The production slowdown at the Shanghai plant which started this month will be extended, according to Tesla's (TSLA.US) planning document, even despite the fact that the Chinese government is easing covid related restrictions. Shares fell over 3.0% in pre-market on the news. Production will last for 17 days next month between 3 to 19 January and will halt in the period from 20 to 31 January for an extended break for Chinese New Year, according to Reuters. The reason behind production cut was not specified and it is unclear whether work would continue outside the assembly lines for the Model 3 and Model Y at the plant during the scheduled downtime.

Similar to its competitors, Tesla also recorded a drop of demand in China, the world’s largest auto market. In order to attract customers, the company ditched its "non-discount" policy and lowered prices for Model 3 and Model Y vehicles by up to 9% in China and offered a subsidy for insurance costs for clients who bought cars this month.

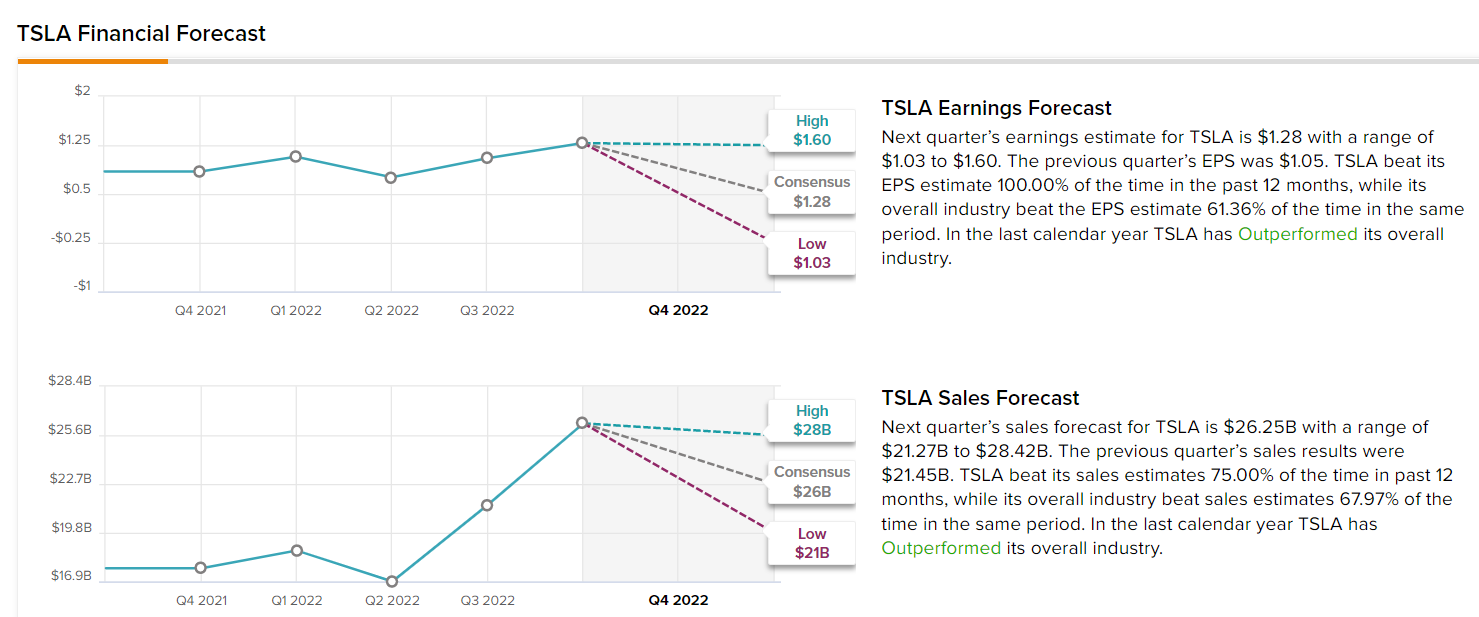

Tesla has set a target for growth of 50% in output and electric vehicle deliveries in 2022. Based on the current Q4 forecasts analysts consensus estimates that output will reach approximately 45%. Nevertheless analysts still expect much stronger earnings and sales figures in the final quarter of 2022 compared to last year.

Company is expected to report solid figures for the soon-to-end fourth quarter. It is worth remembering that nearly every automaker failed to beat its sales targets from the year before, while Tesla, despite a terrible year, still remains quite dominant in its field. Source: Tip Ranks

Company is expected to report solid figures for the soon-to-end fourth quarter. It is worth remembering that nearly every automaker failed to beat its sales targets from the year before, while Tesla, despite a terrible year, still remains quite dominant in its field. Source: Tip Ranks

Despite recession fears, rising rates and concerns over Musk's leadership, Tesla investor and Future Fund manager Gary Black remains a believer and continues to own it, as does ARK Invest's Cathie Wood, who has been buying the dip in recent months. On the other hand, Oppenheimer recently downgraded Tesla to Perform, without price target saying, "We believe increasing negative sentiment on Twitter could linger long term, limiting its financial performance and become an ongoing overhang on TSLA."

