Summary:

-

EURUSD amid tomorrow’s FOMC decision

-

Silver trades near the upper bound of the consolidation range

-

Strong JPY may turn to be a hurdle for Nikkei (JAP225) rebound

Undoubtedly, tomorrow’s FOMC interest rate decision is the market event of the week. Fourth US rate hike looks like a done deal but markets will be mostly focus on Fed’s projections for 2019. Volatility spurred by this event may result in EURUSD breaking out from the 1.13-1.143 consolidation range. The break above the upper limit could result in an extended upward movement. This is especially true as the pair found itself under pressure during the major part of 2018 and concerns surrounding Italian budget began to fade. Decision and statement will be released tomorrow at 7:00 pm GMT. Jerome Powell’s press conference will begin half an hour later.

Source: xStation5

Source: xStation5

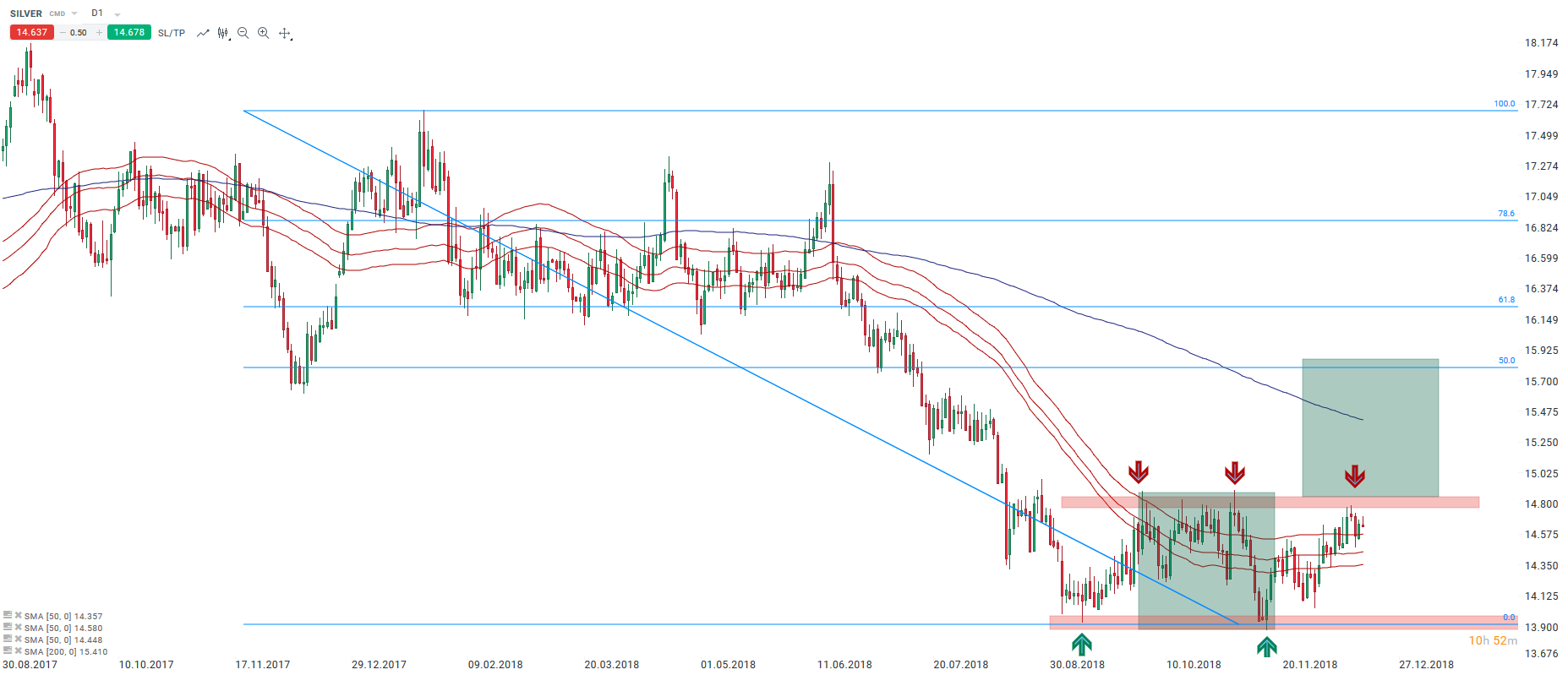

Another interesting market that may draw attention in the nearby future is silver. Despite rebound on the gold market and increased uncertainty on the global financial markets this precious metal keeps trading within a consolidation range. Potential weakening of the USD in the weeks to come could serve as a trigger for extending gains on gold and break higher on silver. Textbook range of the break higher from the current consolidation range can be found at $15.8, what is more or less in line with the 50% retracement level of this year’s downward move. Moreover, every subsequent test of the $14.8 handle increases the likelihood of a break higher. According to the weekly CFTC data net speculative positioning on silver is still negative but investors began to increase long positions.

Source: xStation5

Source: xStation5

Risk aversion that is present currently on the markets supports capital flow to safe haven assets. Among these assets one can find precious metals, the Swiss franc or the Japanese yen. Strengthening of the JPY is one of the risk factors for the Japanese stock market. Stronger currency hits profits of domestic exporters and companies of this type constitute a majority of Nikkei index (JAP225). The Japanese benchmark revisited the 21000 pts area after the latest declines. Additionally, 50-, 100- and 200-session moving averages does not bode well for the buyers as their structure heralds more pressure.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.