- Despite beating expectations and raising its full-year earnings guidance, shares dropped more than 5%, signaling heightened investor expectations.

- Management signals risks related to the federal budget and government contracts, while uneven segment growth dampens market optimism.

- Despite beating expectations and raising its full-year earnings guidance, shares dropped more than 5%, signaling heightened investor expectations.

- Management signals risks related to the federal budget and government contracts, while uneven segment growth dampens market optimism.

Teledyne Technologies Reports Strong Results, but Market Reaction Is Negative. What’s Behind the Stock Price Drop?

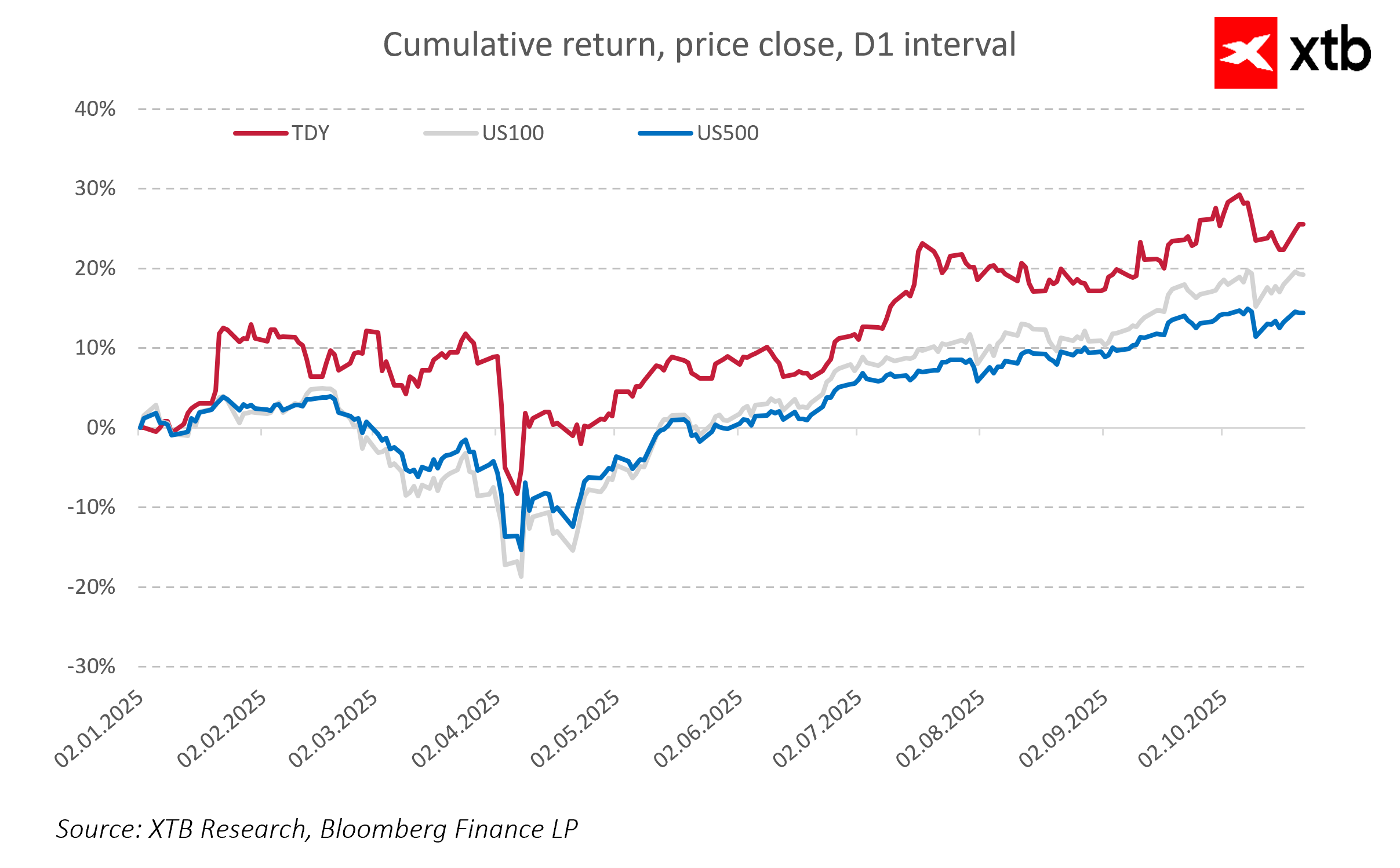

Teledyne Technologies, an advanced technology company operating in electronic systems, satellite imaging, precision sensors, and software, released its financial results for the third quarter of 2025. The company serves key sectors including aerospace, defense, science, industrial, and energy. Its business is largely based on long-term government contracts, primarily in the United States. Despite exceeding analyst expectations and raising its full-year outlook, the stock price fell by more than five percent. This suggests that market expectations were higher both in terms of growth pace and the tone of the management’s communication.

Q3 2025 Financial Highlights

-

Revenue: $1,539.5 million (up 6.7% year-over-year), above consensus (~$1,530 million)

-

Adjusted EPS (non-GAAP): $5.57 (up 9.2% year-over-year), beating expectations ($5.47)

-

GAAP Net Income: $218.8 million versus $260.9 million a year earlier (down 16%)

-

GAAP EPS: $4.65 versus $5.54 a year earlier

-

Free Cash Flow: $313.9 million (versus $220.4 million in Q3 2024)

-

Raised full-year EPS guidance: $21.45–$21.60 (previously $21.10–$21.50)

Although operating results were strong, investors responded with a stock price decline. This indicates that expectations for the company were even more optimistic. One factor potentially contributing to this reaction is the significant difference between GAAP net income and the adjusted non-GAAP result. While such adjustments are common in the technology sector, the magnitude of the gap may raise concerns about the quality of earnings.

Source: xStation

Despite revenue growth, the operating margin declined slightly, possibly due to rising costs or significant investments that temporarily reduce profitability. Segment analysis reveals uneven growth across the business. The Aerospace & Defense Electronics segment posted an impressive increase of over 37 percent, while Digital Imaging, the largest segment, grew by only 2.2 percent and saw a decline in operating profit. The Engineered Systems segment also experienced a revenue decline.

Additionally, the management highlighted key risks related to the strained U.S. budget situation, including the possibility of a federal government shutdown. This could impact the pace of new contract signings and the delivery of existing orders, which is a significant risk for a company heavily reliant on government spending.

The market’s reaction also reflects broader macroeconomic and geopolitical factors, where defense and advanced technology companies are vulnerable to changes in budget policies, interest rates, currency fluctuations, trade policies, and export regulations. In times of uncertainty, even solid financial results may not suffice to maintain positive investor sentiment, especially if the stock price already reflects optimistic forecasts.

Outlook and Challenges Ahead

Fundamentally, Teledyne remains a company with strong foundations, generating stable cash flow and well positioned in key strategic sectors. At the same time, current results show uneven growth rates, with some segments needing improvement in profitability and development pace. Cautious management communication combined with macroeconomic factors may limit short-term stock price growth potential.

For long-term investors, Teledyne could still be an attractive option, particularly if the company can improve results in less dynamic segments and maintain stable government contracts in upcoming quarters. Meanwhile, the market will closely watch the company’s ability to sustain margins and accelerate growth outside the defense segment.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.