The US dollar started September in a significantly weaker position against most global currencies, despite Wall Street remaining closed today due to the Labor Day holiday. In the morning, we observed increased volatility in dollar-related pairs, particularly in EURUSD, which is currently at its highest level in a month and is up 0.35%.

The European currency is supported by positive macroeconomic data from Europe and expectations of limited interest rate cuts by the ECB. The weakness of the dollar stems from growing expectations of faster interest rate cuts by the Fed in the face of deteriorating labor market data and Powell's dovish speech in Jackson Hole. The market is currently pricing in an 88-90% chance of a 0.25 bps cut at the next FOMC meeting. In addition, regulatory uncertainty related to court rulings on Trump's tariffs, as well as disputes over the Fed's independence, are putting additional pressure on the dollar.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

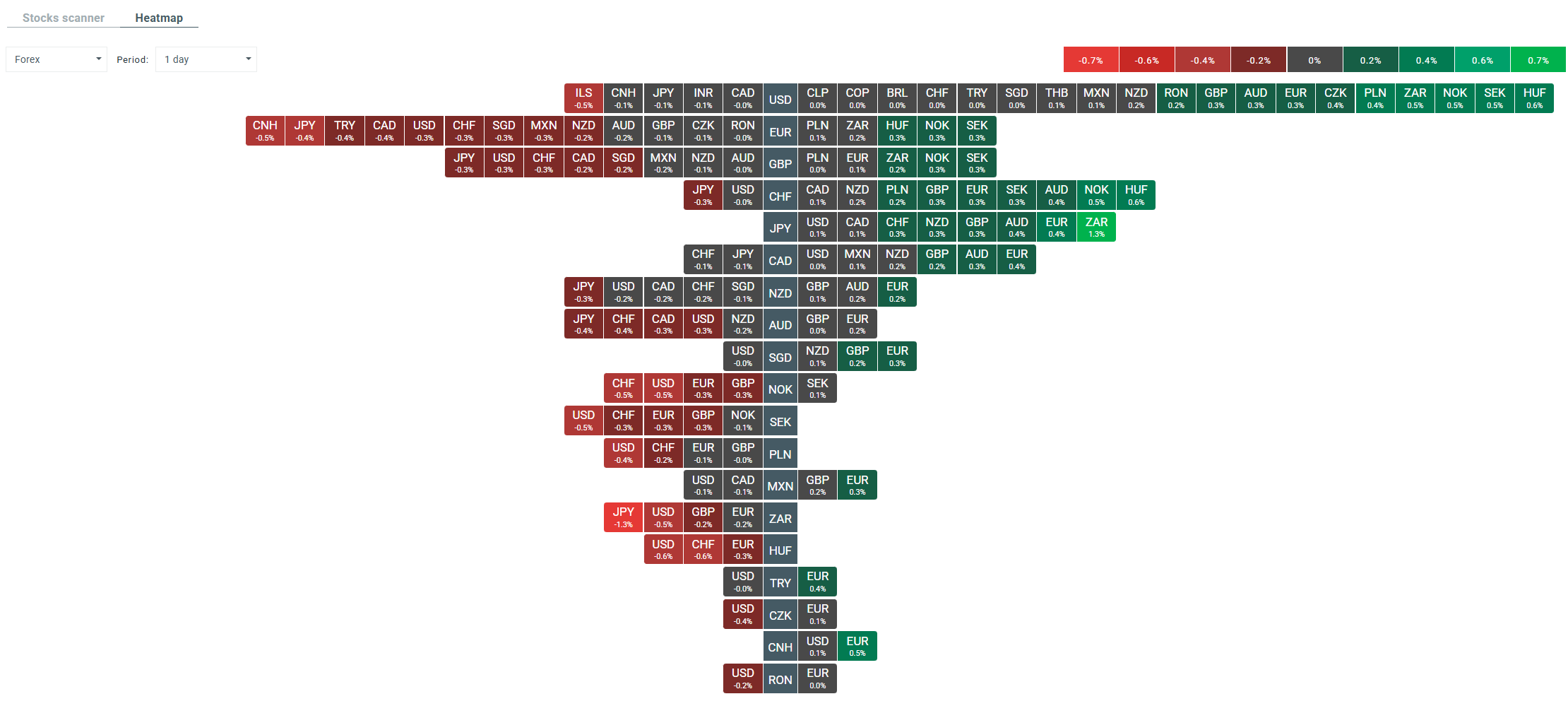

The US dollar is currently one of the worst performing currencies in the world right now. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.