The season of releasing the financial results of major banks and other key financial institutions for Q4 2021 has just begun. Today we learned the results of giants such as JP Morgan (JPM.US), Citigroup (C.US) and Wells Fargo (WFC.US). Investors also got to know the results of the BlackRock (BLK.US). Leaders of the financial sector did not disappoint and reported better than expected quarterly results, which are as follows:

JP Morgan (JPM.US)

Revenue - $30.35 billion (expected - $ 29.9 billion)

Net profit - $10.14 billion (previously - $ 12.14 billion)

EPS - $3.33 (expected - $ 3.79)

The results published by the bank disappointed investors, who decided to sell some of their positions. Currently, the bank's shares are losing about 4.3% before the opening of the session. Source: xStation 5

Wells Fargo (WFC.US)

Revenue - $20.86 billion (expected $18.85 billion)

EPS - $1.38 (expected - $1.02)

The bank reported much better results than analysts' consensus expectations. Investors are buying the company's shares, which are appreciating by about 2% before the stock market opens. Source: xStation 5

Citigroup (C.US)

Revenue - $17.02 billion (expected - $16.80 billion)

EPS - $1.99 (expected - $1.62)

The bank's shares lost about 3.5% before the opening of the US session.Source: xStation 5

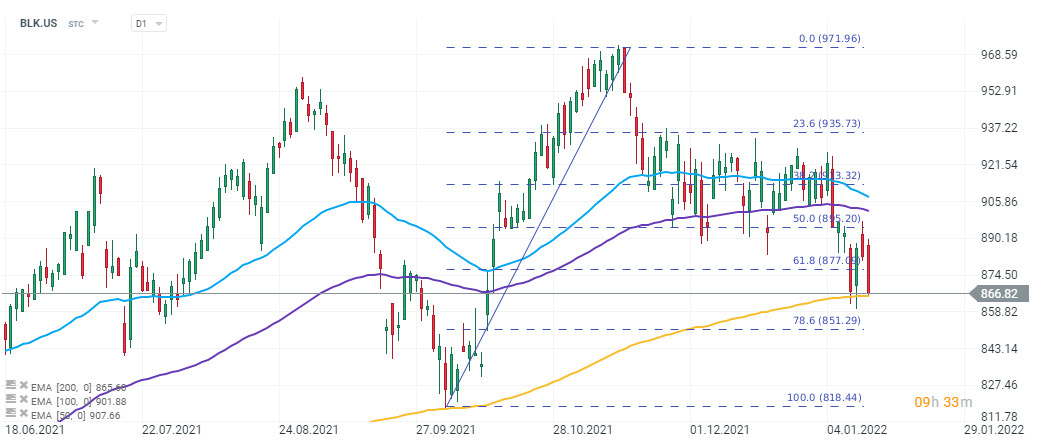

BlackRock (BLK.US)

Revenue - $5.11 billion (expected - $5.16 billion)

EPS - $10.42 (expected - $10.15)

Assets under management -$10.1 trillion (expected - $9.85 trillion)

The stock loses about 1.7% before the session on Wall Street. Source: xStation 5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Navigating Middle East uncertainty and tariff risks

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.