This has been a busy week for financial markets. Central bank speak, geopolitical issues, economic data and earnings reports have all rocked markets, and the vast majority of indices in the US, Europe and Asia are set for another weekly loss. The FTSE 100 is bucking this trend, but as we mentioned, when FTSE 100 returns are currency adjusted, it is posting a small decline on the week due to dollar strength.

Below we take a look at three charts that should help to explain what markets are doing and why.

1, Large caps still dominate

If you thought that the performance in US stock markets was getting broader based, think again. The S&P 500 has seen 35 firms make fresh 4-week lows in recent days, and only 1 company make a fresh 4-week high. This does not suggest that the performance of the S&P 500 is broadening out. Added to this, although the S&P 500 is set to post earnings growth of 7% YoY for Q1, analysts have cut their estimates for earnings for 7 of the 11 sectors within the S&P 500, including materials and energy. Communications services, which includes Meta, and the tech sector have seen their earnings forecasts revised higher. This suggests that tech could lead the way yet again in this earnings season, which could make these stocks more attractive as we move through Q2.

The chart below the S&P 500 and the equal weighted S&P 500, which strips out the effect of the tech giants that dominate the US blue chip index. As you can see, the S&P 500 has outperformed the equal weighted index during this recent period of turmoil, which suggests that investors continue to favour larger companies, including tech firms.

Chart 1:

Source: XTB and Bloomberg

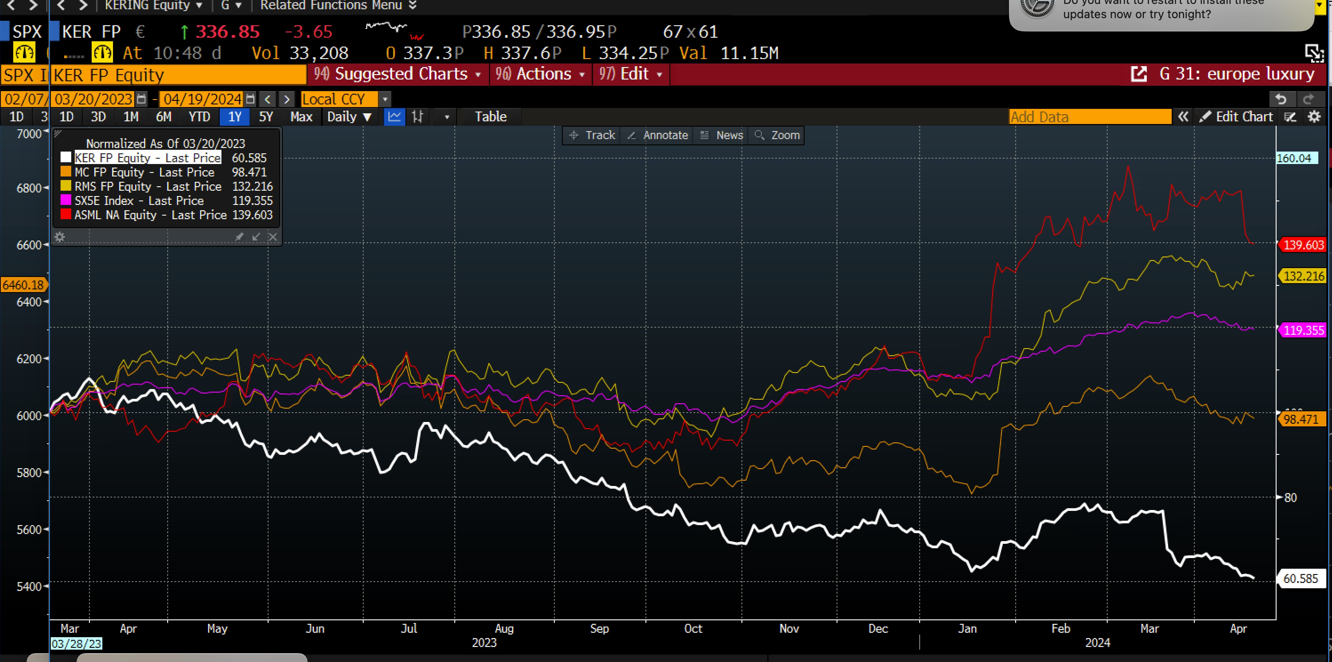

2, European stocks see key sectors struggle

The chart below shows Europe’s luxury houses, along with semiconductor chip maker ASML and the overall Eurostoxx 50 index. This chart has been normalized to show how they move together over a year. As you can see, the luxury sector is struggling, with LVMH and Kerring the weakest performers, and underperforming the overall Eurostoxx 50 index in recent months. LVMH has been hit by concerns about Chinese demand, and it reported like for like sales in Asia that were 6% lower than last year. ASML, the Dutch chip equipment maker, also nose dived this week, after reporting a weaker forecast for Q2 orders.

