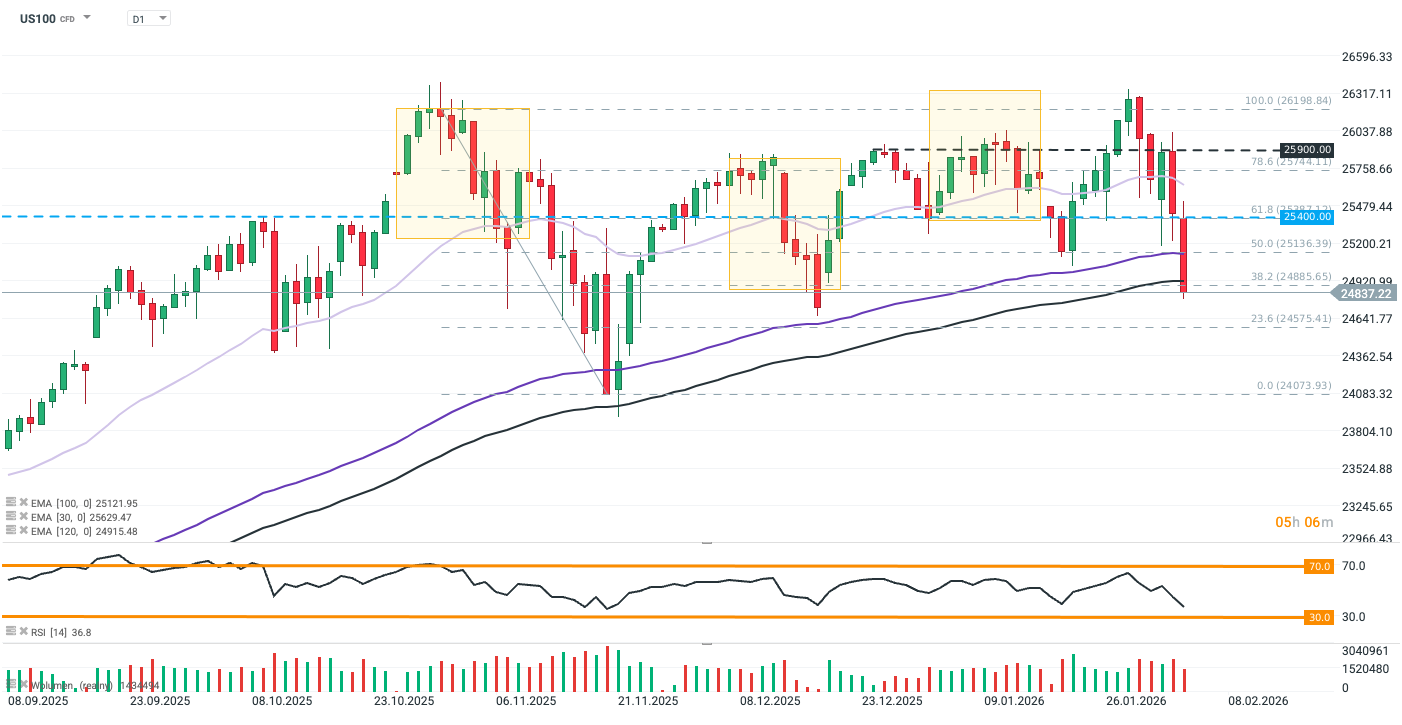

US100 (D1)

The US100 has entered a deeper corrective phase, suffering a sharp 2.3% drop. The index has decisively broken below the 50% Fibonacci retracement (25,136), which acted as support earlier in the day. Current price action is testing the 38.2% Fibonacci level (~24,885) and the long-term 120-period EMA (dark purple line), which now serves as a critical line in the sand for bulls.

A failure to hold 24,800 would likely trigger a slide toward the 23.6% Fibo (24,575) or even the psychological floor at 24,000. Recovery hinges on reclaiming the 25,130 level (100-day EMA). A failure to do so could confirm this breakdown as a structural trend change.

Source: xStation5

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?

Nvidia’s report blows past expectations on Blackwell 📈 Will the AI boom last?

Nvidia delivers another monster earnings report, and forecasts big things to come

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.