The year 2021 was a very bumpy and volatile one for the cryptocurrency market as a whole. Although Bitcoin has risen nearly 70% over the course of the year (a result that, by its scale, doesn't surprise like it used to), investors have also experienced sizable declines that continue to create mixed feelings. In today's laid-back post, we'll give you some interesting On-Chain facts that may illustrate today's situation for the Bitcoin.

Annual Bitcoin price chart and range of major corrections. Source: Bloomberg

Accumulation of long-term addresses

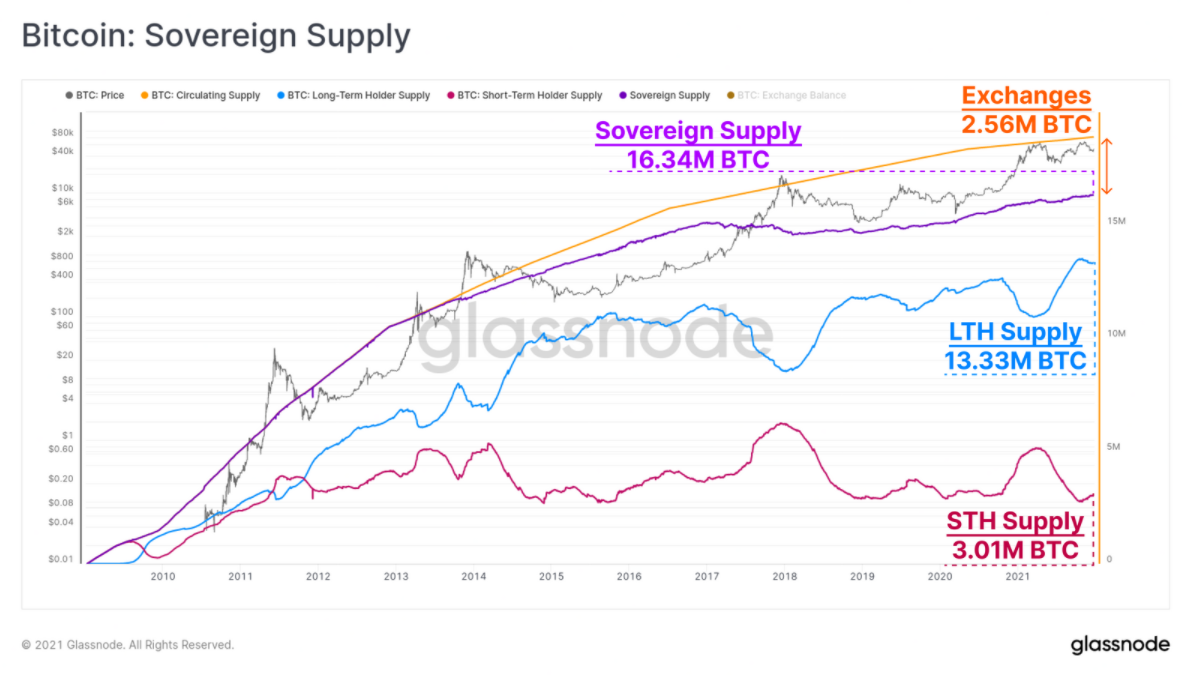

Long-term Bitcoin holders added 1.846 million BTC to their holdings, bringing their total ownership to 13.33 million BTC. This represents a 16% increase over the year. Short-term address supply decreased by 1.428 million BTC and this group now holds 3.01 million BTC. This reflects a decrease of 32% over the year. This data demonstrates the bullish attitude of long-term investors and the buying of Bitcoin from short-term addresses that agree to sell the cryptocurrency at a loss (the total supply of BTC at a loss is now 3.48 million units, or 18.34% of all coins in circulation). The amount of Bitcoin outside of exchange addresses is currently at an all-time high of 13.34 million BTC. The record amount of Bitcoin outside exchanges may indicate that some large holders are not willing to sell the cryptocurrency at current prices and are holding the assets in external wallets.

Fear for new investors and peace of mind for long-term holders. Source: Glassnode

Overleveraging in the market continues

The chart below shows how overleveraging in the Bitcoin market has increased over the past year. This carries the risk of very dynamic downward or upward price movements through the liquidation of stop-losses and mass closing of long or short positions by investors when important information is published that may affect the valuation of the cryptocurrency market.

Overleveraging in the markets has increased over the course of 2021. Overleveraging in the markets has increased by more than 50% through 2021. The chart shows the ratio of open futures contracts to total Bitcoin reserves on exchanges. Source: CryptoQuant

What can investors expect in the current cycle?

Throughout 2021, we haven't seen the euphoria phase that has ended every bull market cycle for Bitcoin so far. Some investors believe that Bitcoin has 'matured' as an asset and that previous dynamic rallies were the result of a smaller market and few institutions able to influence the price of the cryptocurrency.

Other investors believe that the bull market is not over yet and that the phase of the greatest euphoria must come for the cycle to be completed, which could be triggered by such events as the approval by the US SEC of an ETF buying Bitcoin from the market at a spot price. However, with each passing day Bitcoin moves further away from the last halving in 2020 and the number of days since halving so far has been one of the clues to the phase of the 'king of cryptocurrencies' cycle.

Both sides may be wrong, however, as Bitcoin is now an asset bought by large institutions and investment funds, which means that discounts of 80% or even 90% as in previous cycles may no longer occur and blockchain technology is finding more and more practical applications in modern finance. On the other hand, the current capitalization of Bitcoin and institutional capital may 'prevent' the cryptocurrency from spectacular, rapid increases which took place in previous cycles.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.