Interestingly, analysts are revising their expectations for European earnings for this year, which could be positive for stock prices. However, to counter this, luxury and tech are important sectors for Europe. If they continue to under perform then it could make it harder for the overall European indices to stage a recovery in the near term.

Chart 2:

Source: XTB and Bloomberg

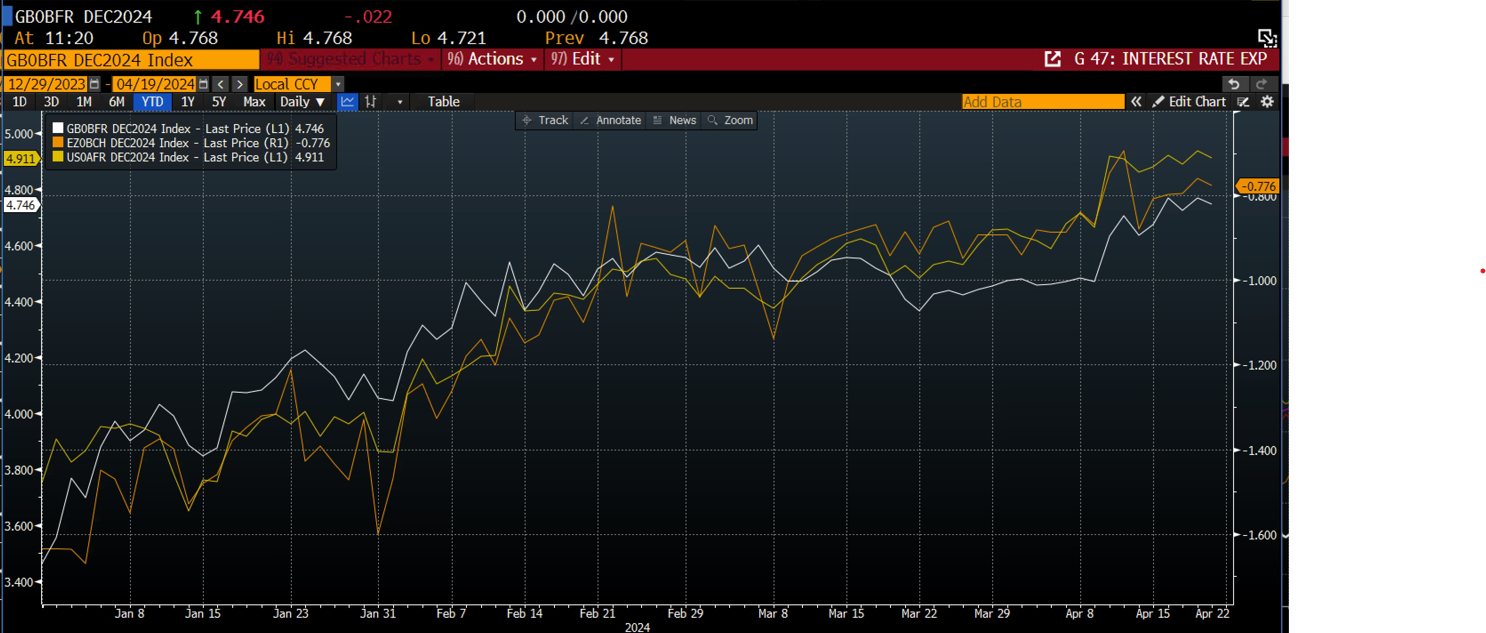

3, Diverging interest rate expectations

The market is recalibrating its expectations for interest rate cuts. At present, the market expects the BOE to cut rates twice this year, the ECB is expected to cut rates just over three times, while the Fed is only scheduled to make one cut, with a roughly even chance of a second cut. The chart below shows where the market expects interest rates to end this year for the ECB, BOE and the Fed. As you can see, they are all still moving in the same direction, but there is a slight variation in the magnitude of cuts.

The risk is that the ECB and the BOE may not feel comfortable fully diverging from the Fed. While making one cut without the Fed following should be ok, a prolonged cutting cycle if the Fed is holding rates or even raising them is unlikely. ECB member Robert Holzmann has put this down to persistent inflation in the US that could become visible in other parts of the world down the line. There is another reason why the ECB and the BOE may not diverge too far from the Fed: easing policy when the Fed is not following suit risks driving the euro and the pound lower vs. the dollar, which can lead to imported inflation, and it can hurt economic growth. Thus, while there has been a lot of chat about interest rate divergence, we think that ECB and BOE officials could scale back rate cut expectations in the coming weeks, if the Fed looks like they are more likely to keep rates on hold for the rest of this year. If this happens, then it could add to the market volatility.

Chart 3:

Source: XTB and Bloomberg

Politics batter the UK bond market once more, as Starmer remains under pressure

The Week Ahead

Market update: recovery takes hold, but investors remain on edge

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.