“While we continue to see Tesla evolving EV and autonomous technology in advance of peers and driving costs to levels those peers will struggle to match—and have tried to separate Elon Musk’s non-Tesla endeavors (personal and professional) from our analysis on TSLA—we believe Mr. Musk’s acquisition and subsequent management of Twitter now make that separation untenable,” wrote Oppenheimer’s analyst Colin Rusch

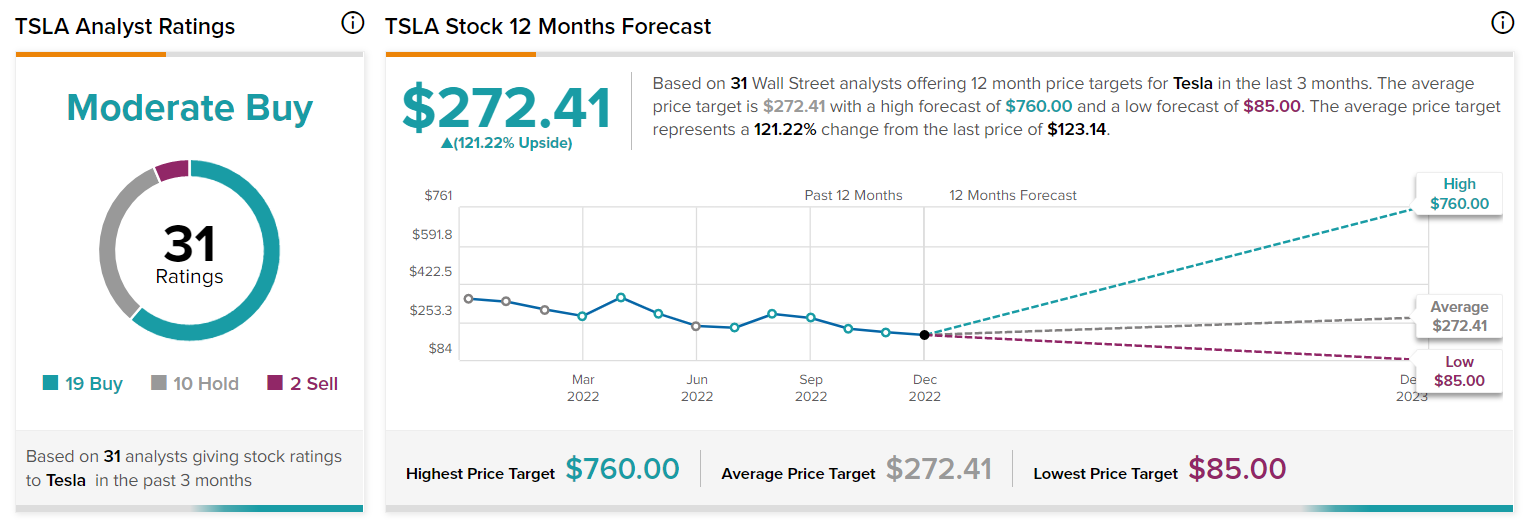

Despite negative sentiment Tesla stock still has a "Moderate Buy" rating based on 31 analysts opinions, with a price target of $272.41, which represents over 127% upward potential from current price levels. Source: Tip Ranks

Despite negative sentiment Tesla stock still has a "Moderate Buy" rating based on 31 analysts opinions, with a price target of $272.41, which represents over 127% upward potential from current price levels. Source: Tip Ranks

Tesla (TSLA.US) stock plunged over 35% this month and nearly 70.0% on a yearly basis. Company is among the S&P 500's biggest losers this year, and erased the majority of its impressive post pandemic gains. Before the opening bell stock fell over 3.0% and if current sentiment prevails, support at $108.00 may be at risk. This level coincides with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Should break lower occur, price may deepen declines towards psychological support at $100.00 or even February 2020 highs at $67.00. It seems that only a return above the earlier broken lower limit of the wedge formation, would indicate some bullish potential. Source: xStation5

Tesla (TSLA.US) stock plunged over 35% this month and nearly 70.0% on a yearly basis. Company is among the S&P 500's biggest losers this year, and erased the majority of its impressive post pandemic gains. Before the opening bell stock fell over 3.0% and if current sentiment prevails, support at $108.00 may be at risk. This level coincides with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Should break lower occur, price may deepen declines towards psychological support at $100.00 or even February 2020 highs at $67.00. It seems that only a return above the earlier broken lower limit of the wedge formation, would indicate some bullish potential. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.